Learn ICT Concepts in 30 Minutes!

Summary

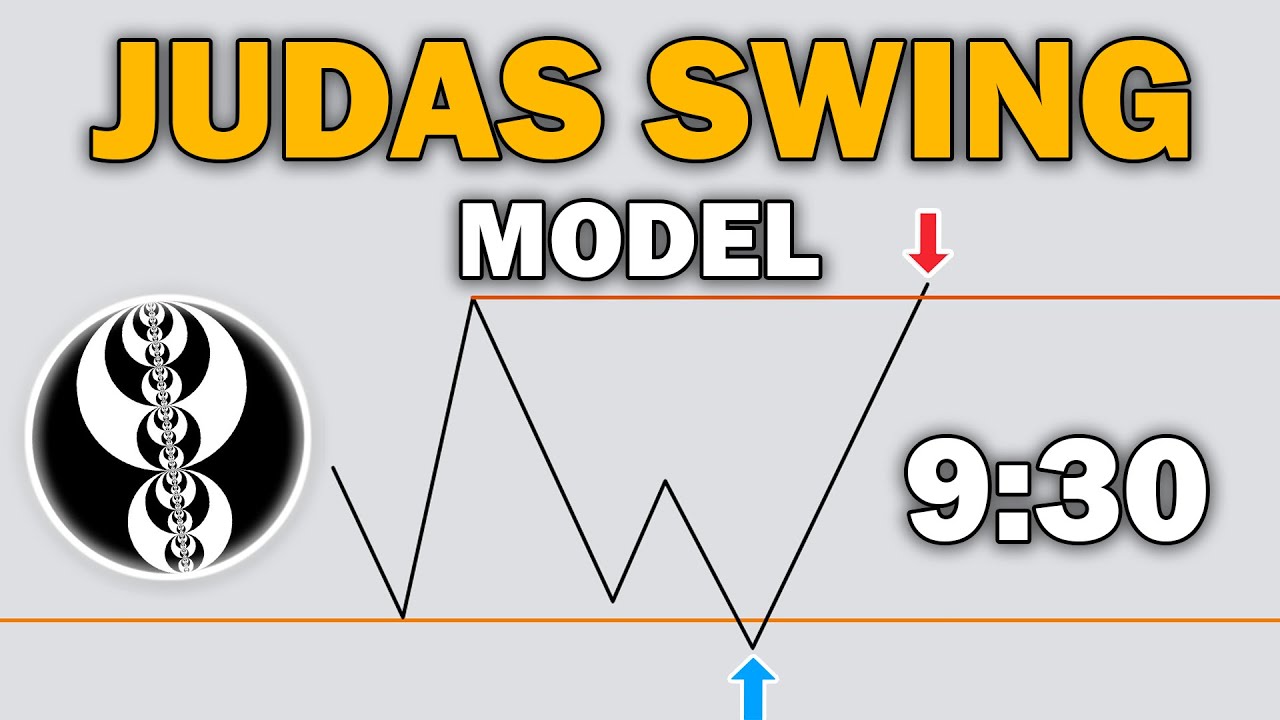

TLDRThe video script is a comprehensive beginner's guide to the Inner Circle Trader (ICT) method, focusing on foundational trading concepts such as swing points, liquidity, buy-side and sell-side levels, and the identification of support and resistance areas. It delves into the strategic use of Fibonacci retracement zones for optimal trade entries and the significance of fair value gaps, volume imbalances, and gaps in trading. The script also introduces order blocks and their impact on price movements, and concludes with the concept of daily bias to predict market direction. The guide emphasizes the importance of understanding and applying these concepts in real-time trading scenarios for effective decision-making.

Takeaways

- 📈 Swing points and liquidity are foundational concepts in ICT trading, with swing points indicating potential areas of high order activity.

- 🛠️ Swing points are identified by comparing the highs and lows of consecutive candles, with swing highs having a lower high on both sides and swing lows having a higher low on both sides.

- 💹 Buy-side and sell-side liquidity levels are areas just above swing highs and just below swing lows, respectively, where retail traders often place orders, leading to deeper liquidity.

- 📊 The identification of buy-side and sell-side liquidity levels is crucial in the ICT method for understanding market behavior and trade setup opportunities.

- 🔄 The concept of old highs and old lows refers to swing points that are isolated and can be indicative of market manipulation or significant price levels.

- 🎯 The idea of premium and discount zones is used to determine optimal trade entry points, with trades being more favorable in the discount zone for long trades and in the premium zone for short trades.

- 🤹♂️ The optimal trade entry (OT) is a specific Fibonacci retracement zone that falls within the discount or premium zones, providing potential entry points for trades based on the current market structure.

