Property, Plant & Equipment (PPE) in Government Accounting part3 | AFAR

Summary

TLDRThe video discusses heritage and infrastructure assets in government accounting, highlighting their unique characteristics and measurement. Heritage assets, valued for their historical and cultural significance, are initially recorded at cost and not depreciated, unless they provide future economic benefits. Infrastructure assets, essential for public service, are depreciated over time. The presentation also covers reforestation projects, outlining their classification as land improvements, and explains borrowing costs related to government financing, detailing their treatment and capitalization in accounting. This comprehensive overview underscores the importance of proper asset management in public sector accounting.

Takeaways

- 🏛️ Heritage assets are defined as those with historical, cultural, and environmental significance, meant for preservation.

- 🏛️ Examples of heritage assets include historical buildings, monuments, and museum collections.

- 💰 Heritage assets are initially measured at cost, specifically the fair value at acquisition, and are subject to impairment but not depreciation.

- 🏢 Infrastructure assets are specialized government-constructed assets that are part of a system, immovable, and have limited alternative uses.

- 🔧 Infrastructure assets are initially measured at cost and subsequently depreciated, typically with a residual value of at least 5% per annum.

- 🌱 Reforestation projects are recognized as land improvements, and costs incurred during the project are recorded as construction in progress until completion.

- 🌳 Maintenance and protection costs for reforestation are expensed after project turnover, while small-scale tree replacements can also be expensed.

- 📜 The carrying amount of property, plant, and equipment (PPE) is recognized upon disposal or when no future economic benefits are expected.

- 🛠️ Idle PPE, which is temporarily out of use, continues to be depreciated even if it is not actively utilized.

- 💵 Borrowing costs can either be expensed in the period incurred or capitalized if directly attributable to a qualifying asset, with calculations based on average expenditure.

Q & A

What are heritage assets in government accounting?

-Heritage assets are those with historical, cultural, and environmental significance, intended to be preserved for future generations. Examples include historical buildings, monuments, and museum collections.

How are heritage assets measured in government accounting?

-Heritage assets are measured at cost, specifically the fair value at the time of acquisition, but are recorded in a registry rather than on the financial statements.

Are heritage assets depreciated?

-Heritage assets are generally not depreciated unless they provide future economic benefits. If they do serve a functional purpose, like being used as offices, they may be depreciated.

What defines infrastructure assets in the context of government accounting?

-Infrastructure assets are constructed by government entities, part of a system or network, specialized, immovable, and typically subject to constraints on disposal.

What is the initial measurement of infrastructure assets?

-Infrastructure assets are initially measured at cost and are subsequently depreciated over their useful lives.

How are reforestation projects recognized in government accounts?

-Reforestation projects are recognized as land improvements and are initially debited to construction in progress until completed, after which they are classified as land improvements.

What costs are associated with maintaining reforestation projects?

-Maintenance costs incurred after project turnover, such as fire line maintenance, replanting, and pest control, are treated as expenses.

What happens to the carrying amount of property, plant, and equipment (PPE) when disposed of?

-The carrying amount of PPE is recognized as a gain or loss in surplus or deficit accounts when it is disposed of or when no future economic benefits are expected.

How are borrowing costs treated in government accounting?

-Borrowing costs can be expensed in the period incurred or capitalized if they are directly attributable to the acquisition of qualifying assets.

What distinguishes specific borrowings from general borrowings in terms of capitalizable costs?

-Specific borrowings allow for capitalizable borrowing costs based on actual costs minus investment income, while general borrowings follow a formula to determine the capitalization rate for average expenditures.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

IND AS 38 INTANGIBLE ASSETS | CA FINAL REVISION LECTURE | FR & AFM BY BHAVIK CHOKSHI

LECTURE 1/4 : MFRS 141/ IAS 41 AGRICULTURE (BIOLOGICAL ASSETS) : FAR320 TOPIC 2 - PART 1

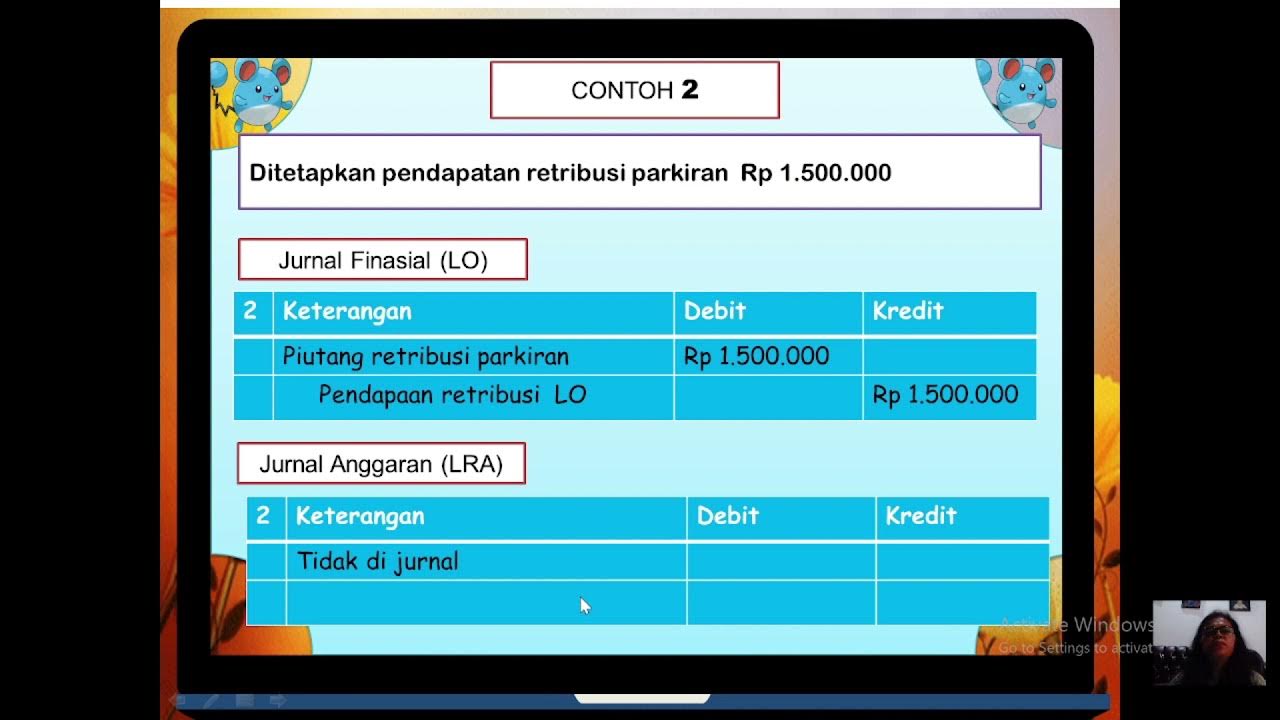

JURNAL SKPD AKUNTANSI PEMERINTAHAN

PSAK 71 adopsi IFRS 9

Assets - Presentation Video Group 8 (Financial Accounting Theory)

IAS 38 Intangible Assets (summary) - applies in 2025

5.0 / 5 (0 votes)