Biden Administration in Panic Mode as This Just Crashed 50%

Summary

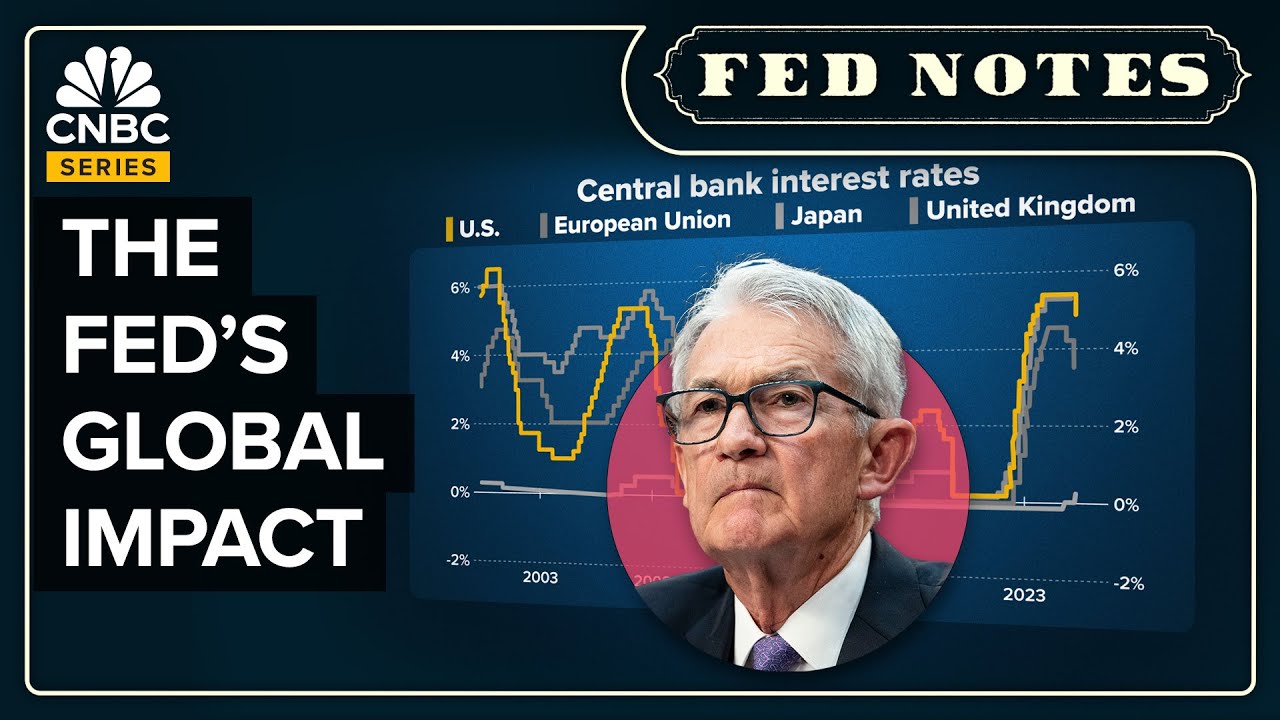

TLDRThe video discusses the Biden Administration's concerns over the US economy, particularly the impact of the Fed's rate decisions on economic growth. It highlights the recent ISM data, which, despite showing slight expansion in manufacturing, indicates underlying issues such as continuing job cuts and shrinking order backlogs. The video also explores the relationship between the US dollar, Fed policy, and manufacturing activity, suggesting that a strong dollar could potentially lead to rate cuts. Additionally, it features Power Metals Corp, a Canadian mining company with potential for significant stock growth, emphasizing the importance of conducting personal research before investing.

Takeaways

- 📉 The Biden Administration is reportedly in a state of panic due to a significant economic indicator's decline.

- 💹 The US economy faces potential devastation if the Federal Reserve does not cut interest rates as expected.

- 🤔 There is uncertainty regarding whether President Biden can maintain his position before the upcoming elections if the economy does not improve.

- 📈 The June Fed rate cut odds have dipped below 50% following strong ISM data, which is a setback for the Biden administration's plans.

- 🏭 US manufacturing has slightly expanded but this comes after 16 consecutive months of contraction, signaling underlying issues.

- 📊 New orders for manufacturers are critical and although there is a slight increase, employment figures suggest ongoing layoffs.

