Auditing 101 | Part 2: Risk Assessment, Assertions, and Materiality | Maxwell CPA Review

Summary

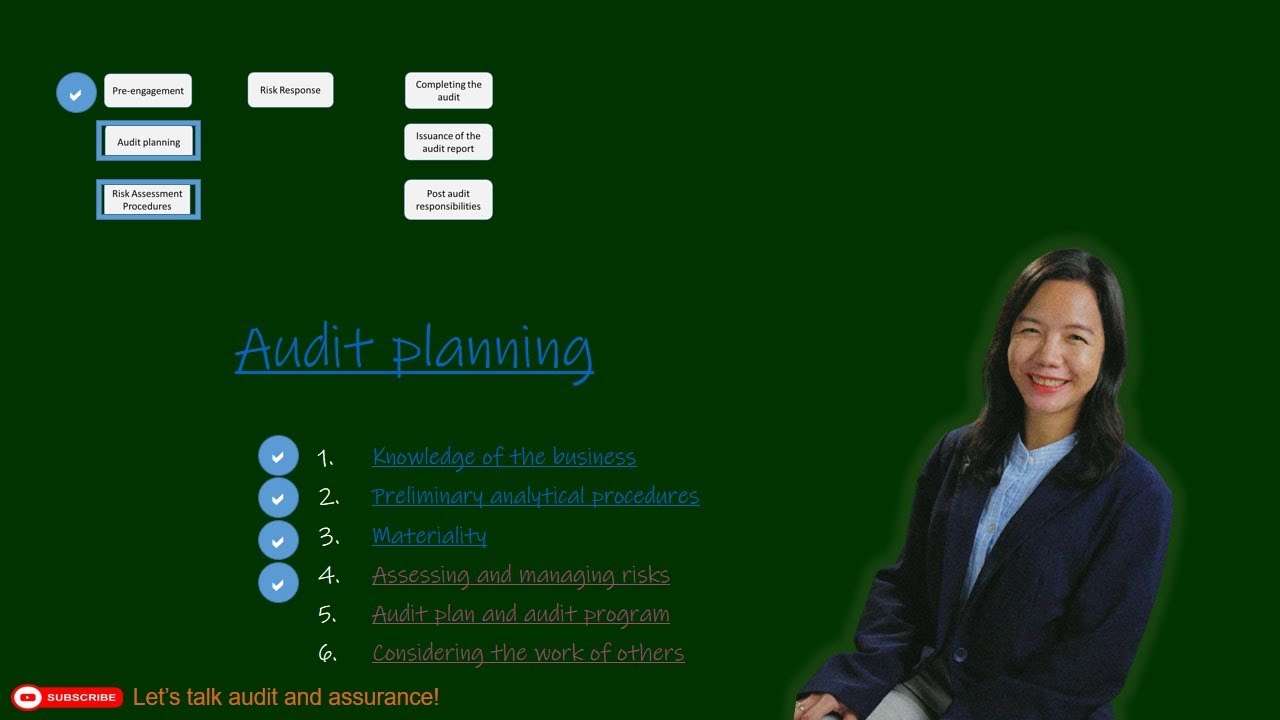

TLDRThe video explains the importance of risk assessment in the audit process, focusing on identifying high-risk areas to prioritize. It discusses the audit risk formula, which includes inherent risk, control risk, and detection risk. The goal is to minimize detection risk as the risk of material misstatement increases. The video also covers testing controls, management assertions, and the concept of materiality—defining what constitutes a significant error that could affect users' decisions. Overall, it emphasizes a systematic approach to auditing through thorough risk assessment and targeted testing.

Takeaways

- 📊 Risk assessment is essential for identifying high-risk areas in a company, allowing auditors to focus their resources efficiently.

