MENGENAL PPH 21 LEBIH DEKAT AGAR TIDAK SALAH PAHAM DENGAN PERUSAHAAN ANDA

Summary

TLDRIn this engaging video, the presenter discusses PPh Pasal 21, Indonesia's income tax for employees. The explanation covers who is subject to this tax, the types of income affected, and the tax calculation process. Viewers learn about the income threshold for tax deductions and how various deductions, including job title and PTKP (non-taxable income), impact taxable income. Through a practical example, the video illustrates the steps to calculate tax liabilities, making the complex topic of income taxation accessible and understandable for a broad audience.

Takeaways

- 😀 PPh 21 is a tax levied on employees by their employers, applicable to both permanent and non-permanent workers.

- 😀 The tax is deducted from various income sources, including salaries, bonuses, and retirement benefits.

- 😀 The threshold for PPh 21 deduction is a monthly income of 4.5 million IDR; below this amount, no tax is deducted.

- 😀 PPh 21 is calculated based on a progressive tax rate system, starting from 5% for annual incomes below 50 million IDR.

- 😀 Employers are responsible for deducting PPh 21 from their employees' income before payment.

- 😀 The tax calculation involves determining gross income, applying deductions for certain expenses, and then calculating the taxable income.

- 😀 The monthly deductions may vary based on the employee's total income and applicable deductions.

- 😀 PTKP (Penghasilan Tidak Kena Pajak) or non-taxable income is considered in calculating taxable income and may vary based on personal circumstances.

- 😀 Employees should keep track of their income and deductions to understand their tax obligations better.

- 😀 Clear understanding of PPh 21 can help employees manage their finances and ensure compliance with tax regulations.

Q & A

What is PPh Pasal 21?

-PPh Pasal 21 is the income tax in Indonesia imposed on employees' earnings. It is a withholding tax deducted by employers from the wages and other compensations paid to employees.

Who are the subjects of PPh Pasal 21?

-PPh Pasal 21 applies to all workers, including permanent employees, temporary employees, freelancers, and pensioners receiving retirement benefits from their employers.

What types of income are subject to PPh Pasal 21?

-Income subject to PPh Pasal 21 includes salaries, bonuses, honorariums, holiday allowances (THR), and commissions, among other forms of compensation.

What is the minimum income threshold for PPh Pasal 21?

-Employees earning above IDR 4.5 million per month are subject to PPh Pasal 21. Those earning below this amount typically do not have income tax withheld.

What are the progressive tax rates for PPh Pasal 21?

-The progressive tax rates for PPh Pasal 21 are as follows: 5% for annual income up to IDR 50 million, 15% for income from IDR 50 million to IDR 250 million, 25% for income from IDR 250 million to IDR 500 million, and 30% for income above IDR 500 million.

How is PPh Pasal 21 calculated?

-To calculate PPh Pasal 21, determine the gross monthly salary, subtract allowable deductions (like insurance and pension contributions), calculate taxable income after adjusting for non-taxable income (PTKP), and then apply the relevant tax rate.

What is PTKP in the context of PPh Pasal 21?

-PTKP stands for 'Penghasilan Tidak Kena Pajak', which means non-taxable income. It is the portion of income that is exempt from taxation and is deducted from the gross income before calculating PPh Pasal 21.

What happens if an employee earns below the minimum threshold?

-If an employee earns below the IDR 4.5 million monthly threshold, they are typically not subject to PPh Pasal 21 and will not have any income tax withheld from their earnings.

Can freelance workers be subject to PPh Pasal 21?

-Yes, freelance workers are subject to PPh Pasal 21. The income they earn from various sources can be taxed, similar to employees in traditional employment.

What should employees do if they have further questions about PPh Pasal 21?

-Employees are encouraged to comment or reach out for further clarifications on PPh Pasal 21, as the speaker in the video offered to create additional content to address any questions.

Outlines

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenMindmap

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenKeywords

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenHighlights

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenTranscripts

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenWeitere ähnliche Videos ansehen

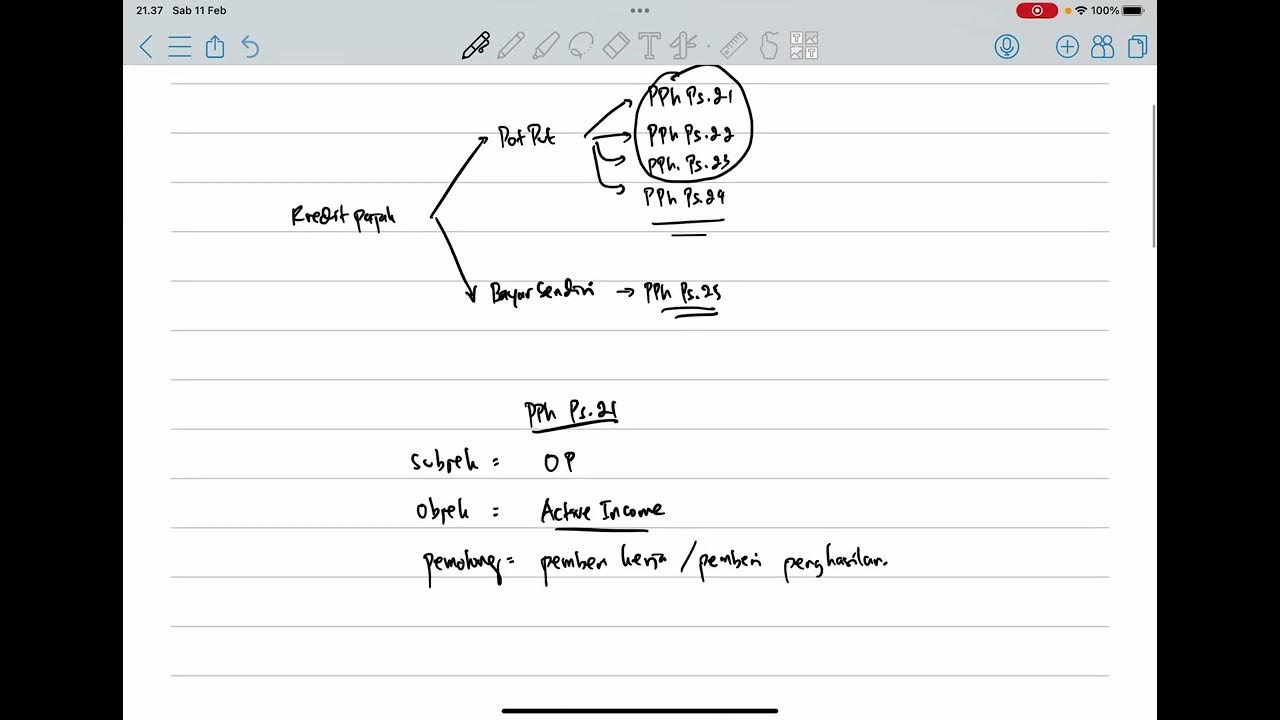

PPh Orang Pribadi (Update 2023) - 5. Kredit Pajak

Menghitung Pajak Penghasilan Pasal 21 || Materi Ekonomi Kelas XI

Perbedaan Pemotongan & Pemungutan Pajak || Withholding Tax #tutorialpajak

Tips memahami apa saja jenis pajak perusahaan yang harus Anda laporkan

E-FUNLEARNING HMAK: PERPAJAKAN PPH PASAL 28 DAN 29

Tutorial Pengisian e-SPT PPh Pasal 21/26

5.0 / 5 (0 votes)