Assets - Presentation Video Group 8 (Financial Accounting Theory)

Summary

TLDRThis presentation delves into asset accounting, covering key topics such as the definition and characteristics of assets, asset recognition, and asset measurement. The group explains how assets are resources controlled by entities that provide future economic benefits, stressing the importance of control, scarcity, and utility. Additionally, the script addresses the challenges auditors face when evaluating asset values, including the use of market inputs and management judgments. With an exploration of historical cost and revaluation models, this session highlights the complexities of asset accounting and the role of auditors in ensuring accurate financial reporting.

Takeaways

- 😀 Assets are resources controlled by an entity, expected to provide future economic benefits from past events.

- 😀 The essential characteristics of assets include future economic benefits, control by the entity, scarcity, and utility.

- 😀 Recognition of an asset depends on two criteria: probable future economic benefits and reliable measurement.

- 😀 Goodwill is difficult to recognize and measure because it is intangible and subject to subjective estimates.

- 😀 The historical cost method is the traditional way of measuring assets, recorded at purchase cost minus depreciation or impairment.

- 😀 The revaluation model allows assets to be measured at fair market value, though it can be more subjective.

- 😀 Different approaches to asset measurement include fair value, replacement cost, and cost approach.

- 😀 Asset management involves identifying the appropriate valuation method and ensuring relevant and reliable financial information.

- 😀 Auditors play a crucial role in assessing asset valuation methods to ensure compliance with accounting standards.

- 😀 Challenges in asset management include ensuring accurate valuation and the proper documentation and transparency of the asset evaluation process.

Q & A

What is the definition of an asset in accounting?

-An asset is a resource controlled by an entity, resulting from past events, and from which future economic benefits are expected to flow to the entity.

What are the key characteristics of an asset?

-The key characteristics of an asset include future economic benefits, control by the entity, and the ability to generate resources such as cash flow or other economic value.

How does the control of an asset work in accounting?

-Control refers to the entity’s ability to use the asset and exclude others from using it. This could be through ownership, or in some cases, through legal agreements like leases.

What is the importance of future economic benefits in asset recognition?

-Future economic benefits are crucial in asset recognition because the asset must have the potential to contribute to the entity’s future cash flows or other economic gains.

Why is goodwill considered a difficult asset to recognize?

-Goodwill is often not recognized as an asset because it cannot be sold separately, and its value is subjective and difficult to measure accurately.

What are the two main criteria for recognizing an asset?

-The two main criteria for recognizing an asset are the probability of future economic benefits and the ability to measure the asset reliably.

What are the two primary methods of asset measurement?

-The two primary methods of asset measurement are the historical cost model, where assets are recorded at their acquisition cost, and the revaluation model, where assets are adjusted to their current market value.

How does the historical cost model differ from the revaluation model in asset measurement?

-The historical cost model records assets at their acquisition cost and adjusts for depreciation, while the revaluation model adjusts asset values based on current market conditions, which can involve subjective judgments.

What challenges do auditors face in evaluating assets?

-Auditors face challenges in verifying the accuracy of asset valuations, especially when market-based valuations are used, and in ensuring that the correct methods and standards are applied consistently.

Why is it important to have qualified professionals involved in asset management?

-Qualified professionals are essential to ensure that assets are measured and valued accurately, that the correct accounting standards are followed, and that financial reports provide reliable information.

Outlines

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنMindmap

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنKeywords

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنHighlights

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنTranscripts

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنتصفح المزيد من مقاطع الفيديو ذات الصلة

VídeoAula EaD Premium -Teorias Gerais Da Contabilidade - Trilha 8

CARA MEMAHAMI PENGERTIAN DAN JENIS AKTIVA || AKUNTANSI DASAR | AKTIVA | HARTA | ASET

[ADVANCED FEATURES] Asset management

Property, Plant & Equipment (PPE) in Government Accounting part3 | AFAR

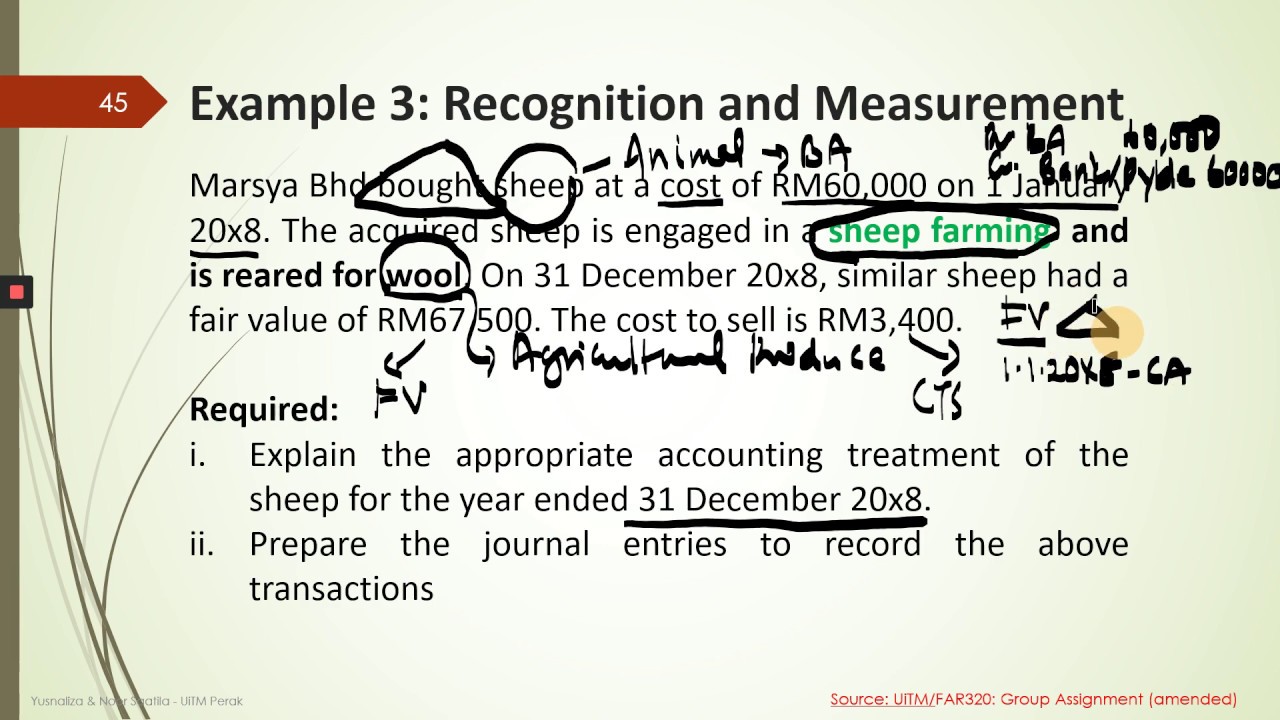

LECTURE 4/4 : MFRS 141/ IAS 41 AGRICULTURE (BIOLOGICAL ASSETS) : FAR320 TOPIC 2-PART 4

PSAK 48 Penurunan Nilai Aset

5.0 / 5 (0 votes)