Lumber Prices are about to Explode! Here's why...

Summary

TLDRThe video discusses the recent factors affecting lumber prices, which have dropped from previous highs due to decreased demand linked to high mortgage rates and inflation. With significant mill closures and curtailments, supply has also diminished. Recent increases in tariffs on Canadian lumber may raise costs for consumers, as U.S. producers could benefit while consumers face higher prices. However, the Federal Reserve's rate cuts and ongoing rebuilding efforts from hurricane damage may lead to an eventual increase in demand for lumber, suggesting a potential price spike in the near future.

Takeaways

- 📉 Lumber prices have dropped significantly in 2024, reaching a low of $464 per thousand board feet in July.

- 📈 Prices peaked at $617 in March 2024, showing volatility in the lumber market.

- 🏠 Demand for lumber is closely tied to the housing market, with fewer new homes being built due to high home prices and mortgage rates.

- 📉 The average new U.S. home uses about 15,000 board feet of lumber, costing approximately $8,000 currently.

- 🏗️ Home construction has decreased since early 2022, leading to lower demand and resulting mill closures.

- 😞 Many industry workers have reported job losses and reduced operations at lumber mills across the country.

- 🇨🇦 Recent increases in tariffs on Canadian lumber from 8.05% to 14.54% aim to protect U.S. producers but often result in higher costs for consumers.

- ⚖️ Canadian lumber companies frequently contest U.S. tariffs, leading to potential government compensation for them.

- 🔧 The Federal Reserve's recent interest rate cuts may lead to lower mortgage rates, making housing more accessible and potentially increasing lumber demand.

- 🌀 Recent hurricanes have caused extensive damage, which will eventually lead to a surge in lumber demand for rebuilding efforts.

Q & A

What recent events have impacted lumber prices?

-Recent events include changes in interest rates, increased tariffs on Canadian lumber, mill closures, and hurricanes, all of which are expected to affect lumber prices moving forward.

How did lumber prices fluctuate in 2023?

-Lumber prices were at their lowest in July 2023 at $464 per thousand board feet, while the highest price was $617 in March. Currently, prices are slightly below the average of those two points.

Why are lumber prices closely linked to the housing market?

-Lumber is a primary material used in home construction; an average U.S. home requires about 15,000 board feet of lumber. Therefore, fluctuations in housing demand directly impact lumber prices.

What effect has inflation and high mortgage rates had on lumber demand?

-Inflation and high mortgage rates have decreased demand for lumber as fewer people are buying lumber for remodeling or purchasing new homes, resulting in lower lumber prices.

What trends have been observed in home building recently?

-Home building peaked in early 2022 but has declined since then. Additionally, new homes are becoming smaller, which reduces the amount of lumber required for construction.

What are the implications of the recent increases in lumber tariffs?

-The recent increase in tariffs on Canadian lumber from 8.05% to 14.54% raises the cost of Canadian lumber, making U.S. lumber more attractive, but ultimately leads to higher prices for American consumers.

How do lumber tariffs affect American consumers?

-Lumber tariffs increase the price of lumber for American consumers, as they end up paying more for lumber products while U.S. lumber companies benefit from higher prices.

What could happen if housing demand increases in the near future?

-If housing demand increases, especially after recent interest rate cuts, there could be a significant spike in lumber prices due to reduced production capacity from mill closures.

What role does the Federal Reserve's actions play in the housing market?

-The Federal Reserve's decisions, such as lowering the interest rates, can lead to lower mortgage rates, making it easier for consumers to purchase homes, which in turn increases demand for lumber.

What are the long-term effects of mill closures on the lumber industry?

-Mill closures reduce the overall production capacity of lumber, which can create shortages when demand rises, leading to significant price increases in the future.

Outlines

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenMindmap

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenKeywords

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenHighlights

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenTranscripts

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenWeitere ähnliche Videos ansehen

Housing Market 2.0: How Lower Interest Rates Will Change The Market

How the US made affordable homes illegal

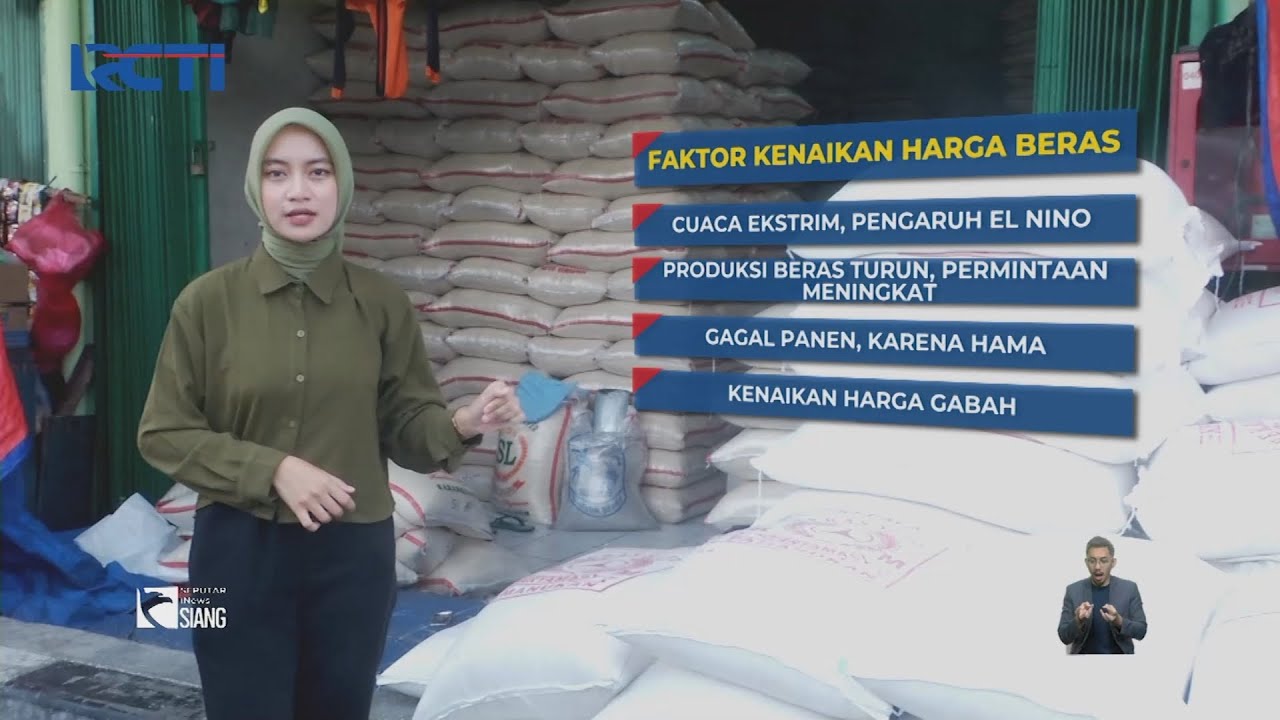

Imbas Gagal Panes di Musim Kemarau, Harga Beras Melambung - SIS 01/09

BEKLENEN KONUT KREDİSİ KAMPANYASI DETAYLARI ve FİYATLAR ARTAR MI?

Episode 12: Change in Demand vs Change in Quantity Demanded

BREAKING NEWS: CPI Inflation Report Released! | Here's What You Need to Know

5.0 / 5 (0 votes)