It's Finally Here

Summary

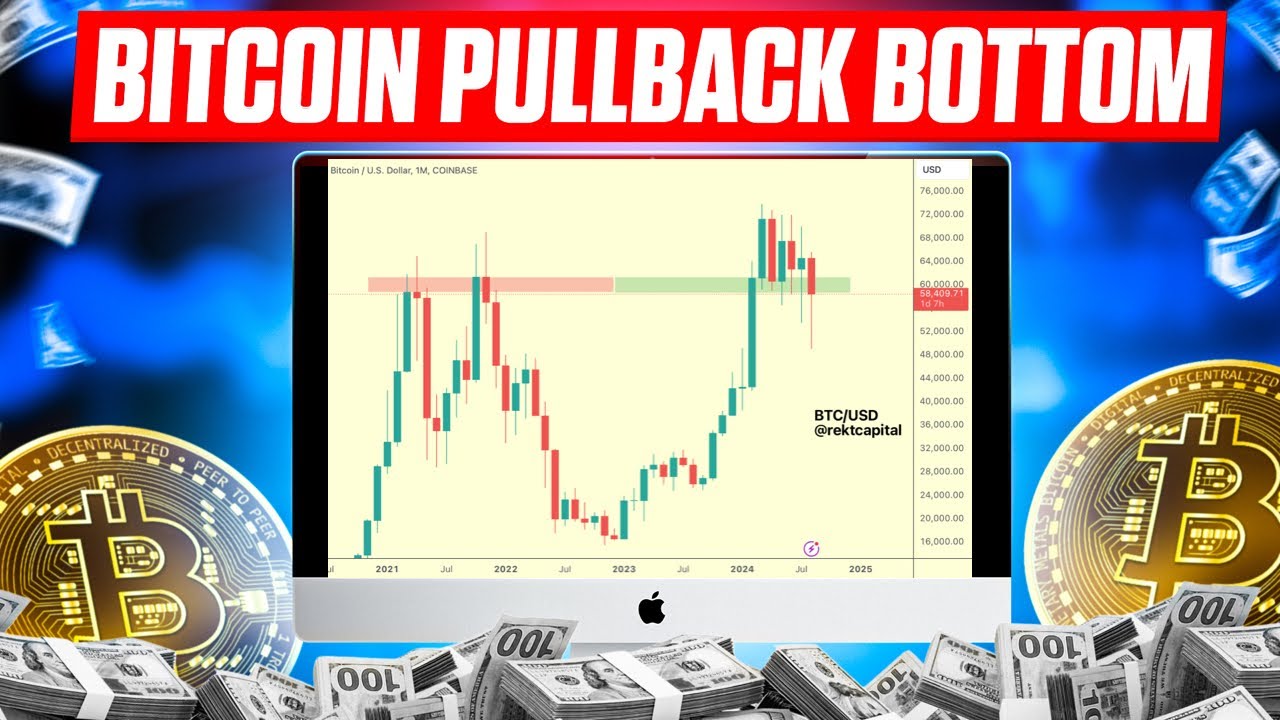

TLDRIn this video, the creator delves into the ongoing global liquidity index breakout and its influence on Bitcoin's price action. They discuss the lagged correlation between Bitcoin and global liquidity, highlighting significant past and recent movements. The creator maintains an optimistic view on Bitcoin, noting bullish signals from various indicators, including the hash ribbon and recent ETF absorption. Despite acknowledging potential pullbacks, they emphasize the long-term potential for Bitcoin, bolstered by upcoming trends in global liquidity and the Federal Reserve's monetary policy. Ethereum and Solana are also briefly covered, with a focus on their recent rallies and market positioning.

Takeaways

- 😀 The Global Liquidity Index breakout continues, showing a strong correlation with Bitcoin’s price movements, especially with a 75-day offset applied to the data.

- 😀 There was a divergence between Bitcoin and Global Liquidity in late 2023, likely caused by the news of the BlackRock spot Bitcoin ETF approval, which temporarily shifted Bitcoin's behavior.

- 😀 The Global Liquidity Index includes not only global M2 but also various other liquidity measures like the Fed's balance sheet, Treasury General Account, and central bank balance sheets from the ECB, People's Bank of China, and others.

- 😀 Despite different offset methods being used by others, the 75-day offset seems to be the most reliable for predicting Bitcoin’s price movements based on the Global Liquidity Index.

- 😀 The current trend suggests Bitcoin may continue its rally until early July, but this is just one tool in a broader investment strategy, and no indicator is guaranteed to be 100% accurate.

- 😀 The recent breakout above the 100K psychological level for Bitcoin indicates strong momentum, making the author optimistic about Bitcoin's short-term performance.

- 😀 The market sentiment is influenced by a range of factors, including the Federal Reserve’s likely upcoming rate cuts and potential end to quantitative tightening, which would benefit risk assets like Bitcoin.

- 😀 Bullish catalysts such as progress in US-China trade deals and crypto-specific news (e.g., Coinbase being added to the S&P 500) are contributing to Bitcoin’s positive outlook.

