Secret Blackrock Report Revealed (Shocking Bitcoin & Crypto Plans)

Summary

TLDRLarry Fink, CEO of BlackRock, suggests Bitcoin has a place in investment portfolios, highlighting its ability to outperform traditional assets like stocks and gold, particularly during periods of geopolitical instability and economic risk. A recent BlackRock report emphasizes Bitcoin's resilience against critical risks such as sovereign debt and currency debasement. Although Bitcoin shows short-term volatility, its long-term performance, as seen in historical returns, is promising. BlackRock remains bullish on Bitcoin, seeing it as a hedge against rising U.S. debt and global uncertainties, predicting a potential 10x price increase.

Takeaways

- 📈 BlackRock CEO Larry Fink strongly supports including Bitcoin in investment portfolios, highlighting its growing relevance.

- 📊 BlackRock's recent report provides a detailed analysis of Bitcoin’s performance compared to the S&P 500 and gold during major political events.

- 💡 Bitcoin is noted to be less affected by traditional risk factors like banking systems, sovereign debt, and currency debasement, making it a unique asset during times of geopolitical or economic disruption.

- 📅 Over a 60-day period following major events, Bitcoin significantly outperforms both the stock market and gold, showing much higher returns.

- 💰 Bitcoin's 24/7 trading capability allows for quick liquidity, which can cause short-term volatility but gives it an edge during periods of global financial stress.

- 📉 BlackRock predicts that due to the escalating U.S. debt, Bitcoin offers potential protection and appeal as a hedge against economic uncertainty.

- 📊 The U.S. national debt is currently at $35 trillion and expected to rise to $44 trillion by 2030, adding pressure on traditional financial assets.

- 🛡️ Reserve assets like Bitcoin are seen as an appealing hedge in light of the global debt spiral and rising geopolitical risks.

- 🚀 Although BlackRock does not give a direct price prediction for Bitcoin, they note its historical performance and suggest potential for significant growth in the future.

- 🔮 BlackRock concludes that Bitcoin has the potential to diversify against risk factors like rising political instability, economic concerns, and U.S. debt, making it a unique investment asset.

