2.3 Overview of the Audit Process Audit Planning Risk Assessment

Summary

TLDRThe video script offers an in-depth exploration of audit planning, emphasizing the importance of risk assessment and the application of a risk-based audit approach. It discusses knowledge of the business, preliminary analytical procedures, and materiality, before diving into the concepts of business and audit risk. The script explains the shift in focus of PSA 315 from understanding to identifying and assessing risks of material misstatement. It outlines the steps for assessing risk, including the use of the audit risk model, and highlights the relationships between materiality, audit risk, and audit effort, setting the stage for further discussions on the audit plan and program.

Takeaways

- 📘 Knowledge of the Business: Understanding the client's industry, entity, accounting, and internal control systems is crucial as per PSA 315.

- 🔍 Preliminary Analytical Procedures: These are essential for identifying plausible relationships among accounts and are used in planning and completion stages, with optional use in testing.

- 📊 Materiality Concepts: The script discusses overall materiality, performance materiality, and specific materiality, highlighting their importance in audit planning.

- 🚀 Risk Assessment: The importance of understanding business risk and audit risk within a risk-based audit approach is emphasized, including the auditor's business risk due to litigation or adverse publicity.

- 🔧 Risk Assessment Procedures: The evolution from PSA 315's focus on understanding to identifying and assessing risks of material misstatement is noted.

- 🔄 Audit Risk Model: The script explains how audit risk is calculated by inherent risk, control risk, and detection risk, and how these are assessed quantitatively or non-quantitatively.

- 📝 Financial Statement Assertions: The categorization and importance of assertions in identifying and evaluating risks of material misstatement are discussed.

- 🔎 Identifying Risks: The process of identifying relevant financial statement assertions, understanding the entity and its environment, and evaluating risks is outlined.

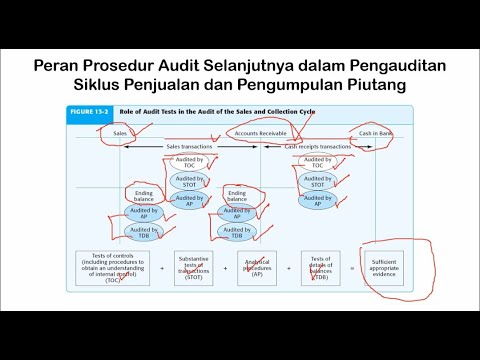

- 🛠️ Substantive Tests Design: Based on the assessed level of risk, the script details how to design substantive tests to provide the necessary level of assurance.

- ⚖️ Acceptable Detection Risk: The concept of acceptable detection risk and its inverse relationship with audit effort and materiality is explained.

- 🔗 Relationships Among Concepts: The script concludes with the interplay between materiality, audit risk, detection risk, and the need for more stringent procedures as risks increase.

Q & A

What is the main focus of the script?

-The script primarily discusses the concepts and procedures related to audit planning, risk assessment, and the application of the audit risk model in a risk-based audit approach.

What does PSA 315 guide in the context of audit planning?

-PSA 315 guides the auditor in obtaining knowledge of the client's industry, entity, accounting, and internal control systems, which is essential for understanding the business and conducting the audit.

What are the three main activities covered in the script under audit planning?

-The three main activities covered are understanding the concept of risk, performing risk assessment procedures, and applying the audit risk model to assess the risk of material misstatement.

What is the auditor's business risk?

-The auditor's business risk is the risk that the auditor will suffer a loss or injury to professional practice due to litigation or adverse publicity in connection with a client.

How has the definition of risk assessment procedures evolved according to PSA 315?

-The definition has evolved from focusing on obtaining an understanding of the entity and its environment to identifying and assessing the risks of material misstatement, reflecting a shift towards a more risk-based audit approach.

What are the types of audit risk and how are they assessed?

-Audit risk consists of inherent risk, control risk, and detection risk. They are assessed by understanding the entity and its environment, evaluating the effectiveness of internal controls, and determining the extent of substantive tests based on the assessed risks.

What is the significance of materiality in the audit process?

-Materiality is crucial as it helps determine the extent of audit effort and the level of audit risk that the auditor is willing to accept. It influences the design of audit procedures and the assessment of the risk of material misstatement.

How do auditors identify relevant financial statement assertions during risk assessment?

-Auditors identify relevant financial statement assertions by understanding the entity and its environment, including internal controls, and by performing inquiries, inspections, observations, and analytical procedures during the planning phase.

What is the relationship between the assessed level of inherent risk and the design of substantive procedures?

-As the assessed level of inherent risk increases, the auditor should design more effective substantive procedures to mitigate the risk of material misstatement.

How does the auditor decide whether to test the controls or not?

-The auditor decides to test the controls if the preliminary assessment of control risk is less than high or is low, indicating that the controls may be reliable. If the preliminary control risk is high, the auditor will not test the controls and will perform more extensive substantive tests instead.

What is the audit risk model and how is it applied?

-The audit risk model is a formula where audit risk is equal to inherent risk times control risk times detection risk. It is applied by assessing the levels of inherent and control risks and then determining the acceptable level of detection risk, which drives the design of further audit procedures.

What is the acceptable detection risk matrix and how is it used?

-The acceptable detection risk matrix is a tool used to determine the level of detection risk based on the assessed levels of inherent and control risks. It helps the auditor to decide on the strictness of the audit procedures needed to achieve the desired level of audit risk.

How do the concepts of materiality and audit risk relate to each other?

-There is an inverse relationship between materiality and audit risk. A higher materiality level means the auditor is less strict, resulting in lower audit risk, while a lower materiality level means the auditor is stricter, increasing the audit risk.

Outlines

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنMindmap

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنKeywords

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنHighlights

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنTranscripts

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنتصفح المزيد من مقاطع الفيديو ذات الصلة

2.2 Overview of the Audit Process Auditing Planning Knowledge, Analytics, Materiality

Pedoman Perencanaan Pengawasan Berbasis Risiko (PPBR)

PERENCANAAN AUDIT - Strategi Audit Keseluruhan dan Program Audit

Audit Risk Model

2.1 Overview of the Audit Process Introduction and Pre Engagement Activities

Audit Risk Overview

5.0 / 5 (0 votes)