บทที่ 3 ดอกเบี้ยและมูลค่าของเงิน ep.2

Summary

TLDRThis transcript provides an educational walkthrough on calculating compound interest in two scenarios: one where interest is compounded annually and the other semi-annually. It explains the necessary formulas and steps to calculate the accumulated amount after 10 years for both cases, starting with a 1,000 or 10,000 Baht deposit at a 3% annual interest rate. The comparison highlights the slight difference in the total amount accumulated when compounding frequency changes, with the semi-annual compounding resulting in slightly higher returns. The lesson emphasizes understanding interest rate adjustments and compounding frequency in financial calculations.

Takeaways

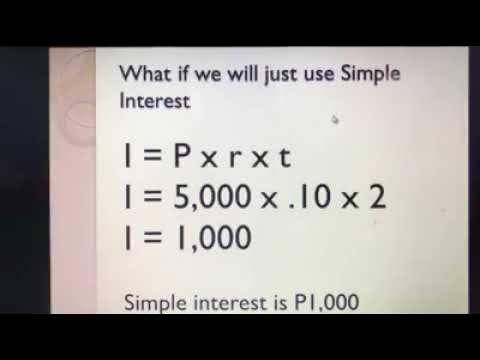

- 😀 Compound interest is calculated using the formula: A = P × (1 + R/K)^(K×N).

- 😀 The script explains how compound interest is applied differently when interest is compounded annually vs. semi-annually.

- 😀 Example 1 demonstrates how depositing 1,000 Baht at 3% annual interest compounded annually for 10 years results in approximately 1,343.91 Baht.

- 😀 Example 2 shows that with 10,000 Baht deposited at 3% annual interest compounded semi-annually for 10 years, the total amount is about 13,460.85 Baht.

- 😀 The more frequent compounding (e.g., semi-annual) leads to a slightly higher final amount, even with the same interest rate and time period.

- 😀 In Example 2, since interest is compounded twice per year, the interest rate per period is halved to 1.5%.

- 😀 The compound interest formula requires four key variables: the principal (P), the annual interest rate (R), the number of compounding periods per year (K), and the total number of years (N).

- 😀 The process for calculating compound interest involves substituting the appropriate values for these variables into the formula to find the accumulated amount (A).

- 😀 Small differences in the compounding frequency can result in noticeably different final amounts, even when the interest rate and time period are the same.

- 😀 The script emphasizes the importance of understanding the compounding frequency when evaluating interest-bearing investments or savings.

Q & A

What is the main topic discussed in the transcript?

-The main topic discussed is compound interest, specifically how to calculate the total amount after depositing money into a bank account with compound interest over a certain number of years.

What is the formula used to calculate the total amount of money with compound interest?

-The formula used is: Total Amount = P * (1 + R/K)^(K*N), where P is the principal, R is the annual interest rate, K is the number of times interest is compounded per year, and N is the number of years.

What does each variable in the compound interest formula represent?

-In the formula, P represents the initial deposit (principal), R represents the annual interest rate (as a decimal), K represents the number of times the interest is compounded per year, and N represents the number of years the money is invested.

In the first example, how much money is initially deposited?

-In the first example, the initial deposit is 1,000 Baht.

How often is the interest compounded in the first example?

-In the first example, the interest is compounded once per year.

What is the interest rate used in the first example?

-The interest rate in the first example is 3% per year.

How many years is the money deposited in the first example?

-In the first example, the money is deposited for 10 years.

What is the total amount after 10 years in the first example?

-The total amount after 10 years is approximately 13,430.91 Baht.

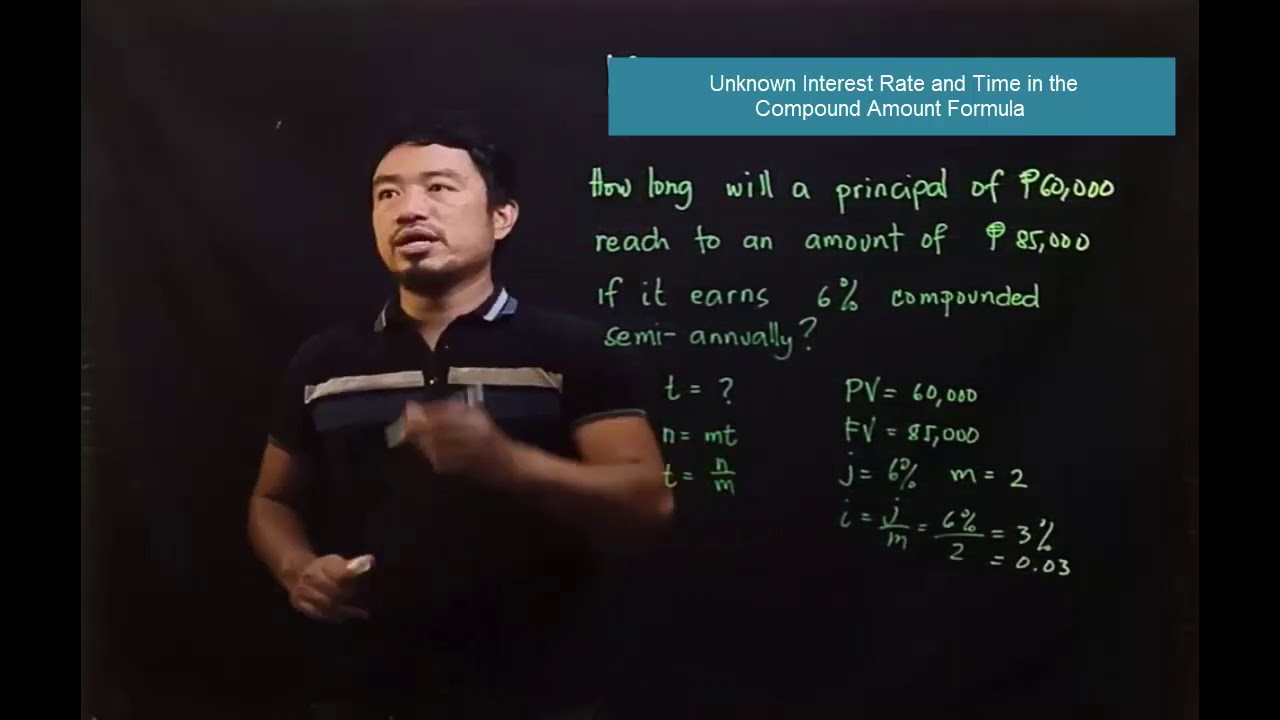

What is the difference between the second and third examples regarding how interest is compounded?

-In the second example, interest is compounded once per year, while in the third example, interest is compounded every 6 months, meaning twice per year.

Which example results in a higher total amount after 10 years?

-The third example, where interest is compounded every 6 months, results in a slightly higher total amount compared to the second example, where interest is compounded once per year.

Outlines

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenMindmap

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenKeywords

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenHighlights

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenTranscripts

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenWeitere ähnliche Videos ansehen

BUNGA MAJEMUK (Matematika Ekonomi) by Dwika Rahmi Hidayanti

COMPOUND INTEREST (compounded annually) || GRADE 11 GENERAL MATHEMATICS Q2

บทที่ 3 ดอกเบี้ยและมูลค่าของเงิน ep.5 [มูลค่าปัจจุบันและมูลค่าอนาคต]

COMPOUND INTEREST LONG METHOD PERSONAL FINANCE L3 Video2

Bunga Tunggal

Compound Amount Formula with Unknown Interest Rate and Time

5.0 / 5 (0 votes)