MMXM Trader V2 Forex Trading course- ICT Concept: 6.0 The Double Purge An Eye Opener to Liquidity

Summary

TLDRThe video script delves into the 'Double Purge' trading strategy, highlighting its significance in identifying market movements with low resistance. It emphasizes the importance of Smart Money Trade (SMT) and higher time frame Price and Order Flow (PD) arrays to predict reversals or continuations. The script provides a step-by-step guide on recognizing and leveraging the Double Purge pattern for high-probability trades, with examples illustrating its application in various market scenarios.

Takeaways

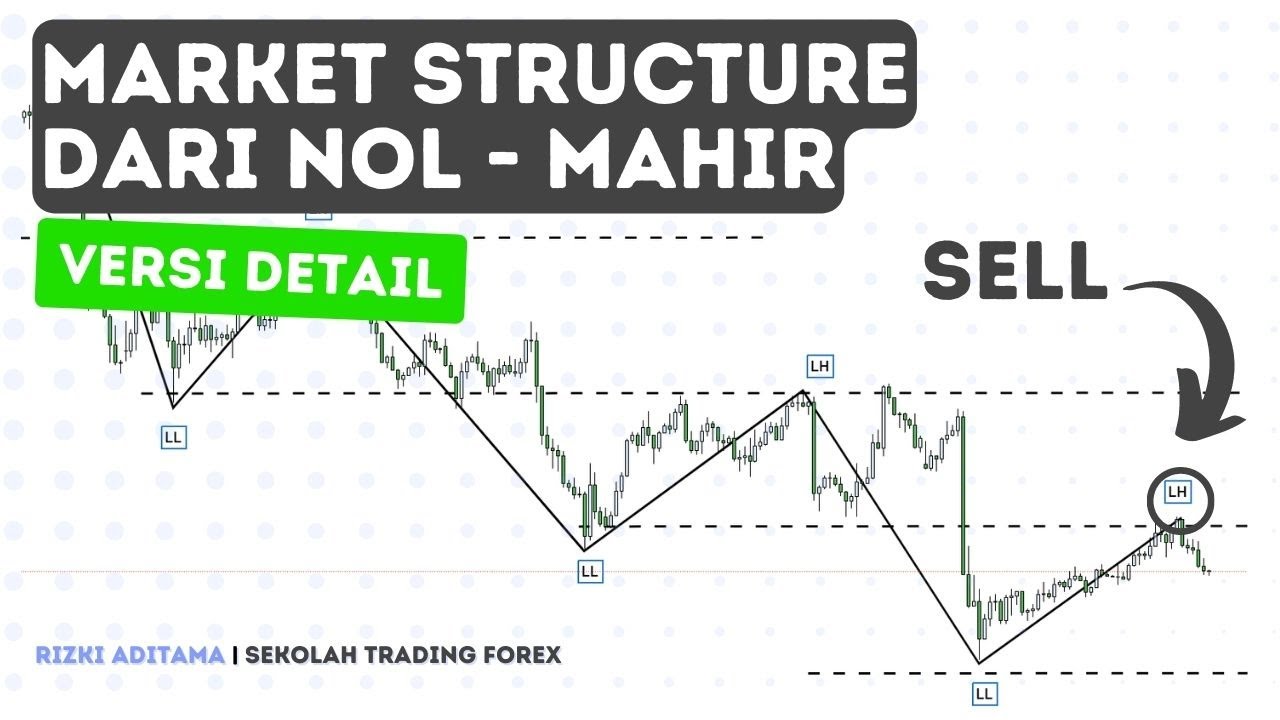

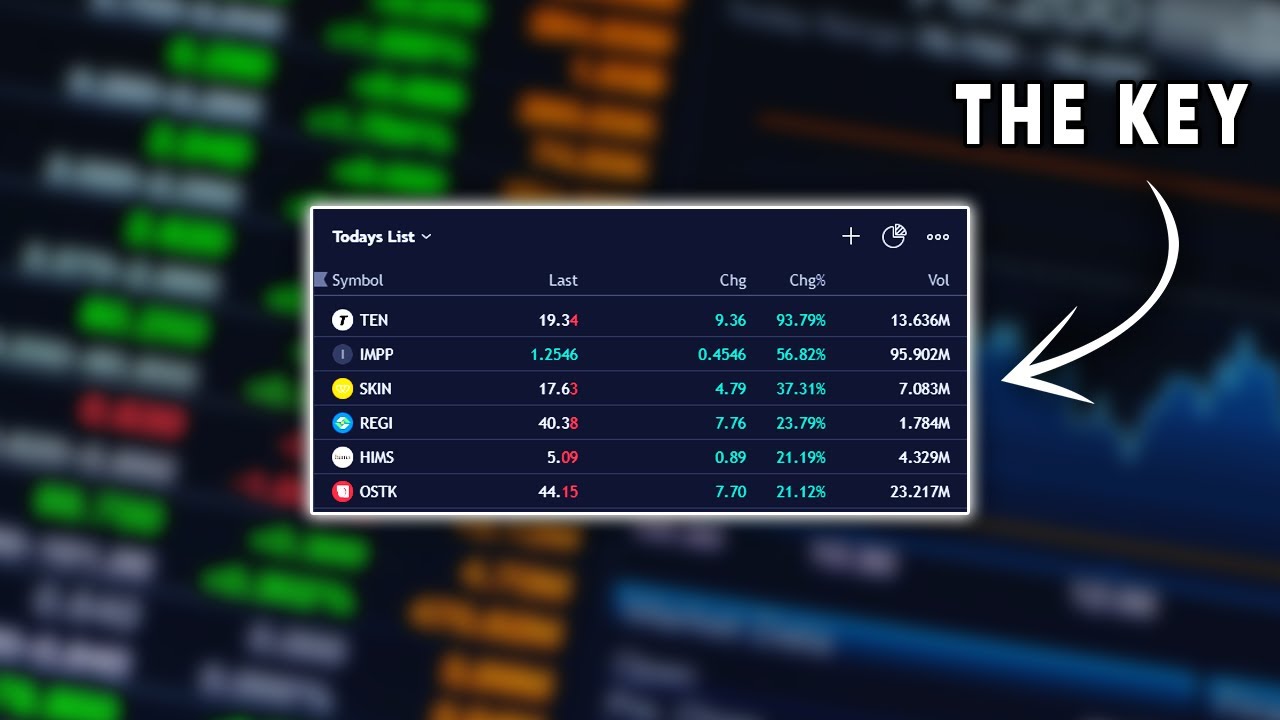

- 🔍 Market makers move price with low resistance after purging both sides of the market.

- 📈 Use the double purge pattern in the direction of higher time frame institutional order flow.

- 📊 SMT (Smart Money Technique) is crucial for identifying high probability order blocks.

- 🔄 Double purge can indicate both reversals and continuations in the market.

- 🛑 In bearish scenarios, sell stops are taken out first, then buy stops, forming a protected high.

- 📉 In bullish scenarios, buy stops are taken out first, then sell stops, forming a protected low.

- 🔗 Order pairing of buy stops and sell stops is essential for determining market moves.

- 🖥️ Mechanical approach: Purge stops in sequence to predict market direction.

- 📌 Identifying premium and discount levels within the range is key for making trading decisions.

- 🔁 Example analysis: Double purge of stops followed by low resistance liquidity run confirms the market direction.

Q & A

What is the main focus of the 'double Purge' strategy discussed in the video?

-The 'double Purge' strategy focuses on liquidity by knocking out both sides of the market (sell stops and buy stops) to allow market makers to move the price with low resistance in the direction of higher time frame institutional order flow.

How can the 'double Purge' pattern be used in trading?

