ICT MMXM Trading Strategy That Works Every Time! (Highly Profitable)

Summary

TLDRIn this video, the Market Maker Model is explained as a powerful trading strategy, emphasizing the importance of identifying high time frame price delivery areas (PD), consolidation, and distribution phases. Traders are guided to recognize market structure shifts and use mitigation blocks and fair value gaps for low-risk entries. With real-world examples and practical advice on targeting risk/reward ratios, the video simplifies the model, focusing on how to manage risk and execute trades effectively. The speaker stresses that this method is both powerful and simple, making it accessible for traders aiming to improve their trading techniques.

Takeaways

- 😀 Identify High Time Frame PDAs (Price Delivery Arrays) such as Auto Blocks, Break Up Blocks, Fair Value Gaps, or significant liquidity levels for potential price reversal zones.

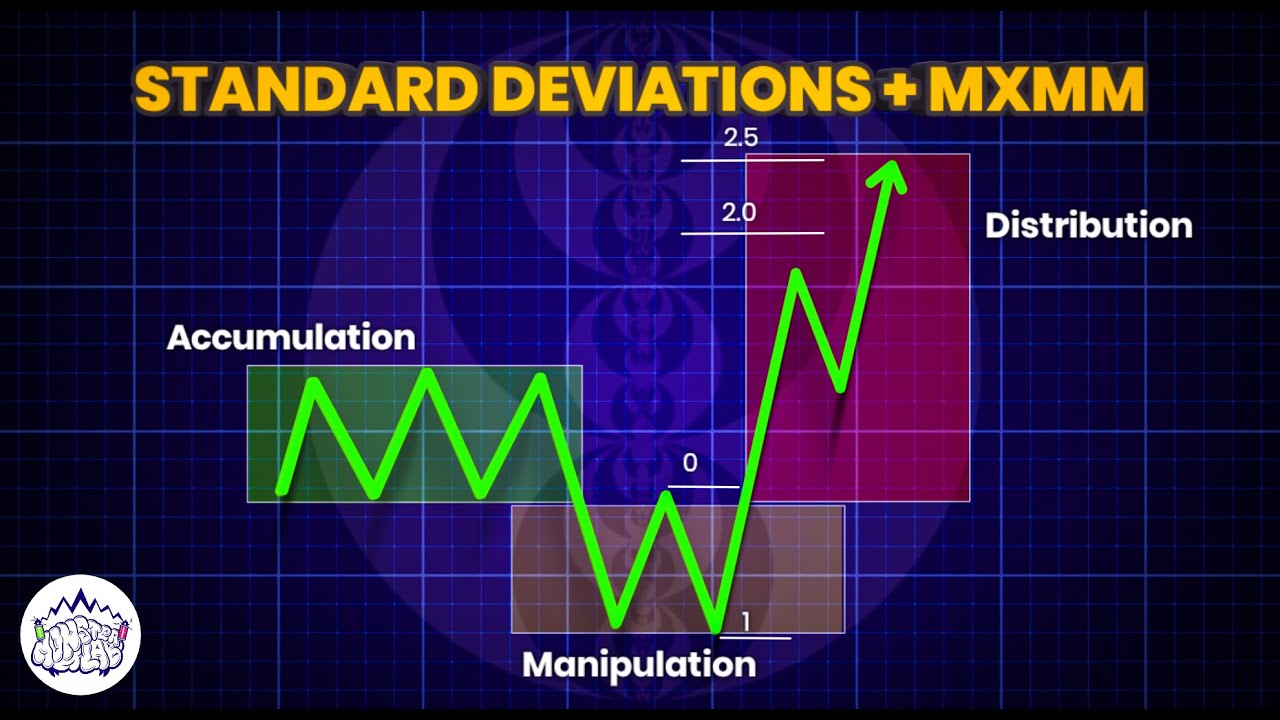

- 😀 Recognize consolidation and distribution (for sell) or accumulation (for buy) phases as part of the Market Maker Model.

- 😀 A consolidation phase is followed by a distribution (bearish) or accumulation (bullish) phase depending on the market direction.

- 😀 Once price enters the high time frame PD, look for a market structure shift to confirm potential trade entry.

- 😀 Mitigation Blocks (old auto blocks, fair value gaps, volume imbalances) are key entry zones after a market structure shift.