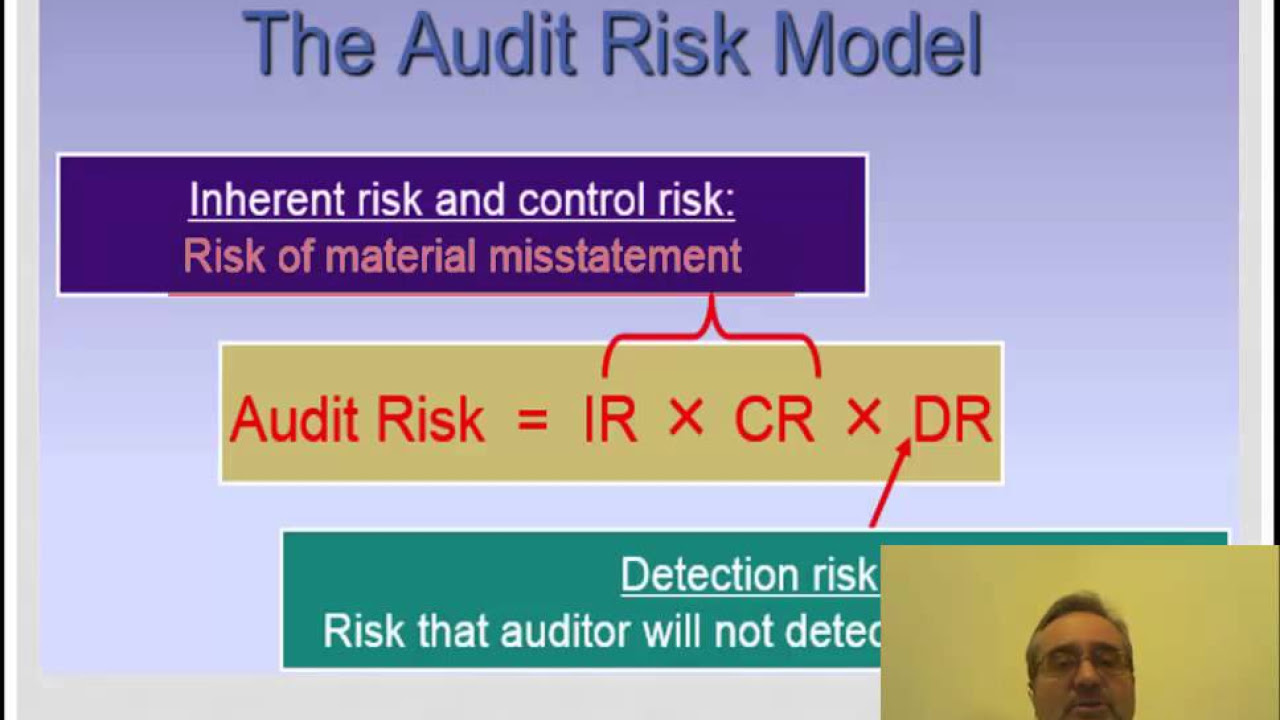

- 🧠 The audit risk formula is crucial in understanding where potential errors could arise: Audit Risk = Inherent Risk × Control Risk × Detection Risk.

- 💸 Inherent risk relates to the specific nature of an account. For example, cash has a high inherent risk, while prepaid expenses have a low inherent risk.

- 🔍 Control risk refers to the company's ability to detect misstatements through its internal controls.

- 🕵️♂️ Detection risk is the chance that auditors fail to identify errors during the audit process.

- 🔄 Auditors cannot control inherent or control risk, but they can manage detection risk by adjusting the nature, timing, and extent of audit tests.

- ⚙️ Substantive procedures and tests of controls are two key types of audit tests. Substantive tests check the details, while control tests assess the effectiveness of internal controls.

- 📑 Management assertions are claims made by the company regarding its financial statements. These include assertions like existence, completeness, classification, and accuracy.

- ⚖️ Materiality helps determine which errors are significant enough to affect the users of the financial statements, guiding auditors on which discrepancies to focus on.

- 💡 Auditors set materiality benchmarks based on percentages of total assets or revenue, adjusting as necessary during the audit process.

Q & A

Why is risk assessment important in the audit process?

-Risk assessment helps auditors identify the more risky areas of a company, so they can focus their limited resources on those areas during the audit. This ensures an efficient and effective audit process.

What is the audit risk formula and what does it represent?

-The audit risk formula is: Audit Risk = Inherent Risk × Control Risk × Detection Risk. It represents the risk that errors in the financial statements go undetected by both the company and the auditors.

What is the difference between inherent risk and control risk?

-Inherent risk is the risk associated with a particular account's nature, such as cash being more susceptible to theft. Control risk refers to the likelihood that the company’s internal controls will not detect a misstatement.

What is detection risk in an audit?

-Detection risk is the risk that auditors, despite performing their tests, fail to identify errors in the financial statements. It is the only part of the audit risk formula that auditors can control by adjusting the extent and rigor of their tests.

How do inherent and control risks relate to detection risk?

-As inherent and control risks increase, detection risk must decrease to maintain a reasonable overall audit risk. Auditors can lower detection risk by performing more thorough or extensive testing.

What are the two levels of risk of material misstatement?

-The two levels of risk of material misstatement are the financial statement level, which affects the overall company, and the relevant assertion level, which applies to specific transactions, account balances, and disclosures.

What are tests of controls, and why would an auditor perform them?

-Tests of controls assess the operating effectiveness of a company’s internal controls. Auditors perform them to potentially reduce control risk, which would lower the risk of material misstatement and reduce the amount of substantive testing needed.

What are management assertions in an audit?

-Management assertions are claims made by the company about the accuracy of their financial statements. These include assertions about the existence, completeness, classification, cutoff, accuracy, rights and obligations, and presentation of the financial data.

What is materiality in an audit, and why is it important?

-Materiality is the threshold for determining whether an error or misstatement in the financial statements is significant enough to affect decision-making by users of the financial statements. It helps auditors prioritize which errors to focus on.

How do auditors determine the level of materiality?

-Auditors typically determine materiality by taking a percentage of the company’s total assets or revenue. The materiality level may be adjusted as the auditors learn more about the company during the audit.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade Now5.0 / 5 (0 votes)