2.2 Overview of the Audit Process Auditing Planning Knowledge, Analytics, Materiality

Summary

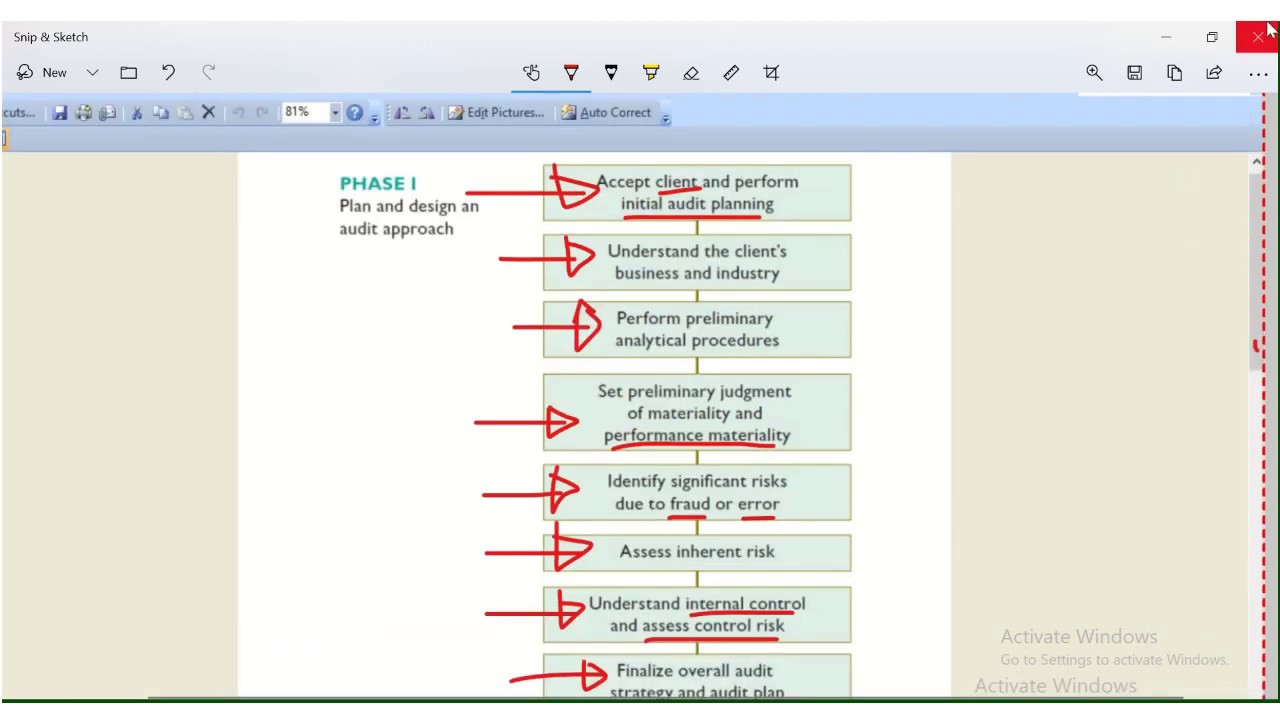

TLDRThis video script delves into the intricacies of audit planning and risk assessment within a risk-based audit approach. It outlines the benefits of audit planning, emphasizing its role in focusing on important areas, identifying potential problems, and ensuring the audit is organized and managed effectively. The script also covers the process of obtaining knowledge of the business, preliminary analytical procedures, and a detailed explanation of materiality, including overall, performance, and specific materiality levels, highlighting their significance in audit planning and decision-making.

Takeaways

- 📘 The video discusses the importance of audit planning and its role in the risk assessment phase of the risk-based audit approach.

- 🔍 Audit planning is essential for focusing on important areas, identifying potential problems, and organizing the audit engagement effectively and efficiently.

- 🛠 Benefits of audit planning include assisting in proper assignment of work, facilitating direction, supervision, review, and coordination of the engagement team's work.

- 🔑 The auditor should obtain knowledge of the business to identify and understand events, transactions, and practices that may significantly affect the financial statements.

- 👀 Knowledge of the business is obtained through previous experience, discussions with entity personnel, internal audits, legal advisors, and other sources.

- 📊 Preliminary analytical procedures are used to identify unusual relationships and red flags in the financial data before testing begins.

- 📐 Materiality is defined as the magnitude of an omission or misstatement that would influence the decision-making of financial statement users.

- 📈 There are different types of materiality including overall materiality, performance materiality, and specific materiality, each serving different purposes in the audit process.