- 😀 Always use mitigation blocks to find low-risk entries after identifying the market direction (bearish or bullish).

- 😀 The best time to enter a trade is when price is below the 0.5 level of the range. After this level, probabilities of success decrease.

- 😀 Keep trade targets realistic with a risk/reward ratio of 1:2 or 1:3 to maintain a disciplined and psychologically healthy trading approach.

- 😀 In a bearish market, identify the consolidation and distribution phases before executing a sell trade. In a bullish market, focus on accumulation phases for buy trades.

- 😀 In the execution phase, transition from high time frame analysis (e.g., daily) to lower time frame charts (e.g., 1-hour) for precise entry points and trade management.

- 😀 The Market Maker Model is effective across multiple time frames, providing a consistent and reliable approach to trading once the model’s principles are mastered.

Q & A

What is the Market Maker Model?

-The Market Maker Model is a trading strategy based on identifying consolidation and distribution phases in the market. It involves recognizing price patterns and structures, such as fair value gaps, and using mitigation blocks to enter low-risk trades with a high probability of success.

What is meant by 'High Time Frame PDRA'?

-PDRA stands for Price Delivery and Rejection Area. It refers to significant price zones on higher timeframes, such as daily or weekly, where price has previously reversed or consolidated. These areas include levels like auto blocks, breakup blocks, fair value gaps, or significant liquidity levels.

What are 'Auto Blocks' and how are they used in trading?

-Auto Blocks are key price zones where price action has previously shifted in a particular direction. These blocks help traders identify where price might react again in the future. In the context of the Market Maker Model, traders use them to mark potential entry points after a market structure shift.

How do you identify a consolidation phase in the Market Maker Model?

-A consolidation phase is identified by a period of sideways price movement, typically marked by price staying within a defined range. It represents a phase where the market is undecided, and it often precedes a distribution (for bearish markets) or accumulation (for bullish markets) phase.

What is the significance of a market structure shift?

-A market structure shift indicates a change in the direction of price movement. It is a key signal in the Market Maker Model, as it marks the point where price moves from a phase of consolidation or distribution to a new trend. This shift is crucial for confirming trade entries based on the strategy.

What is a mitigation block and how does it relate to trade entries?

-A mitigation block is a price zone formed when price retraces to an area where it has previously shown a strong reaction. These blocks are used to identify low-risk entries after a market structure shift. Traders can enter positions near these levels, where price is likely to respect past market behavior.

How does the Market Maker Model incorporate fair value gaps in trade setups?

-Fair value gaps are price zones where there is an imbalance, typically caused by fast price movements. In the Market Maker Model, these gaps are used as potential entry points, where price might retrace before continuing in the desired direction. Traders look for these gaps to confirm the validity of their trades.

Why is it important to use a 0.5 level as a rule of thumb in the Market Maker Model?

-The 0.5 level, or the midpoint of a range, is used as a key reference point to gauge the strength of a market move. If price is below the 0.5 level, it is considered a more favorable time to enter trades, as the probability of a successful move is higher. Once price exceeds the 0.5 level, the likelihood of success decreases.

How do you handle multiple distribution phases in the Market Maker Model?

-While multiple distribution phases can occur, it is not necessary to identify all of them. The primary focus should be on the first distribution phase after the consolidation phase. Traders can use this initial distribution phase as a key signal to enter trades, even if further distribution phases follow.

Can the Market Maker Model be applied to different time frames?

-Yes, the Market Maker Model is versatile and can be applied across different time frames. It works on any chart, from daily down to hourly or lower time frames. The key is to identify consolidation and distribution phases, market structure shifts, and mitigation blocks on the appropriate time frame for the trade.

Outlines

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenMindmap

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenKeywords

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenHighlights

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenTranscripts

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenWeitere ähnliche Videos ansehen

Standard Deviations + MMXM | ICT Concepts | DexterLab

Episode 8: Finding Market Makers Models (MMXM's) - ICT Concepts

ICT Market Maker Models - A Simple Guide

Time & Price Algorithmic Trading: Draw On Liquidity

MMXM IPDA cycles + PO3 | Fractal Cheat Code For Price Anticipation

How to trade Market Maker Models - A Deep Dive (ICT Concepts)

5.0 / 5 (0 votes)