- 🔗 Fair value gaps are three-candle patterns that create a gap between the first and third candle shadows, which can be used as support and resistance levels.

- 📉 Volume imbalances and gaps occur when there is a gap between the open and close of adjacent candles or between their highs and lows, representing areas of price action without trading activity.

- 🏦 Order blocks are formed by large body candles that sweep liquidity and lead to a break of an old high or low, often leading to price retracements back to the order block level.

- 📅 The daily bias is a method to anticipate the next day's market direction by observing how price interacts with the previous day's high and low.

Q & A

What are swing points in ICT trading and how are they identified?

-Swing points in ICT trading are either swing lows or swing highs that indicate potential areas of liquidity. They are identified by looking at three consecutive candles. For a swing high, the middle candle must have a lower high compared to the candles on either side. Conversely, for a swing low, the middle candle must have a higher low compared to its neighboring candles.

Why are swing points important in relation to liquidity in the market?

-Swing points are important because they often correspond to areas where retail traders place their top orders, such as buy stop orders above swing highs and sell stop orders below swing lows. This concentration of orders leads to deeper liquidity in these areas, which can affect price movements and provide opportunities for traders.

What is the concept of buy side and sell side liquidity in ICT trading?

-Buy side liquidity refers to the concentration of buy stop orders just above a swing high, where traders expect the price to rise above that level. Sell side liquidity, on the other hand, refers to the concentration of sell stop orders just below a swing low, where traders expect the price to fall below that level. These areas of liquidity are significant because they can influence the direction and momentum of the market.

How do equal highs and lows differ from old highs and lows in the context of the ICT method?

-Equal highs and lows are swing points that cluster together at roughly the same price level, while old highs and lows are isolated swing points that stand out and do not cluster with others. Old highs and lows are particularly significant as they can indicate market manipulation or significant price levels that may resist future price movements.

What is the significance of the premium and discount zones in the ICT method?

-The premium and discount zones are halves of the price range between a swing high and swing low. The discount zone is considered a favorable area to enter long trades, as it offers a better risk-reward ratio. Conversely, the premium zone is a favorable area for short trades. The deeper into these zones the trade entry is, the greater the potential risk-reward ratio.

How is the Optimal Trade Entry (OT) zone determined in the ICT method?

-The Optimal Trade Entry (OT) zone is a specific Fibonacci retracement level that falls within the discount or premium zone, depending on whether it's a long or short trade. For a long trade, the OT zone is from 0.62 to 0.79, with the midpoint at 0.75. For a short trade, the OT zone is also from 0.62 to 0.79 but is located within the premium zone.

What is a fair value gap in the ICT method and how is it identified?

-A fair value gap is a three-candle pattern where there is no overlap between the upper shadow of the first candle and the lower shadow of the third candle, or vice versa for a bearish gap. This creates a 'gap' between the two price points, which can act as a zone of support or resistance and can be used to identify potential reversal points in the market.

What is the concept of volume imbalances and gaps in the ICT method?

-Volume imbalances occur when there is a gap between the open and close of adjacent candles, but with trading activity within the gap. A gap, on the other hand, is when there is no trading activity between the high of one candle and the low of the next, or vice versa. Both volume imbalances and gaps can act as areas of support and resistance and are important for traders to watch for potential price reactions.

How do order blocks function in the ICT method and what are the two types?

-Order blocks in the ICT method are areas where price is expected to retrace before continuing its movement. There are two types: high probability order blocks, which are formed by large body candles that sweep liquidity and lead to a break of an old high or low, and low probability order blocks, which are formed by small body candles with prominent shadows in the middle of a single price movement.

What is the daily bias in the ICT method and how is it determined?

-The daily bias is a concept used to anticipate whether the next trading day will be bullish or bearish. It is determined by observing how price interacts with the previous day's high and low. If price closes above the previous day's high, it suggests a bullish bias, while closing below the low indicates a bearish bias. The daily bias can help traders frame their expectations for the upcoming session.

How can the concepts of fair value gaps, volume imbalances, and gaps be applied similarly in the ICT method?

-Fair value gaps, volume imbalances, and gaps can all be used as zones of support and resistance in the ICT method. Traders can monitor how price reacts to these areas, looking for signs of potential reversals or continuations of trends. These concepts help traders identify key levels that may influence future price movements.

What is the importance of practicing the identification of swing points in the ICT method?

-Practicing the identification of swing points is crucial as it helps traders become more adept at recognizing these key areas of liquidity and potential market reactions. By practicing in replay mode or real-time, traders can develop the skill to quickly and accurately identify swing points, which is essential for making informed trading decisions based on the ICT method.

Outlines

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraMindmap

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraKeywords

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraHighlights

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraTranscripts

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraVer Más Videos Relacionados

5.0 / 5 (0 votes)