Risk and Return: Capital Asset Pricing Model (CAPM) 【Dr. Deric】

Summary

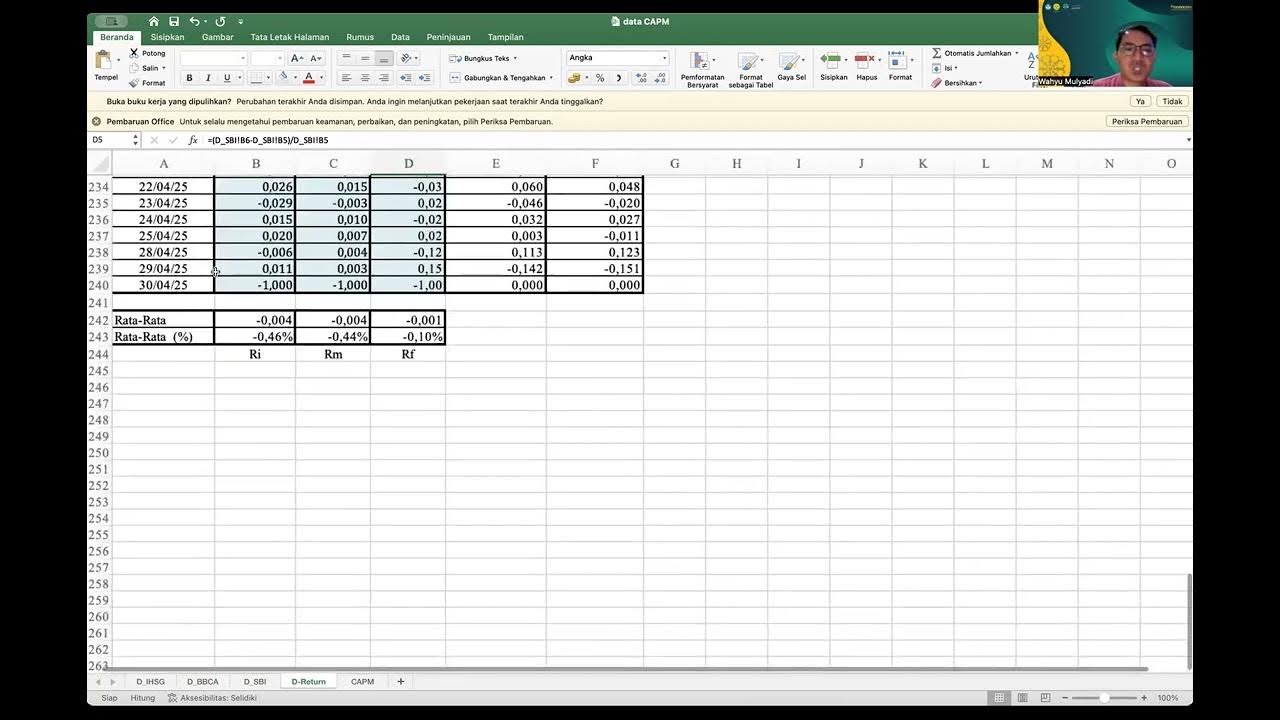

TLDRIn this video, Deric explains the Capital Asset Pricing Model (CAPM), a key finance concept that measures an asset’s systematic risk through its beta. He covers the theory behind CAPM, how to calculate an asset’s beta, and how the model determines the required return based on market conditions. Deric also discusses examples of different companies with varying betas, illustrating how CAPM helps investors make decisions. He concludes with practical examples of portfolio performance analysis using CAPM, providing insights into when to accept or reject investments based on required versus expected returns.

Takeaways

- 😀 CAPM (Capital Asset Pricing Model) is a financial model used to estimate the required return on an asset based on its systematic risk, as measured by beta.

- 😀 Systematic risk refers to the market-wide risk that affects all assets, unlike unsystematic risk, which is specific to individual companies.

- 😀 Beta is the key metric used in CAPM to quantify an asset’s sensitivity to market movements. A beta of 1 means the asset's risk mirrors the market's risk.

- 😀 A beta greater than 1 indicates an asset is more volatile (riskier) than the market, while a beta less than 1 means the asset is less volatile (safer).

- 😀 The formula to calculate the required return in CAPM is: Required Return = Risk-Free Rate + (Market Return - Risk-Free Rate) × Beta.

- 😀 In CAPM, the risk-free rate is typically the return on T-bills, while the market return is the expected return on the broader market.

- 😀 Portfolio beta is calculated by taking a weighted average of the betas of the individual assets in the portfolio.

- 😀 An asset's return can move in the same direction as the market (positive beta) or in the opposite direction (negative beta).

- 😀 If the expected return on an asset is greater than the required return (calculated by CAPM), the asset is considered to have outperformed and is a good investment.

- 😀 If the expected return is less than the required return, the asset has underperformed, and investors should consider avoiding or selling it.

- 😀 CAPM is based on historical data, and while it provides useful insights, it may not always predict future performance accurately due to changing market conditions.

Q & A

What is the primary focus of the Capital Asset Pricing Model (CAPM)?

-CAPM primarily focuses on measuring the systematic risk of an asset, which is the market-related risk that cannot be eliminated through diversification.

Why is unsystematic risk not considered in CAPM?

-Unsystematic risk, or company-specific risk, is considered irrelevant in CAPM because it can be reduced or eliminated through diversification within a portfolio.

What is the role of Beta in CAPM?

-Beta in CAPM measures an asset’s systematic risk by assessing its sensitivity to overall market movements. A higher Beta indicates greater volatility compared to the market, while a lower Beta indicates less volatility.

How is Beta calculated in CAPM?

-Beta is calculated by regressing the returns of an individual asset against the returns of the market. The slope of the regression line represents the asset's Beta.

What does a Beta value of 1, greater than 1, and less than 1 signify?

-A Beta of 1 means the asset’s price moves in line with the market. A Beta greater than 1 indicates more volatility (higher risk), and a Beta less than 1 indicates less volatility (lower risk).

How is the Beta of a portfolio determined?

-The Beta of a portfolio is the weighted average of the individual Betas of the assets in the portfolio, based on their proportion in the total portfolio.

What are the two main components of the required return in CAPM?

-The required return in CAPM consists of the risk-free rate (typically the return on T-bills) and the risk premium, which is determined by the asset's Beta and the difference between the market return and the risk-free rate.

How do you calculate the required return for an asset using CAPM?

-The required return is calculated using the formula: Required Return = Risk-Free Rate + Beta * (Market Return - Risk-Free Rate).

What assumption does CAPM make about market efficiency?

-CAPM assumes that markets are efficient, meaning that all relevant information is already reflected in asset prices, and that investors can use this information to make rational decisions.

What does it mean when an asset’s expected return is higher or lower than its required return?

-If the expected return is higher than the required return, the asset is likely undervalued, making it a good investment. If the expected return is lower than the required return, the asset is likely overvalued, making it a poor investment choice.

Outlines

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenMindmap

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenKeywords

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenHighlights

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenTranscripts

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenWeitere ähnliche Videos ansehen

5.0 / 5 (0 votes)