Trial balance explained

Summary

TLDRA trial balance is a key accounting tool used to ensure that debits and credits match and to verify the accuracy of journal entries. It is prepared after recording transactions in the journal and T-accounts but before preparing financial statements. A trial balance helps detect errors, such as incorrect journal entries or unrecorded transactions, and includes accounts from both the balance sheet and income statement. Although modern accounting systems automatically check for balance, understanding trial balances remains essential for error detection and financial accuracy.

Takeaways

- 😀 A trial balance is a tool used in accounting to ensure that the sum of debits equals the sum of credits, helping to identify any mathematical errors.

- 😀 The trial balance fits between preparing T-accounts and financial statements in the accounting process.

- 😀 It allows accountants to verify the balance of accounts against expectations, like checking if accounts receivable is much higher than usual.

- 😀 Not all activities within a company need to be recorded in the accounting system, such as casual greetings or site tours.

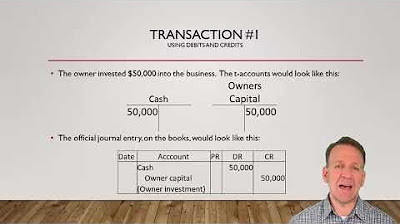

- 😀 A journal entry needs to be made when a transaction, like purchasing goods on credit, occurs, with proper debit and credit entries.

- 😀 A trial balance lists all ledger accounts with their respective debit or credit balances for a given period.

- 😀 Assets are typically listed first in a trial balance, with each account having the sum of debits and credits calculated.

- 😀 The trial balance includes both balance sheet and income statement accounts, helping ensure overall financial accuracy.

- 😀 If the trial balance is balanced, no error is detected, though some issues (like swapped debits and credits) might still be hard to spot.

- 😀 A trial balance can highlight errors, such as incorrect journal entries, posting to wrong accounts, or missing transactions.

- 😀 While modern accounting systems automatically validate journal entries, understanding the trial balance concept is still valuable for early error detection.

Q & A

What is a trial balance?

-A trial balance is a listing of all ledger accounts along with their respective debit or credit balances for a specific period. It helps ensure that the sum of the debits equals the sum of the credits, which serves as an initial check for errors in the accounting records.

How does a trial balance fit into the accounting process?

-A trial balance comes after preparing journal entries and T-accounts, and before preparing the financial statements. It is used to check for mathematical errors and to ensure that account balances are reasonable and align with expectations.

Why is a trial balance important for accountants?

-A trial balance is crucial because it helps accountants identify errors by ensuring that the debits and credits are in balance. It also helps detect mistakes in journal entries, such as swapped debits and credits or incorrect amounts.

What does a trial balance help accountants check?

-It helps accountants check whether the sum of the debits equals the sum of the credits, and whether the balances in different accounts (like Accounts Receivable or Inventory) align with expectations based on prior data.

What is the role of the journal entries in a trial balance?

-Journal entries are the source of the information that makes up the trial balance. The debits and credits from journal entries are posted to various accounts, and the trial balance aggregates these entries to ensure correctness.

How do you prepare a trial balance for a new company?

-To prepare a trial balance for a new company, you begin by listing the company's asset, liability, equity, revenue, and expense accounts along with their respective debit or credit balances. Then, you sum the debits and credits to ensure they are equal.

Why might a trial balance not balance?

-A trial balance might not balance if there is an error in the journal entries, such as a swapped debit and credit, incorrect amounts, missing transactions, or posting to the wrong accounts. These errors must be located and corrected.

How is net income related to a trial balance?

-Net income itself is not listed in the trial balance. Instead, individual income statement accounts like revenue and expenses are included, and the net income will be determined later when preparing the financial statements.

Can a trial balance detect all errors in accounting records?

-While a balanced trial balance indicates no obvious mathematical errors, it cannot detect all errors. For example, if journal entries are posted to the wrong accounts or if transactions are missed entirely, these errors might not be caught unless further investigation is done.

How has technology affected the need for trial balances?

-Technology, through electronic accounting systems with built-in validation rules, has reduced the need for manual trial balance checks. However, it's still important for accountants to understand how a trial balance works as it can help identify errors early in the accounting process.

Outlines

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenMindmap

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenKeywords

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenHighlights

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenTranscripts

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenWeitere ähnliche Videos ansehen

The TRIAL BALANCE Explained (Full Example!)

