Does more trade = more income? Realistic expectations. becoming a risk manager

Summary

TLDRIn this video, the host addresses a common misconception among new traders: that more trades equate to more income. Emphasizing the importance of patience and risk management, the host shares insights from experienced traders who prioritize quality over quantity in trades. Highlighting the pitfalls of overtrading and the necessity of understanding market conditions, the video encourages traders to develop a discerning eye for high-probability setups and to avoid the cycle of revenge trading that often leads to account depletion.

Takeaways

- 📈 Trading more does not necessarily equate to more income; it often leads to more risk and potential losses.

- 🧐 Beginners often misunderstand the nature of the market and believe that increased trading frequency will lead to higher profits.

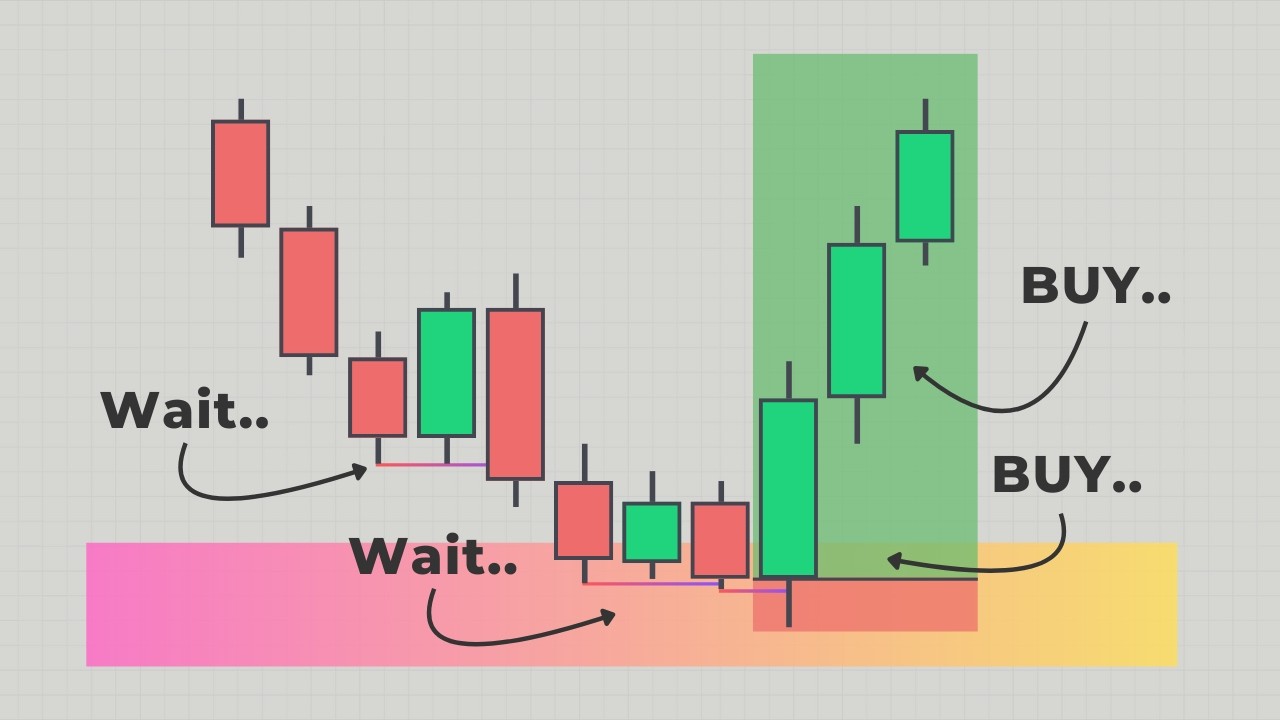

- 🤔 The key to profitability is understanding and practicing patience, waiting for the right trading setups to appear.

- 📉 More trades can lead to a deeper drawdown, making it harder to recover and potentially resulting in more losses.