- 😀 While Bitcoin is experiencing significant momentum, the author advises caution and profit-taking in some positions to maintain a balanced portfolio, aiming for 30% cash.

- 😀 Bitcoin’s deflationary supply is now increasing due to large institutional buys (e.g., Strategy’s Bitcoin purchases), which is reducing the overall available supply on the market.

- 😀 Ethereum has shown impressive gains recently, and while there is optimism about its price reaching new highs, caution is needed until key moving averages are reclaimed for long-term confirmation.

- 😀 Altcoins, like Solana, have been performing well too, with a strong rally and growth in DeFi activity. However, it remains uncertain which blockchain project will ultimately lead in the long term.

Q & A

What is the Global Liquidity Index, and why is it important for Bitcoin's price prediction?

-The Global Liquidity Index is a broad measure of global liquidity, which includes various liquidity measures like the Fed's balance sheet, the Treasury General Account, reverse repo programs, and central bank balances from around the world. It is crucial for Bitcoin price prediction because Bitcoin has shown a strong, lagged correlation with this index, suggesting that movements in global liquidity can often predict Bitcoin's price movements.

Why did Bitcoin diverge from the Global Liquidity Index in late 2023?

-Bitcoin diverged from the Global Liquidity Index in late 2023 due to the approval of the BlackRock spot Bitcoin ETF. This event caused Bitcoin to rally independently, as many investors were initially skeptical about its approval. After the rally, Bitcoin realigned with the Global Liquidity Index.

What is the 75-day offset applied to the Global Liquidity Index, and how does it improve analysis?

-The 75-day offset is used to better visualize the lagged correlation between Bitcoin and the Global Liquidity Index. By applying this offset, the chart becomes clearer in showing how Bitcoin’s price follows changes in the liquidity index with a delay, helping to make more accurate predictions based on past behavior.

Why is the Global Liquidity Index more comprehensive than global M2 alone?

-The Global Liquidity Index is more comprehensive because it includes not only global M2 money supply but also other key liquidity measures, such as the Fed's balance sheet, the Treasury’s General Account, and the central bank balances of major economies like China and Europe. This broader approach offers a more complete view of global liquidity.

What impact does the Federal Reserve’s actions, such as rate cuts and quantitative easing, have on Bitcoin?

-The Federal Reserve’s actions, particularly rate cuts and the end of quantitative tightening, are seen as positive for Bitcoin. These actions typically weaken the US dollar and create favorable conditions for risk assets like Bitcoin, as liquidity increases and investors seek alternative assets.

What is the significance of the CPI print and the potential for rate cuts by the Fed?

-The CPI (Consumer Price Index) remained at 2.8%, indicating that inflation is under control, which reduces the urgency for the Federal Reserve to maintain high interest rates. This paves the way for potential rate cuts, which could support Bitcoin's price by lowering borrowing costs and increasing liquidity.

What is the Hash Ribbon buy signal, and what does it suggest about Bitcoin?

-The Hash Ribbon buy signal occurs when Bitcoin miners stop selling their holdings after capitulating during a price drop. This signal has historically been a reliable indicator for Bitcoin’s price action, suggesting that the market could see upward momentum in the coming weeks and months.

How does Bitcoin’s current deflationary status relate to the supply dynamics mentioned in the script?

-Bitcoin is currently deflationary because more Bitcoin is being absorbed by institutions, such as Grayscale's Bitcoin Trust, than is being issued by miners. This leads to a reduction in available supply, which can drive up the price, as demand outstrips new issuance.

What does the speaker mean by 'buying during fear' and 'selling during greed'?

-The speaker refers to the classic investment strategy of buying when market sentiment is fearful and prices are low, and selling when the market is greedy, and prices are high. This strategy is based on the idea that emotional decisions often lead to buying at the top and selling at the bottom, so controlling emotions is key to successful investing.

What is the significance of Bitcoin’s relationship with the 200-week moving average?

-Bitcoin’s relationship with its 200-week moving average is crucial because it tends to return to this level during bear markets. When Bitcoin is far from this average, the likelihood of a correction or a 'blow-off top' increases. Investors who buy closer to this moving average typically see favorable long-term results.

Outlines

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنMindmap

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنKeywords

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنHighlights

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنTranscripts

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنتصفح المزيد من مقاطع الفيديو ذات الصلة

Bitcoin TEST: Preparing for a Major Crypto BREAK OUT & BULL TRAP! (Watch ASAP)

Economic Recession! Will Crypto Survive? Everything You Need To Know!

[BTC]🚨MARKET UPDATE🚨50BPS RATE CUT!! | PUMP ATAU DUMP?? | INI DETAILNYA | #DYOR

Bitcoin Crashes Again - Where Is the Bottom?

The REAL Signal Behind Bitcoin’s Weird Price Action!

SUI COIN JUST DID THE UNTHINKABLE! (REALISTIC PRICE PREDICTION 2025)

5.0 / 5 (0 votes)