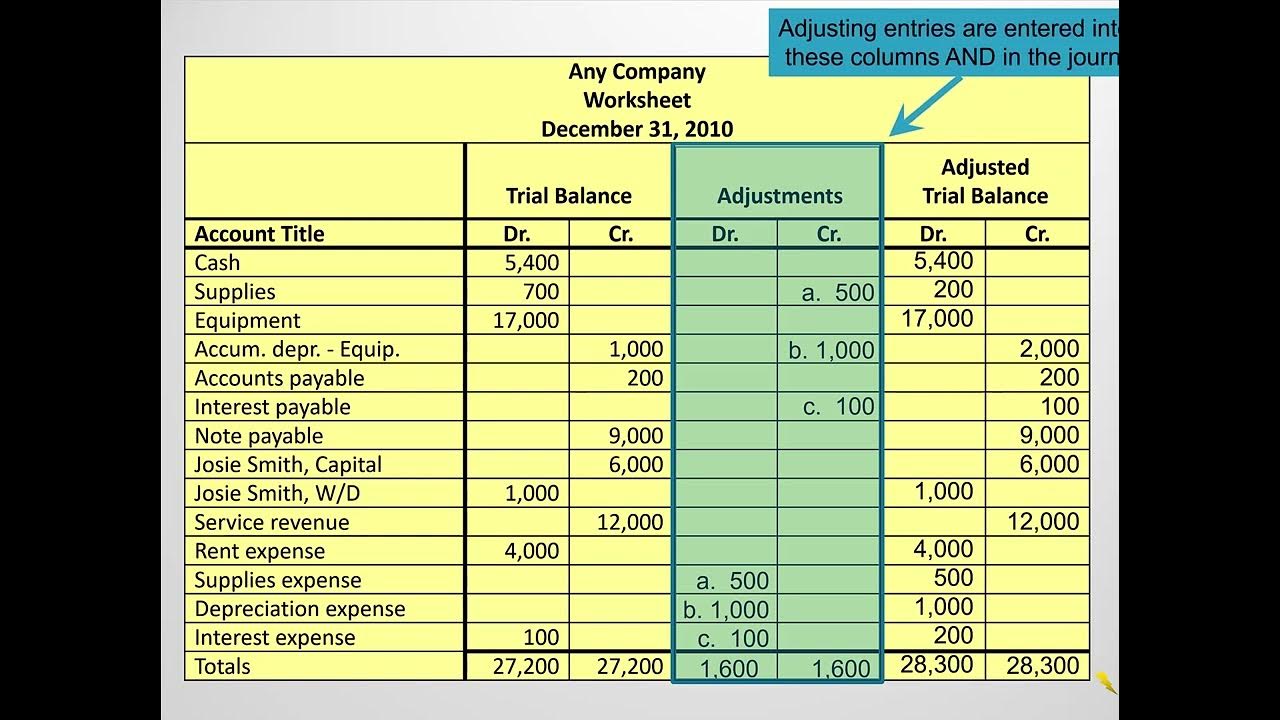

What is the Adjusted Trial Balance and How is it Created?

Neng Ida Soniawati–Ekonomi XII-SMAN 1 Babakan Madang-Jurnal Penutup & Pembalik – Nov2022#pgtkjabar

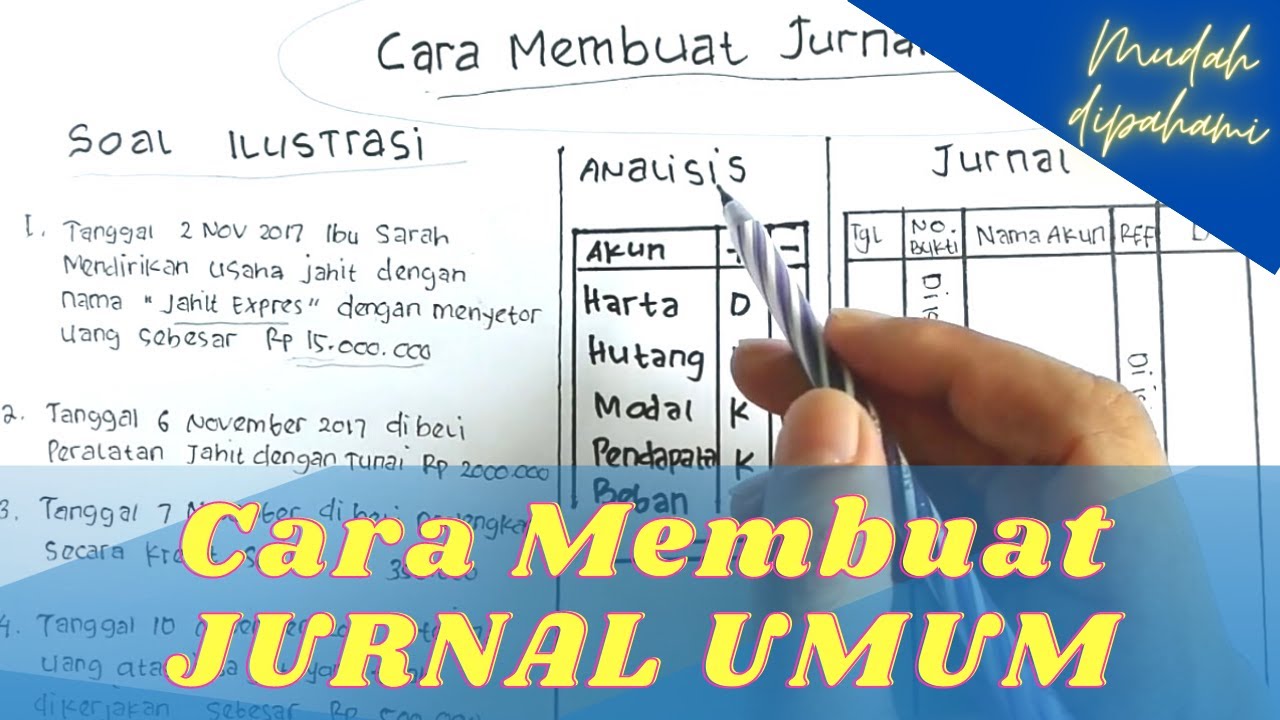

Cara Membuat Jurnal Umum Perusahaan Jasa untuk Pemula

Double Entry Accounting and t-accounts (Debits and Credits)

FA16 - Adjusted Trial Balance

5.0 / 5 (0 votes)