- 🌐 A member from China suggests that more trades could equal more losses, highlighting the risk of overtrading.

- 🛑 Risk management is emphasized as a crucial skill for experienced traders, prioritizing safety over the pursuit of profits.

- 🚫 Learning when not to trade is as important as knowing when to trade, which is a skill that comes with experience and discipline.

- 🔍 Traders need to develop a good filter to discern high-probability environments from low-probability ones to increase their chances of success.

- 📊 Each trading strategy or pattern has specific conditions under which it performs best; understanding these is vital for effective trading.

- 💡 Being an experienced trader involves looking at the market from a risk perspective and focusing on setups that offer a slight edge in probability.

- 🌟 A trader from Hong Kong exemplifies success by securing significant funding through consistent profitability, emphasizing the importance of patience and risk management.

Q & A

Does trading more frequently necessarily lead to more income?

-No, trading more frequently does not necessarily equate to more income. It can lead to more risk and potentially more losses, especially if the trades are not well-considered or are taken in suboptimal market conditions.

What is the common misconception among new traders about trading frequency and income?

-The common misconception is that if they trade more, they will make more money. New traders often believe that higher trading volume directly correlates with higher income without considering the quality of trades and market conditions.

What is the key to becoming a consistently profitable trader according to the video?

-The key to becoming a consistently profitable trader is understanding how to not trade. It involves having the patience and discipline to wait for the right setup and recognizing suboptimal conditions to avoid trading.

What is the importance of risk management in trading?

-Risk management is crucial in trading as it prioritizes the trader's capital preservation. It helps in making informed decisions to avoid unnecessary risks and ensures long-term profitability.

Why is it essential for traders to have a good filter for identifying trading opportunities?

-A good filter helps traders identify high-probability trading opportunities. It prevents them from taking trades in low-probability environments, thus reducing the chances of losses and increasing the overall success rate.

What does the speaker mean by 'trading at key levels'?

-Trading at key levels refers to entering trades at specific price points where there is a higher likelihood of other traders making similar decisions, potentially leading to a decisive price movement in one direction.

How does the speaker define a 'struggling trader'?

-A struggling trader is someone who is caught in a cycle of making money, experiencing heavy drawdowns, blowing their account, and then repeating the same pattern. They often lack proper education and fail to understand when to stop trading.

What is the role of education in avoiding the cycle of a struggling trader?

-Education plays a vital role in breaking the cycle of struggling trading by providing traders with the necessary knowledge and skills to make informed decisions, manage risk, and understand market conditions.

What is the significance of the '1 Percentage Trade Club' mentioned in the video?

-The '1 Percentage Trade Club' is a community where traders discuss and share insights on trading strategies and experiences. It aims to foster a supportive environment for traders to learn and improve their trading skills.

How does the speaker suggest traders should approach trading in a range-bound or choppy market?

-The speaker suggests that traders should be cautious when trading in a range-bound or choppy market, as overtrading in such conditions can lead to losses and a loss of confidence. It's important to identify high-probability setups and avoid trading in suboptimal conditions.

What is the main reason the speaker gives for traders losing money or struggling?

-The main reason given for traders losing money or struggling is not the lack of knowledge on how to trade, but rather the lack of proper education on risk management, trading psychology, and understanding market conditions.

Outlines

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraMindmap

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraKeywords

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraHighlights

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraTranscripts

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraVer Más Videos Relacionados

Trading Liquidity ~ How It Works (& how to profit from it)

1 Trading Mistake That Keeps You Unprofitable (Here’s the Fix)

Do high pass filters ruin your mixes? Fixing Bad Music Production and Mixing Advice EP.2

Największe błędy na orbitreku Jak ćwiczyć na orbitreku?

How To Start Trading Stocks As A Complete Beginner - Ep.3

TOP 10 Day Trading Mistakes YOU NEED TO KNOW!!!

5.0 / 5 (0 votes)