If the AI bubble pops, will the whole U.S. economy go with it? | About That

Summary

TLDRThe video explores the volatility of the AI market, questioning whether the AI bubble is about to burst. It examines the stock fluctuations of companies like Nvidia and OpenAI, highlighting concerns over speculative investments and circular financial deals. While AI's potential for automation, scientific advancements, and economic growth fuels optimism, experts warn of unsustainable losses, skyrocketing energy demands, and the looming deadline for AI investments to generate returns. The global economy's dependence on the AI sector makes even a small shock potentially catastrophic.

Takeaways

- 📉 Recent stock market volatility has raised fears that the AI industry may be entering a bubble rather than a sustainable growth phase.

- 🏔️ Much of the U.S. stock market’s value is concentrated in just seven major tech companies heavily invested in AI, amplifying systemic risk.

- 💰 Nvidia’s rise to over $4 trillion in valuation is driven largely by its dominance in AI chips powering most global AI projects.

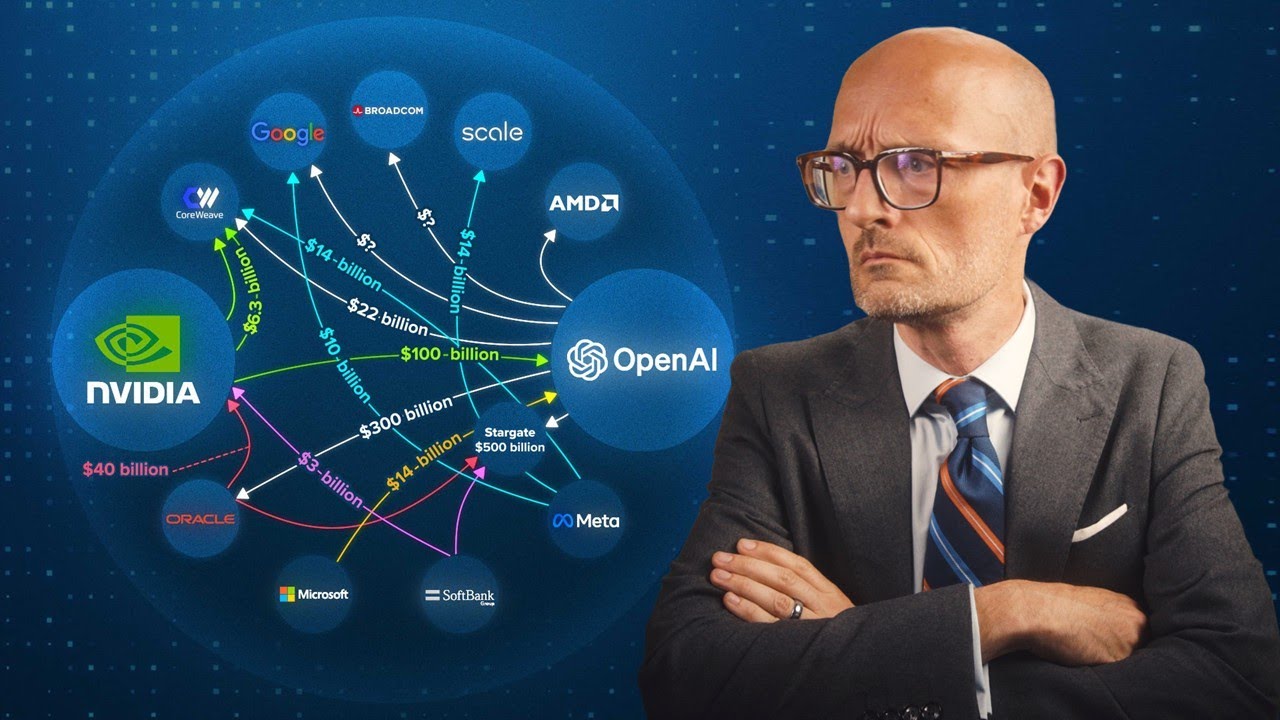

- 🔁 Nvidia’s large investment in OpenAI is effectively circular, since OpenAI uses that money to buy Nvidia’s own chips.