- 🧮 The computation of overall materiality involves selecting a benchmark and applying a percentage, which is a matter of the auditor's professional judgment.

- ✂️ Performance materiality is set at an amount lower than overall materiality to capture uncorrected misstatements and is determined by applying a 'haircut' percentage to overall materiality.

- 🎯 Specific materiality is set for particular items that require special attention and is used when the auditor deems it necessary for certain classes of transactions or account balances.

Q & A

What are the primary benefits of audit planning?

-The primary benefits of audit planning include ensuring appropriate attention is given to important areas of the audit, identifying and resolving potential problems in a timely manner, especially in high-risk areas, and organizing and managing the audit engagement effectively and efficiently.

What is the purpose of the mnemonic 'PIE' in the context of audit planning?

-The mnemonic 'PIE' stands for Potential problems, Important areas, and Effective and efficient audit. It helps to remember the primary benefits of audit planning.

What are the secondary benefits of audit planning?

-Secondary benefits of audit planning include assisting in the proper assignment of work to engagement team members, facilitating direction, supervision, and review of the team's work, and coordinating work done by auditors of components, such as branches, subsidiaries, or divisions.

What is the mnemonic 'ADC' used for in audit planning?

-The mnemonic 'ADC' stands for Assignment, Direction, Supervision, Review, and Coordination. It helps to remember the secondary benefits of audit planning.

What are the six activities involved in audit planning?

-The six activities involved in audit planning are knowledge of the business, preliminary analytical procedures, materiality, and three other activities that are not mentioned in the provided script.

What is the importance of obtaining a knowledge of the business in audit planning?

-Obtaining a knowledge of the business is crucial for identifying and understanding events, transactions, and practices that may significantly affect the financial statements or the audit report. It helps in establishing materiality judgments, identifying areas of special audit consideration, and designing further audit procedures.

What is the role of PSA 315 in obtaining knowledge of the business?

-PSA 315 requires the auditor to obtain a knowledge of the business sufficient to identify and understand significant effects on the financial statements. It is the standard for 'getting to know you' (GTKY) in the audit process.

How can an auditor obtain knowledge of the business?

-An auditor can obtain knowledge of the business through previous experience with the entity or its industry, discussions with people within the entity, internal audit personnel, other auditors, legal advisors, publications, legislations, regulations, and by visiting the entity's premises and reviewing documents produced by the entity.

What are the three phases of analytical procedures in an audit?

-The three phases where analytical procedures can be performed in an audit are the planning phase, the testing phase, and the completion phase.

Why are analytical procedures performed in the planning phase of an audit?

-Analytical procedures are performed in the planning phase to assist the auditor in planning the nature, timing, and extent of other auditing procedures, and to identify any red flags or unusual relationships that may require further investigation.

What is the definition of materiality in the context of auditing?

-In auditing, materiality is defined as the magnitude of an omission or misstatement of accounting information that, in the judgment of a reasonable person relying on that information, would have been changed or influenced by the omission or misstatement.

What are the different types of materiality mentioned in the script?

-The different types of materiality mentioned in the script are overall materiality (also known as planning materiality or general materiality level), performance materiality (also known as tolerable misstatement or scoping materiality), and specific materiality (or individual materiality).

How is overall materiality determined?

-Overall materiality is determined by selecting a benchmark, such as profit before tax or sales, and applying a percentage to it, based on the auditor's professional judgment.

What is the purpose of performance materiality?

-Performance materiality, which is an amount less than overall materiality, is used to determine which financial statement line items to be tested. It helps to ensure that the auditor captures any uncorrected misstatements that, when aggregated, may be considered material.

Why is specific materiality set for particular items?

-Specific materiality is set for particular classes of transactions, account balances, or disclosures that require special attention due to the nature of the item or the expectations of the users of the financial statements.

How does the auditor's choice of benchmark and percentage affect the materiality levels?

-The choice of benchmark and percentage directly affects the calculation of materiality levels. Different benchmarks and percentages will result in different materiality levels, which in turn influence the extent of substantive tests and the auditor's approach to identifying and evaluating misstatements.

Outlines

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenMindmap

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenKeywords

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenHighlights

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenTranscripts

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenWeitere ähnliche Videos ansehen

2.3 Overview of the Audit Process Audit Planning Risk Assessment

PERENCANAAN AUDIT - Strategi Audit Keseluruhan dan Program Audit

Pedoman Perencanaan Pengawasan Berbasis Risiko (PPBR)

2.1 Overview of the Audit Process Introduction and Pre Engagement Activities

Audit Risk Model

13-7 - 4 Tahap Proses Audit

5.0 / 5 (0 votes)