Tutorial Estimasi ARDL Model Dengan Eviews

Summary

TLDRThis tutorial explains the use of the ARDL (Autoregressive Distributed Lag) model in econometrics to forecast economic variables. The speaker demonstrates how to test for stationarity, perform cointegration tests, and implement ARDL to understand long-term relationships among variables like GDP, exchange rates, and exports. The process includes checking assumptions, model estimation, and ensuring stability for forecasting. The tutorial highlights practical steps in software like EViews, showcasing the application of ARDL for reliable long-term predictions and addressing issues like non-stationary data and cointegration.

Takeaways

- 😀 The ARDL (Autoregressive Distributed Lag) model is used to analyze the relationship between variables by incorporating both current and past values of dependent and independent variables.

- 😀 The ARDL model can be particularly useful when the data is non-stationary, and it can be applied even when variables are cointegrated at different levels.

- 😀 The first step in using the ARDL model is to perform a stationarity test on the variables, ensuring they are stationary at the first difference level if necessary.

- 😀 If the variables are not stationary, they should be transformed. Once stationary, cointegration testing follows to determine if there is a long-term relationship between the variables.

- 😀 If cointegration is not found, the ARDL model can still be used, provided the variables are stationary and suitable for the model.

- 😀 The Johansen cointegration test is used to verify the long-term relationships between variables. If cointegration exists, it indicates a valid model for forecasting.

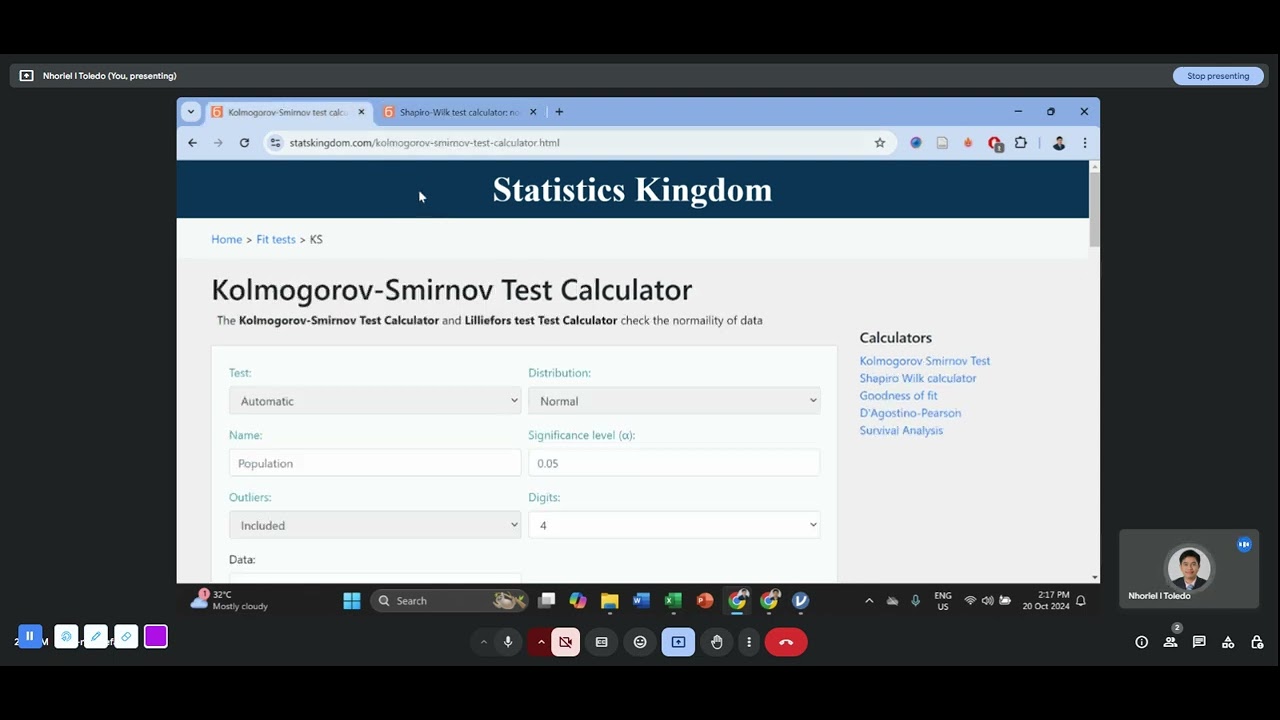

- 😀 Classical assumption tests (normality, autocorrelation, heteroscedasticity) are conducted to ensure the ARDL model is robust and reliable.

