Cash Receipt Transaction || Myob Parts Tutorial. 10

Summary

TLDRThis tutorial provides a comprehensive guide on how to input receipt transactions, covering various scenarios such as receiving payments from settling receivables, cash sales, and other transactions. The video explains the process of entering these receipts in detail, from handling discounts on receivables to recording cash sales and dividend income. Additionally, it covers how to process receipts from different sources, including cash sales and the payment of written-off receivables, ensuring a thorough understanding of transaction entry. Practical examples illustrate how to navigate the system for each type of receipt.

Takeaways

- 😀 The tutorial explains how to input receipt transactions for various scenarios such as cash sales, receivable settlements, and other income types.

- 😀 Receipts from the settlement of receivables can be input by selecting the 'Receive Payment' menu and ensuring the correct customer account is chosen.

- 😀 For receivables paid within 10 days, a 2% discount is applied to the sales value, as described in the example with Toko Cahaya Elektro.

- 😀 When there are multiple debts, the system allows the user to apply payments to specific lines, and it automatically calculates discounts and payment amounts.

- 😀 For payments received after 10 days but within 30 days, no discounts are applied, as shown in the example with Jaya Electro Shop.

- 😀 Cash sales require a different process compared to credit sales. A new customer account is created to record these transactions.

- 😀 The tutorial demonstrates how to input cash sales with various items, their sales values, and associated costs such as transportation fees.

- 😀 Income from non-sales transactions, such as dividends, should be entered under the 'Banking' menu and recorded as 'Dividend Income'.

- 😀 Receipts from the write-off of receivables are also recorded in the 'Banking' menu, with the corresponding accounts listed as 'Reserve for Receivables Loss'.

- 😀 For receipts related to non-sale transactions, such as share sales, the income is recorded under 'Long-Term Investment' in the system.

Q & A

What is the main topic of the tutorial in the transcript?

-The main topic of the tutorial is how to input receipt transactions, including receipts from the settlement of receivables, cash sales, and other types of transactions.

What is the process for entering a receipt transaction for the settlement of receivables?

-To enter a receipt transaction for the settlement of receivables, you need to access the 'Receive Payment' menu, select the customer, input the transaction details, and apply any discounts if applicable. The system will automatically calculate the discount based on the payment terms.

How is a discount applied when receiving a payment for receivables?

-A discount is applied if the payment is made within a specified period, for example, less than 10 days. In the transcript, a 2% discount is applied when the payment is made within 10 days, reducing the amount of the receivable.

What is the significance of the date mentioned in the receipt transaction?

-The date in the receipt transaction is important because it determines whether a discount is applicable, based on the payment terms, and also affects the calculation of overdue fines if the payment is made late.

How is the amount received from the customer recorded if it is a payment made after 10 days from the sale?

-If the payment is made after 10 days from the sale, no discount is applied. The total amount received is recorded without any deductions, as seen in the example for a payment received on December 14th.

What is the process for recording a cash sale receipt?

-For recording a cash sale receipt, you need to enter the 'Sales' menu, create a new customer record for cash sales, and enter the transaction details including the items sold, quantity, and total amount. The transaction is immediately recorded as cash sales.

What is the procedure for recording a receipt of income from non-sales transactions, such as dividend income?

-For non-sales transactions like dividend income, you go to the 'Banking' menu, select 'Receive Money,' and enter the relevant details, such as the source of income (e.g., dividend income), the amount received, and the account it should be recorded under.

How are receipts from the settlement of written-off receivables recorded?

-Receipts from the settlement of written-off receivables are recorded by selecting the 'Receive Money' option, then categorizing the receipt as a 'Reserve for Receivables Loss' in the appropriate account, as demonstrated for a payment received on the 20th of the month.

What type of transactions are recorded under the 'Receive Money' menu?

-The 'Receive Money' menu is used to record any receipt of money from non-sales transactions, such as dividend income, receipt of written-off receivables, or the sale of assets like shares.

