Audit Risk Model

Summary

TLDRThis video covers the risk assessment process in auditing financial statements, focusing on audit risk, material misstatement, and the audit risk model. It explains the three key components: inherent risk, control risk, and detection risk, and how auditors manage these risks through careful planning and testing. The session emphasizes understanding an entity's business risks, internal controls, and regulatory environment to effectively assess risks. The importance of fraud detection, both in misappropriation of assets and financial statement manipulation, is also highlighted to ensure a proper audit opinion.

Takeaways

- 📊 Audit risk is the risk that an auditor may express an inappropriate audit opinion when the financial statements are materially misstated.

- 🔍 The audit process is limited by time and resources, which means auditors must manage audit risk effectively.

- 💡 Audit risk is considered at the assertion level, focusing on individual account balances, disclosures, and the overall financial statements.

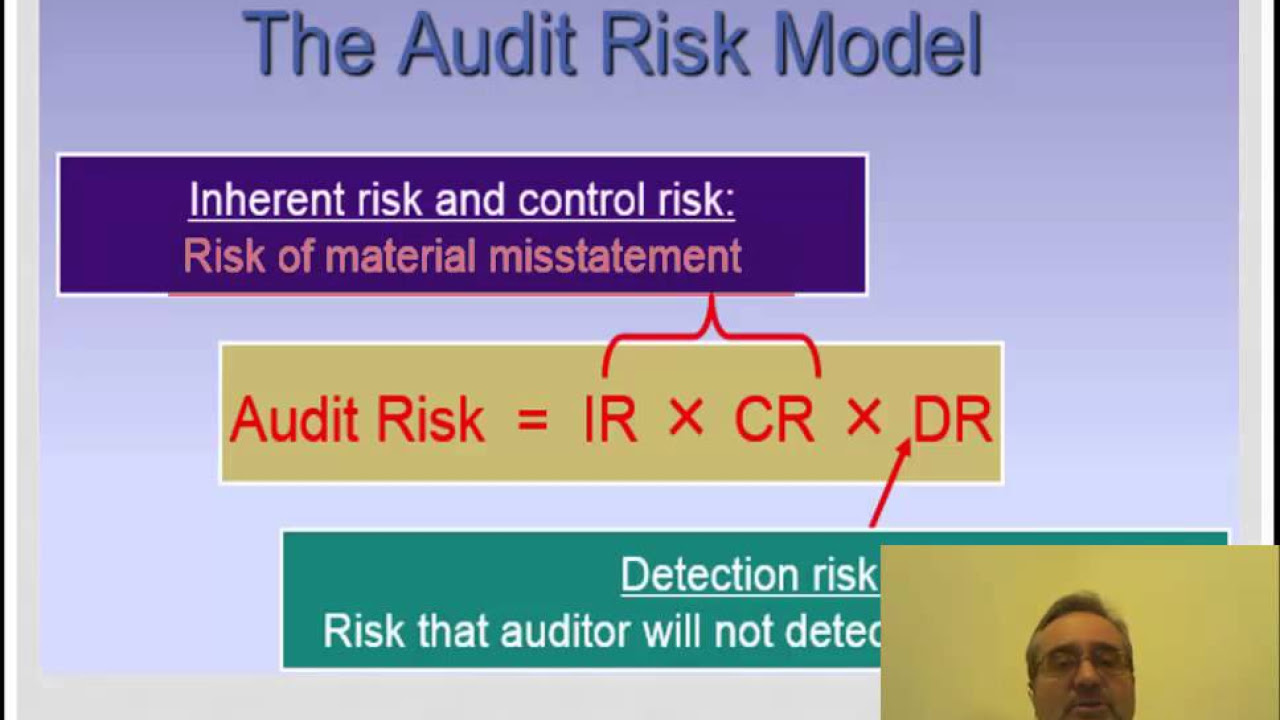

- 🔄 The audit risk model is a tool that represents audit risk as the product of inherent risk, control risk, and detection risk.

- 🛡 Inherent risk refers to the natural risk associated with an element within the financial statements, such as the risk associated with cash.

- 🛠 Control risk is about the effectiveness of management's internal controls in mitigating inherent risks.

- 🕵️♂️ Detection risk is the risk that the auditor will not detect a material misstatement during the audit process.

- 📉 To manage audit risk, auditors assess the risk of material misstatement and use this to design audit procedures aimed at reducing audit risk to an acceptable level.

- 🚨 Engagement risk is the auditor's exposure to financial loss and damage due to litigation, adverse publicity, or audit errors.

- 🔎 Auditors gather evidence through inquiries, analytical procedures, observations, and inspections to understand the entity's risks and to assess the risk of material misstatement.

Q & A

What is audit risk and how does it relate to the financial statements?

-Audit risk is the risk that the auditor expresses an inappropriate audit opinion when the financial statements are materially misstated. It relates to the financial statements as it is the potential for the auditor to issue an incorrect opinion about the financial statements' accuracy.

Why is it important for auditors to consider audit risk during an audit?

-Auditors must consider audit risk because it helps them to focus their efforts on areas that may have a higher likelihood of material misstatements. This ensures that the audit is efficient and effective in detecting any material discrepancies in the financial statements.

What are the three components of the audit risk model?

-The three components of the audit risk model are inherent risk, control risk, and detection risk. These components are multiplicatively related, meaning that the overall audit risk is the product of these three risks.

How does inherent risk differ from control risk?

-Inherent risk refers to the susceptibility of an account balance to material misstatement due to its nature, while control risk pertains to the effectiveness of the entity's internal controls in preventing or detecting material misstatements.

What is meant by the risk of material misstatement?

-The risk of material misstatement refers to the possibility that the financial statements may contain errors or fraud that are significant enough to affect the decisions of users of the financial statements.

How do auditors manage detection risk?

-Auditors manage detection risk by planning and conducting audit procedures such as tests of details, substantive analytical procedures, and tests of controls. The nature, timing, and extent of these procedures are influenced by the assessed risk of material misstatement.

What is the purpose of the audit risk model?

-The audit risk model serves as a planning tool to help auditors understand and manage the risks associated with the audit. It guides the auditor in designing audit procedures to reduce audit risk to an acceptable level.

Why is it important for auditors to understand the entity's business risks?

-Understanding the entity's business risks is crucial for auditors as it helps them identify areas that may be more susceptible to material misstatements. This understanding allows them to focus their audit efforts on those areas and assess the risk of material misstatement more accurately.

How do auditors gather evidence during the risk assessment process?

-Auditors gather evidence through inquiries of management and other personnel, observation, inspection, and analytical procedures. They also consider information from external sources and industry experts to help assess the risk environment.

What are the limitations of the audit risk model?

-The audit risk model is a planning tool and has limitations such as not being able to guarantee the desired level of audit risk, not accounting for potential audit errors, and not providing a precise measure of the preliminary level of audit risk of material misstatement.

How does the risk assessment process impact the auditor's approach to the audit?

-The risk assessment process impacts the auditor's approach by influencing the nature, timing, and extent of audit procedures. It helps the auditor to prioritize areas of high risk and allocate audit resources more effectively.

Outlines

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraMindmap

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraKeywords

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraHighlights

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraTranscripts

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraVer Más Videos Relacionados

Auditing 101 | Part 2: Risk Assessment, Assertions, and Materiality | Maxwell CPA Review

Risk of Material Misstatement

2.3 Overview of the Audit Process Audit Planning Risk Assessment

Materialitas dan Resiko Audit

Audit Risk Overview

1.5 - Financial Statement Auditing Process - An Overview of Auditing for Auditors

5.0 / 5 (0 votes)