Q & A

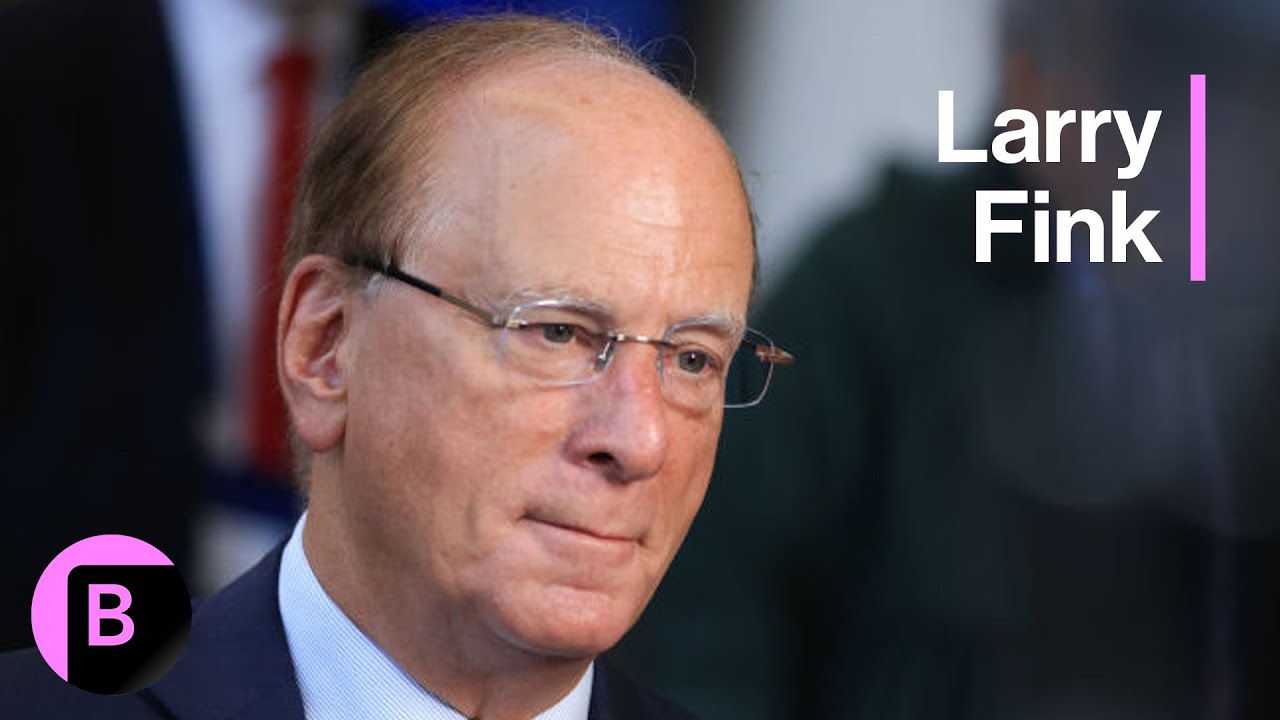

Who is Larry Fink, and what is his stance on Bitcoin?

-Larry Fink is the CEO of BlackRock, the world's most powerful asset management company. He believes there should be room for Bitcoin in investment portfolios, signaling a positive stance on Bitcoin's potential role in finance.

What report did BlackRock recently release, and what is its relevance to Bitcoin?

-BlackRock released a comprehensive report discussing Bitcoin's performance and its potential as a risk asset. The report highlights Bitcoin's unique position in the financial landscape, especially in relation to major geopolitical and economic events.

How does Bitcoin compare to the S&P 500 and gold in terms of performance following major political events?

-According to BlackRock's report, Bitcoin consistently outperforms both the S&P 500 and gold in terms of 60-day returns after major political events. While Bitcoin shows higher volatility in the short term, it delivers superior returns in the long run.

What explanation does BlackRock give for Bitcoin's volatility during periods of market stress?

-BlackRock explains that Bitcoin’s 24/7 trading capability and near-instantaneous cash settlement make it a highly liquid asset during periods of stress. This leads to short-term volatility, but Bitcoin tends to outperform other assets in the long term.

What does the report say about the US debt situation and its potential impact on Bitcoin?

-The report notes that the US debt is spiraling with no end in sight. BlackRock suggests that Bitcoin can act as a hedge against increasing national debt and political instability, making it an attractive asset in uncertain times.

Does BlackRock provide a specific price prediction for Bitcoin?

-BlackRock does not provide a specific price prediction for Bitcoin, as they must be cautious in their forecasts. However, they reference previous bull market peaks and suggest a potential for Bitcoin to experience significant gains in the future.

What historical Bitcoin market cycles does BlackRock reference in their report?

-BlackRock references several past Bitcoin market cycles, including a nearly 600x return in the first cycle, followed by a 550x, a 100x, and most recently a 21x return. These cycles illustrate Bitcoin’s long-term growth potential despite short-term volatility.

What are some fundamental drivers that differentiate Bitcoin from other risk assets?

-According to BlackRock, Bitcoin's fundamental drivers are starkly different from equities and other risk assets. These drivers include its unique ability to serve as a hedge against geopolitical tensions, rising debt, and economic instability.

How does BlackRock view Bitcoin's relationship with the US dollar?

-BlackRock appears to be bearish on the US dollar, viewing Bitcoin as a potential hedge against dollar depreciation. Rising geopolitical and economic uncertainties make Bitcoin an attractive alternative in diversifying risk away from the dollar.

What conclusion does BlackRock draw about Bitcoin’s long-term outlook?

-BlackRock is bullish on Bitcoin in the long term, suggesting it will increasingly be seen as a unique diversifier in investment portfolios, offering protection against various risks such as political instability, currency debasement, and rising national debt.

Outlines

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraMindmap

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraKeywords

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraHighlights

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraTranscripts

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraVer Más Videos Relacionados

BlackRock CEO Larry Fink on US Economy, Trump Vs. Harris, Geopolitical Risks (Full Interview)

Revolutionize Your Portfolio with Gold, Silver, and Bitcoin

How He Built The Biggest Investment Company In The World!

Investment Case for Gold - John Reade

Larry Fink - The Most Powerful Man in Finance | A Documentary

Cuanomix: Kripto Tetap Moncer Meski Ada Perang? Ini Kata Timothy Ronald | Liputan 6

5.0 / 5 (0 votes)