What is the procedure for recording the receipt of money from the sale of shares?

-When recording the receipt of money from the sale of shares, you enter the 'Receive Money' menu, select the appropriate transaction ID, enter the amount received, and categorize the transaction under 'Long-Term Investment' or the relevant investment account.

Outlines

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenMindmap

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenKeywords

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenHighlights

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenTranscripts

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenWeitere ähnliche Videos ansehen

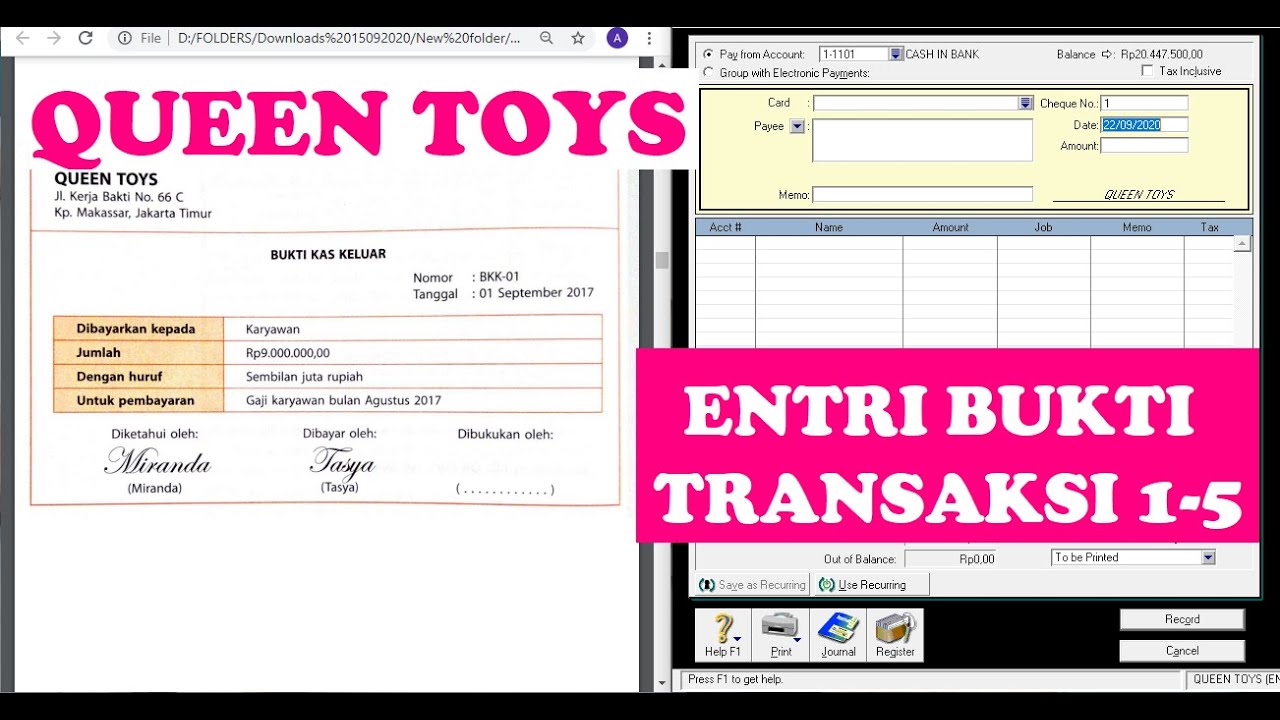

(9-QT) MENGENTRI BUKTI TRANSAKSI 1-5 | MYOB Accounting Plus V18 ED (Queen Toys)