-The 'double Purge' pattern can be used for both reversals and continuations. It involves purging sell stops and buy stops to create high probability order blocks and fair value gaps, guiding traders on where to place stop-loss orders.

What role does SMT (Smart Money Technique) play in the 'double Purge' strategy?

-SMT is crucial in the 'double Purge' strategy as it helps identify high probability order blocks and fair value gaps. It increases the probability of successful trades by confirming protected highs and lows.

In a bearish scenario, what sequence of events should traders look for according to the 'double Purge' strategy?

-In a bearish scenario, traders should look for sell stops to be taken out first, followed by buy stops. After the buy stops are taken, SMT should be identified to form a high probability order block or fair value gap, indicating a protected high.

In a bullish scenario, what is the expected sequence of events in the 'double Purge' strategy?

-In a bullish scenario, buy stops should be taken out first, followed by sell stops. After the sell stops are taken, SMT should be identified to form a high probability order block or fair value gap, indicating a protected low.

What is the significance of the 'premium key PD array' and 'discount key PD array' in the 'double Purge' strategy?

-The 'premium key PD array' and 'discount key PD array' are crucial levels in the 'double Purge' strategy. They help traders identify areas where buy stops and sell stops should be accumulated, guiding the mechanical approach to trading.

Why is it important to accumulate sell stops below an old low and buy stops above an old high in the 'double Purge' strategy?

-Accumulating sell stops below an old low and buy stops above an old high is important because it sets up the order pairing necessary for the 'double Purge.' This ensures that once both sides are purged, the market can move in the desired direction with low resistance.

How does the 'double Purge' strategy ensure a low resistance liquidity run (LRLR)?

-The 'double Purge' strategy ensures a low resistance liquidity run by first purging both sell stops and buy stops, creating a situation where market makers can move the price in the real direction it wants to go with minimal resistance.

What is the importance of marking out premium and discount ranges in the 'double Purge' strategy?

-Marking out premium and discount ranges helps traders identify where the buy stops and sell stops are likely to be accumulated. This is essential for applying the 'double Purge' strategy effectively and ensuring trades are taken at high probability areas.

How can traders identify high probability order blocks or fair value gaps in the 'double Purge' strategy?

-Traders can identify high probability order blocks or fair value gaps by looking for SMT formations after the double purge of sell stops and buy stops. These formations indicate protected highs or lows, which are likely to result in successful trades.

What is the role of fractals in the 'double Purge' strategy?

-Fractals play a significant role in the 'double Purge' strategy as they allow traders to apply the pattern on various time frames. By identifying fractal ranges, traders can spot double purges and low resistance liquidity runs at different scales of price action.

How can traders use order blocks formed by the 'double Purge' strategy to place trades?

-Traders can use order blocks formed by the 'double Purge' strategy to place trades by entering positions at high probability areas such as discount fair value gaps or order blocks. These areas offer optimal entry points with minimal risk, ensuring effective trade execution.

What is the significance of a 'protected low' or 'protected high' in the 'double Purge' strategy?

-A 'protected low' or 'protected high' signifies a level where price is unlikely to return after the double purge. These levels are essential in the 'double Purge' strategy as they indicate the direction of the low resistance liquidity run, guiding traders on where to place stop-loss orders.

How does the 'double Purge' strategy help traders anticipate market moves during high impact news events like CPI releases?

-The 'double Purge' strategy helps traders anticipate market moves during high impact news events by identifying liquidity purges that occur before the news. By spotting these purges, traders can position themselves for the subsequent low resistance liquidity run triggered by the news event.

What is the key takeaway from the examples of the 'double Purge' strategy applied to various markets and time frames?

-The key takeaway is that the 'double Purge' strategy is a versatile and effective approach that can be applied to various markets and time frames. By understanding the mechanics of liquidity purges and SMT formations, traders can consistently identify high probability trading opportunities.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

5.0 / 5 (0 votes)