Firm Specific v Market Risk

Summary

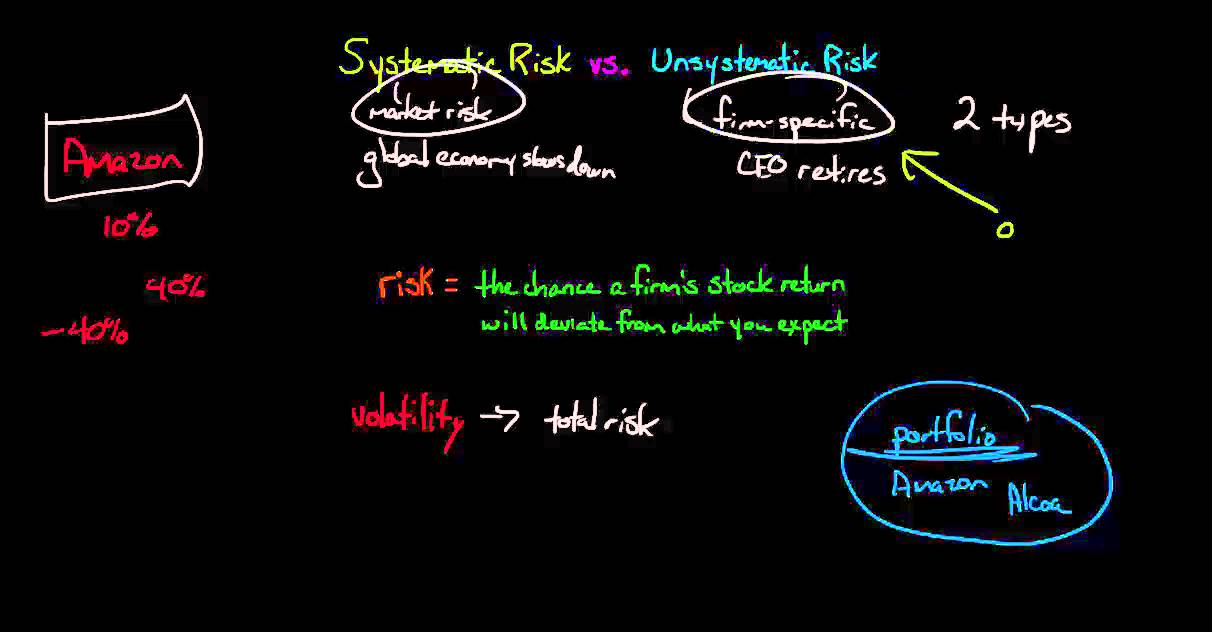

TLDRThis video explains the key difference between firm-level risk (idiosyncratic risk) and market risk (systematic risk). Firm risk pertains to individual companies, like General Motors going bankrupt, which doesn’t affect the entire market. Market risk, on the other hand, impacts the whole economy, as seen during the 2008 financial crisis. Diversification is introduced as a strategy to mitigate firm-specific risks by spreading investments across various assets, thereby reducing exposure to individual company failures. The video also touches on the Capital Asset Pricing Model (CAPM) and how beta measures the risk associated with individual stocks.

Takeaways

- 😀 Firm risk (idiosyncratic risk) refers to the risk of individual companies, such as General Motors going bankrupt, which does not affect the broader market.

- 😀 Market risk (systematic risk) affects the entire market, such as the 2008 recession where most equities declined simultaneously.

- 😀 Diversification is a strategy used by investors to reduce firm-level risk by spreading investments across multiple companies, sectors, and asset classes.

- 😀 Holding stocks from various companies reduces the impact of a single company's failure on the overall portfolio, exemplified by owning both Radio Shack and Amazon stocks.

- 😀 The Capital Asset Pricing Model (CAPM) includes the risk-free rate plus beta times the market risk premium to determine market risk.

- 😀 Beta represents a stock's sensitivity to overall market movements, indicating how much the stock is exposed to market risk.

- 😀 Diversification is important because it allows investors to offset losses in one stock with gains in others, thus minimizing overall risk exposure.

- 😀 If an investor puts all their money into one company, like General Motors, they face a high level of idiosyncratic risk.

- 😀 Having a well-diversified portfolio, with thousands of stocks and bonds, helps mitigate the impact of firm-specific risks.

- 😀 A properly diversified portfolio can withstand individual company failures without significantly affecting the investor's total returns.

- 😀 The difference between firm risk and market risk is critical for investors to understand, as it affects portfolio management and risk assessment.

Q & A

What is the difference between firm-level risk and market risk?

-Firm-level risk (also known as idiosyncratic risk) refers to the risk that is specific to an individual company, such as General Motors going bankrupt. Market risk (or systematic risk) affects the entire market, such as a recession that causes a broad decline in equity prices.

Can firm-level risk affect the entire market?

-No, firm-level risk affects only the individual company and does not necessarily impact the broader market. For example, if General Motors goes bankrupt, the S&P 500 index may not be affected.

What is an example of market risk?

-An example of market risk is the 2008 financial crisis, where the value of most equities fell across the market due to a major recession.

Why is diversification important in reducing risk?

-Diversification spreads investments across multiple assets, reducing the impact of individual company failures. If one company fails, the overall portfolio is less likely to be significantly affected if it includes a variety of other investments.

What would happen if an investor put all their money into one company?

-If an investor concentrated all their investments in one company, like General Motors, they would be exposed to higher risk. If that company failed, the investor's entire portfolio could suffer significant losses.

How does diversification help with firm-level risk?

-Diversification helps manage firm-level risk by holding a variety of stocks and other assets. If one stock underperforms or fails, other investments in the portfolio can offset the losses.

What is beta in the context of CAPM?

-Beta is a measure of a company's risk in relation to the overall market. It is used in the Capital Asset Pricing Model (CAPM) to adjust for firm-level risk, with higher beta indicating higher risk relative to the market.

What does the Capital Asset Pricing Model (CAPM) account for?

-CAPM accounts for both the risk-free rate and the additional market risk premium, adjusted by beta. It helps investors assess the return required for taking on the risk of a particular investment.

What happens if an investor owns a highly diversified portfolio?

-If an investor owns a highly diversified portfolio, the firm-level risks are minimized, and the investor is primarily exposed to market risk. Losses from one investment are likely to be offset by gains from others.

What is the primary takeaway from understanding firm-level and market risk?

-The primary takeaway is that while firm-level risk can be mitigated through diversification, market risk is broader and cannot be easily eliminated. Diversification helps manage individual risks, but investors must still be prepared for systemic market downturns.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Systematic Risk vs Unsystematic Risk

Capital Market Line (CML) vs Security Market Line (SML)

The difference between a hazard and a risk

La differenza tra rischio e pericolo spiegato con un leone, Renato e Carolina

HAZARD VS. RISK | Animated video with explanation, differences, and examples (with Hindi subtitles).

Cara Mudah Menentukan Portofolio yang Efisien | Pemilihan Portofolio

5.0 / 5 (0 votes)