Cara Menggunakan Accurate Online untuk Pemula ‼️

Myob Accounting UD. Buana || Input Transaksi No. 11 - 25 || Part. 5

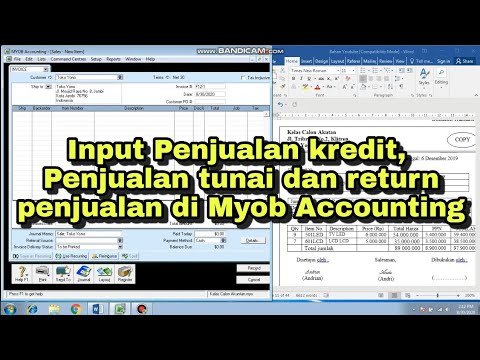

CARA INPUT TRANSAKSI PENJUALAN KREDIT, PENJUALAN TUNAI DAN RETURN PENJUALAN DI MYOB ACCOUNTING

Lecture 04: Share Capital. [Corporation Accounting]

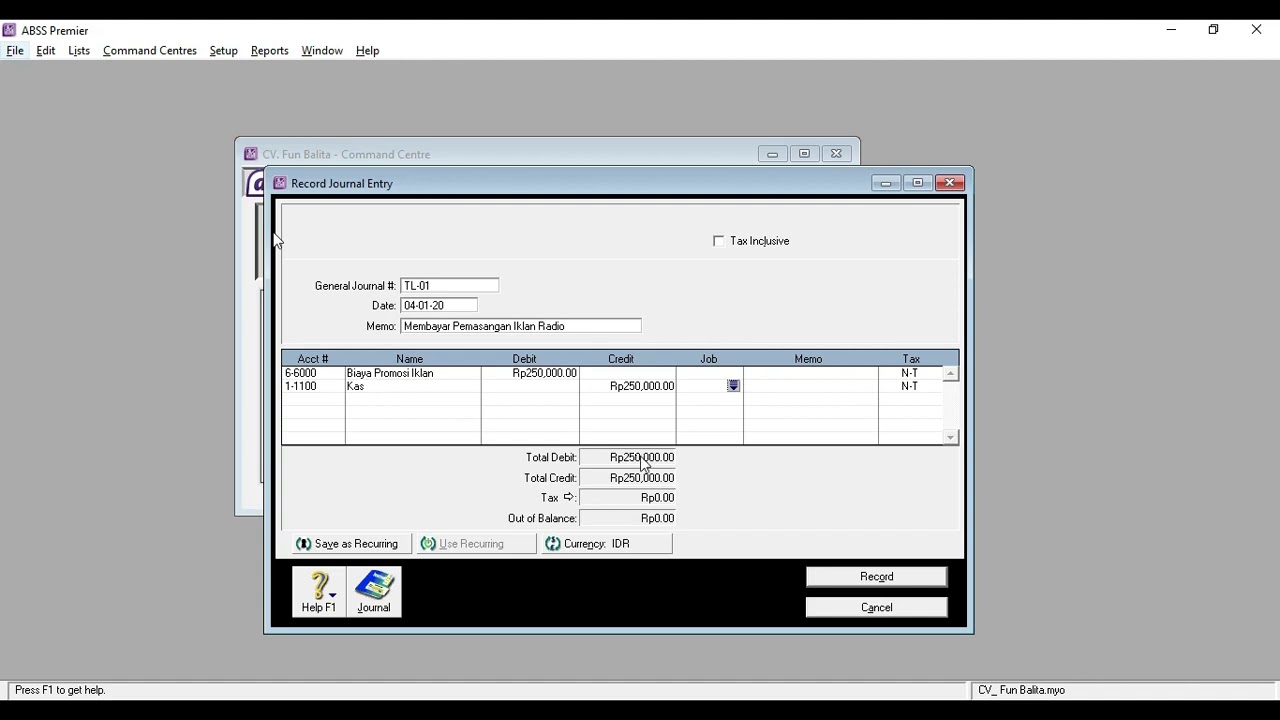

028 Aplikasi Komputer Akuntansi II (ABSS) Pertemuan 3 (Part3)

5.0 / 5 (0 votes)