- 🔄 The backlog of orders continues to contract, which may lead to further workforce reductions in the manufacturing sector.

- 📈 Retailer inventories are high, but this does not necessarily indicate a healthy economy or demand.

- 💼 The labor market is a key factor to watch, as continued claims rising may indicate a slowdown in manufacturing activity.

- 🌐 Rising oil and raw material costs, along with increased transportation rates, are contributing to higher production costs for manufacturers.

- 💲 The strength of the US dollar could potentially influence the Federal Reserve's decision on interest rates, offering a glimmer of hope for the Biden administration.

Q & A

What is the main concern for the Biden Administration mentioned in the transcript?

-The main concern for the Biden Administration mentioned is the potential negative impact on the US economy due to the Fed rate cut odds dropping below 50% after strong ISM data, which could be problematic for their plans before the November elections.

How does the transcript suggest the market reacted to the June Fed rate cut odds dipping below 50%?

-The transcript suggests that the market reacted by adjusting the fed easing expectations for the year, with swap contracts pricing in fewer than 65 basis points, indicating a reduced likelihood of multiple rate cuts before the elections.

What was the significance of the ISM manufacturing PMI for March according to the transcript?

-The ISM manufacturing PMI for March was significant because it exceeded all estimates in the Bloomberg survey, leading to a market reaction where bond yields increased and the possibility of a Fed rate cut was questioned.

What does the transcript imply about the current state of the US manufacturing sector?

-The transcript implies that the US manufacturing sector has been through a challenging period, with contraction for 16 consecutive months, and while there is a slight expansion indicated by the PMI of 50.3, there are concerns about the sustainability of this growth due to factors such as a backlog of orders contraction and employment issues.

How does the transcript connect the state of the US labor market to the performance of the manufacturing sector?

-The transcript connects the US labor market to the manufacturing sector by suggesting that continued job cuts and a potential slowdown in new orders could be a result of a lack of demand and high labor costs, which could lead to a decline in manufacturing activity.

What is the potential implication of the bond market's reaction to the Fed's rate policy?

-The bond market's reaction suggests that rates may stay higher for longer, which could indicate a belief that the Fed has not fully addressed the economic challenges and that the economy may not be as resilient as suggested by some data points.

What does the transcript suggest about the role of consumer spending in the US economy?

-The transcript suggests that consumer spending plays a critical role in the US economy, with total compensation trends influencing manufacturing activity. If consumers do not have the money or access to credit, they will not spend, which can lead to a decline in new orders and manufacturing activity.

How does the transcript discuss the impact of rising costs on manufacturers and consumers?

-The transcript discusses that rising costs, such as oil and raw material prices, along with increased transportation rates, have led to higher producer prices. However, it also notes that manufacturers raising their prices does not guarantee that consumers will be willing or able to pay more, which could lead to a decrease in demand.

What is the significance of the yield curve inversion mentioned in the transcript?

-The yield curve inversion, where short-term interest rates are higher than long-term rates, is typically seen as a warning sign of an impending economic downturn or recession. The transcript suggests that this inversion is not yet over and that the manufacturing sector could face further challenges.

What hope does the transcript offer for a potential Fed rate cut?

-The transcript suggests that a rising dollar could potentially lead to a slowdown in the US economy that might prompt the Fed to cut rates. This is seen as a potential hope for the Biden Administration and a factor that could provide some relief before the elections.

How does the transcript describe the potential impact of the discussed economic factors on the stock of Power Metals Corp?

-The transcript describes Power Metals Corp as being well-positioned to take advantage of the North American battery initiative with high-grade lithium and cesium projects. It suggests that the stock could experience a significant increase in value due to market expectations and past performance.

Outlines

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraMindmap

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraKeywords

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraHighlights

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraTranscripts

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraVer Más Videos Relacionados

How Fed Rate Cuts Affect The Global Economy

Cooked Data Boosts Dollar, Sinks Silver (Era Of Infinite Debt Begins)

Menkeu Bahas soal Kondisi Ekonomi Terkini dan Keuangan Negara Jelang Pergantian Pemerintahan

September 2024 - Market Update

Markets Wonder Whether Inflation Could Be Higher, Says Roubini

Underlying growth is strong enough for market to handle fewer rate cuts, strategist says

5.0 / 5 (0 votes)