Print, Pump, Tax, Repeat

Summary

TLDRIn this video, Matthew from Bitcoin University discusses the potential economic implications of Kamala Harris's tax plan, which includes a 45% long-term capital gains tax and a 25% tax on unrealized gains. He warns that these policies, combined with money printing by the government, could lead to significant wealth confiscation, particularly affecting those in states with high state taxes. Matthew argues that an unrealized capital gains tax could force asset sales to pay taxes, even if the assets' value is inflated by money printing rather than real growth. He suggests that Bitcoin could offer a portable and less taxable alternative in such an economic scenario.

Takeaways

- 📈 The video discusses the concept of 'print pump and tax and repeat', which involves governments using money printing to inflate asset prices and then taxing the unrealized gains.

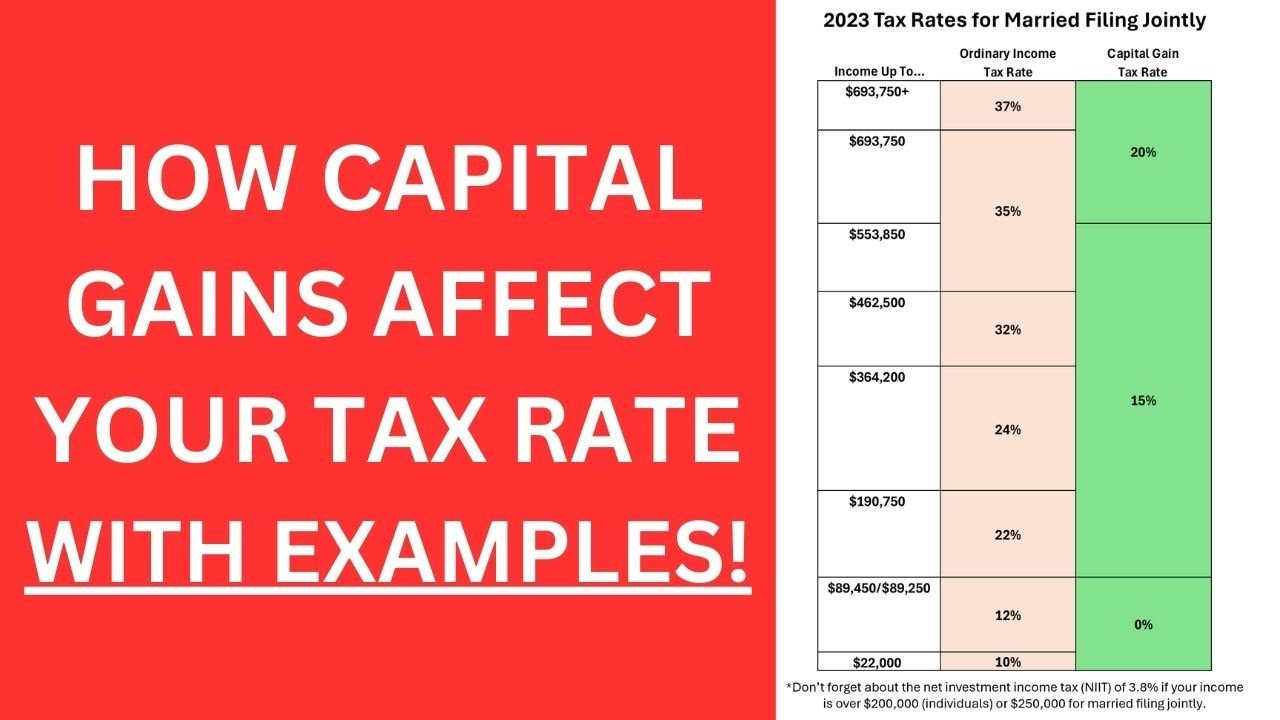

- 💸 Kamala Harris's tax plan is criticized for endorsing a 45% long-term capital gains tax, which is higher than historical rates even under President Jimmy Carter.

- 🏦 The combination of high capital gains tax rates and state taxes could lead to effective tax rates of 55-60% in some states, significantly impacting taxpayers.

- 🏠 The video explains the difference between realized and unrealized capital gains taxes, with the latter being particularly concerning as it taxes assets based on their current value, not just the profit made upon sale.