- 😀 Model selection involves checking for the optimal number of lags and regressor selection. This is done through automatic selection criteria and ensuring the model is appropriately specified.

- 😀 Once the model is estimated, the ARDL model can be used for long-term forecasting, but it is essential that the assumptions (stationarity and cointegration) are met before prediction.

- 😀 The final model's stability is tested using parameter stability tests, which ensure the model's predictions will remain consistent over time.

- 😀 Forecasting results are compared to actual values to assess the accuracy of the model, with predictions showing a close match to actual data, though errors may increase over time.

Q & A

What is the ARDL model, and why is it important in econometrics?

-The ARDL (Autoregressive Distributed Lag) model is used to analyze the relationship between variables over time. It includes both the current and past values of the explanatory variables, helping to capture the dynamic effects. It is particularly useful in situations where variables are not stationary and allows for cointegration testing, which is key for long-term predictions and understanding the long-term equilibrium relationship.

What is the primary advantage of the ARDL model?

-The main advantage of the ARDL model is that it does not require all variables to be cointegrated at the same order. It is also suitable for small sample sizes and can handle variables that are stationary at different levels or after first differencing.

How do you determine whether a model is suitable for the ARDL approach?

-To determine if the ARDL model is suitable, you first need to check for stationarity of the variables. If they are stationary at their levels or after first differencing, and if cointegration is found, then ARDL can be applied for long-term forecasting.

What is a stationarity test, and why is it important?

-A stationarity test helps determine whether the statistical properties of a time series, such as its mean and variance, are constant over time. It is important because non-stationary data can lead to spurious results in time series models. The ARDL approach requires stationarity in the data before proceeding with further analysis.

What does cointegration mean, and why is it relevant in ARDL modeling?

-Cointegration refers to a situation where two or more non-stationary time series move together over time, implying a long-term equilibrium relationship between them. It is important in ARDL modeling because cointegration tests confirm whether a stable long-term relationship exists between variables, which is necessary for reliable long-term forecasting.

What are the steps involved in applying the ARDL model in econometrics?

-The steps include: 1) Conducting a stationarity test on the variables, 2) If necessary, transforming the data to make it stationary, 3) Testing for cointegration, 4) Estimating the ARDL model, 5) Performing classical assumption tests (normality, autocorrelation, heteroscedasticity), 6) Using the model for long-term forecasting and stability testing.

What is the significance of the Johansen cointegration test in the ARDL process?

-The Johansen cointegration test is used to determine whether there is a long-term equilibrium relationship between the variables. If the test indicates no cointegration, the ARDL model can still be used for further analysis, as long as the variables are stationary and not cointegrated.

What is meant by 'spurious regression' in the context of ARDL modeling?

-Spurious regression refers to a situation where a model indicates a relationship between variables that does not exist, typically due to non-stationary data. The ARDL model helps prevent this by ensuring that all variables are stationary before analysis, which improves the validity of the results.

How do you test the classical assumptions for ARDL model validity?

-Classical assumptions can be tested using various tests: 1) Normality test (e.g., Jarque-Bera test), 2) Autocorrelation test (e.g., Breusch-Godfrey test), and 3) Heteroscedasticity test (e.g., White's test). If these assumptions hold, the ARDL model is considered reliable for estimation and forecasting.

How can ARDL be used for forecasting, and what challenges might arise?

-ARDL can be used for forecasting by estimating the long-term relationship between the variables and applying it to predict future values. Challenges include the possibility of forecasting errors, which may increase as the forecast horizon lengthens. Additionally, the model's accuracy depends on the stability of the relationships over time.

Outlines

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenMindmap

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenKeywords

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenHighlights

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenTranscripts

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenWeitere ähnliche Videos ansehen

MATERI 1. KONSEP DASAR EKONOMETRIKA ( MK. EKONOMETRIKA/ 3 SKS) Prodi Agribisnis Perikanan

How to Select the Correct Predictive Modeling Technique | Machine Learning Training | Edureka

Praktikum Ekonometrika II - Analisis Panel Dinamis di Stata

Biostatistics & Epidemiology - Use of Excel and Jamovi on Correlation Analysis

REGRESI DENGAN DUMMY VARIABEL LEBIH DARI 2 KATEGORI Oleh Agus Tri Basuki Part 2

Autoregressive Models | Auto Regression | Machine Learning for Beginners | Edureka

5.0 / 5 (0 votes)