- 🧩 These circular financial relationships between AI companies create the illusion of independent growth and dominance.

- 📊 Goldman Sachs estimates that up to 15% of Nvidia’s future sales may come from such circular deals.

- 💸 OpenAI is valued at roughly $500 billion but is projected to lose over $70 billion in three years and remains unprofitable.

- 🏗️ Data centers for AI now cost more to build than all other manufacturing facilities combined, reflecting enormous capital intensity.

- ⚡ AI models lose money on every user request due to high energy and infrastructure costs.

- 🙏 Much of the AI investment case relies on faith that future breakthroughs will eventually justify today’s massive spending.

- 🌍 AI is promoted as a foundation for productivity, automation, and new industries, similar to infrastructure like roads and railways.

- ⏳ Unlike traditional infrastructure, AI hardware rapidly degrades and becomes obsolete, creating a strict deadline for returns.

- 🌐 Tech stocks now represent nearly half of U.S. stock market value, making the global economy highly dependent on AI-driven firms.

- ⚠️ Even a small downturn in AI valuations could have enormous worldwide economic consequences due to unprecedented exposure.

Q & A

Why does the AI industry seem to be in a rough spot despite its potential?

-The AI industry is currently facing volatility in the stock market, with global stocks heading for a tough week. This drop in stock value, while concerning, is relatively small compared to previous market disruptions like the impact of Trump's tariffs. Still, there’s speculation about whether the AI bubble is about to burst.

How significant is AI in driving stock value in the S&P 500?

-AI is a major driver of stock value, as over a third of the S&P 500's value comes from just seven tech companies, all heavily invested in AI. This highlights how pivotal AI is in the broader stock market performance.

What role does Nvidia play in the AI industry?

-Nvidia has become a key player in the AI industry by supplying powerful chips used in AI models. It powers approximately 90% of the world’s AI projects, making it one of the most valuable companies in the world, valued at over $4 trillion.

What’s the concern regarding Nvidia’s investment in OpenAI?

-Nvidia's $100 billion investment in OpenAI raises questions because it’s essentially paying OpenAI to buy Nvidia's chips, creating a circular financial relationship. Investors are concerned whether this constitutes a genuine investment or is just a way for Nvidia to funnel money back to itself.

How do circular investments impact the perception of a company’s financial health?

-Circular investments can create the illusion of company dominance, but they don’t necessarily translate into real value creation. This distorts perceptions about a company’s strength, as in the case of Nvidia and OpenAI, where large investments may just be moving money around rather than generating new value.

Why is OpenAI struggling financially despite its high valuation?

-OpenAI, with a valuation around $500 billion, is facing massive losses. Despite its high valuation, it’s not profitable and is projected to lose over $70 billion in three years. The company has high operating costs and isn't yet generating enough revenue to cover them, making its financial future uncertain.

What are some of the huge costs associated with developing AI like ChatGPT?

-Developing AI models like ChatGPT requires massive investments, including $40,000 for a single Nvidia chip, plus additional costs for power, cooling, real estate, data centers, salaries, and research. The scale of these expenses raises doubts about the profitability of AI companies.

Why do AI companies lose money the more customers they have?

-AI companies lose more money as they scale because their energy demands are sky-high. Each interaction with an AI model costs pennies or even dollars, and the infrastructure needed to support these models, such as data centers and chips, adds to the financial burden.

What are the risks of continuing to invest in AI despite the financial uncertainty?

-The primary risk is the potential for a bubble, where speculative investments push stock prices too high without corresponding revenue generation. If AI companies fail to deliver a return on these massive investments, the bubble could burst, leading to significant financial losses.

How does AI investment compare to traditional infrastructure investments like roads and bridges?

-AI investments are similar to infrastructure projects in that they require significant upfront costs, but unlike roads or bridges, AI infrastructure (like data centers) becomes obsolete quickly, which creates a deadline for profitability. If AI companies don’t deliver returns soon, these investments could become wasted capital.

Outlines

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنMindmap

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنKeywords

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنHighlights

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنTranscripts

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآن5.0 / 5 (0 votes)