- 📉 An unrealized capital gains tax could lead to forced selling of assets, such as stocks and real estate, to pay the tax, which could destabilize markets and affect asset values.

- 💢 The video argues that the IRS or similar bodies may overvalue assets for tax calculation purposes, leading to higher tax burdens for individuals.

- 💵 The script suggests that the government's money printing combined with unrealized capital gains taxes could lead to a significant wealth confiscation from citizens.

- 🚫 The video warns that such tax policies could drive wealthy individuals and businesses to leave the country, as seen in Norway's experience with unrealized capital gains taxes.

- 🌐 The script highlights Bitcoin as a potential hedge against these policies due to its portability and resistance to inflation, suggesting it as a safeguard for personal wealth.

- ⚖️ The video concludes by urging viewers to consider the economic implications of such tax policies, advocating for a more prudent approach to economic management.

Q & A

What is the main concern expressed in the video about Kamala Harris's tax plan?

-The video expresses concern over Kamala Harris's endorsement of Biden's capital gains tax proposal, which includes a 45% long-term capital gains tax rate, potentially leading to confiscation of savings through high taxation and inflation.

How does the concept of 'print pump tax and repeat' relate to the government's use of money printers?

-The term 'print pump tax and repeat' refers to a strategy where the government uses its money printers to inflate asset prices, leading to increased capital gains taxes owed by individuals, effectively allowing the government to confiscate a significant portion of people's wealth.

What is the difference between realized and unrealized capital gains tax as explained in the video?

-Realized capital gains tax is paid when an asset is sold for more than it was purchased. Unrealized capital gains tax, on the other hand, requires individuals to pay taxes on the increase in value of an asset at a given point in time, as if they had sold it, regardless of whether they actually sold the asset.

Why might the implementation of an unrealized capital gains tax lead to heavy selling of stocks?

-An unrealized capital gains tax could lead to heavy selling of stocks as individuals may need to sell some of their shares to raise the necessary cash to pay the taxes on the increased value of their assets, even if they have not sold them.

How does the video suggest that the IRS might determine the value of a house for tax purposes?

-The video suggests that the IRS might determine the value of a house for tax purposes by inflating the value, which would result in higher unrealized capital gains taxes owed by the homeowner.

What is the potential impact of an unrealized capital gains tax on the housing market according to the video?

-The video suggests that an unrealized capital gains tax could lead to people being pushed out of their homes due to the inability to pay the increased taxes, potentially benefiting large corporations like Black Rock that could buy the houses at a lower price.

How does the video argue that inflation affects tax brackets and individual finances?

-The video argues that inflation pushes individuals into higher tax brackets because tax brackets are based on income, which increases due to inflation. This means that people are taxed at higher rates even though their real income, adjusted for inflation, may not have increased.

What is the video's stance on the potential effects of unrealized capital gains taxes on the stock market?

-The video predicts that the implementation of unrealized capital gains taxes would lead to a significant drop in the stock market due to the forced selling of stocks by individuals and corporations to pay the increased taxes.

Why does the video suggest that Bitcoin could be a beneficial asset in the face of unrealized capital gains taxes and inflation?

-The video suggests that Bitcoin could be beneficial because it is portable, easy to hide, and not subject to the same confiscatory taxes as traditional assets, making it a potential hedge against inflation and high taxation.

What historical example does the video use to illustrate the potential backlash against high taxation?

-The video references the historical example of the American Revolution, where colonists revolted against a 3% tax on tea and paper, to illustrate the potential backlash against the proposed high taxation rates.

Outlines

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraMindmap

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraKeywords

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraHighlights

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraTranscripts

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraVer Más Videos Relacionados

Accountant Explains: Kamala's Most RADICAL Financial Policies

1 1 5 Different Direct Tax Laws 2

Gain from Stock market? Pay Zero tax | LTCG | STCG | Save Capital Gain Tax on Stock market gain

NEW! - Can Capital Gains Push Me Into a Higher Tax Bracket?

How to Smartly Save Taxes on Stock Market Gains? | CA Rachana Ranade

🚨Satoshi Unmasked🚨Canary XRP ETF Filed & Ripple Wins!

5.0 / 5 (0 votes)