CARA MEMBUAT KODE PAJAK DI MYOB

Summary

TLDRIn this instructional video, the presenter explains the process of creating and managing tax codes in the Mayona application. The focus is on setting up a 10% VAT (PPN) tax rate, detailing the steps to modify existing tax codes, link relevant accounts, and ensure correct configuration for both sales and purchase transactions. The presenter also demonstrates how to remove unused tax codes and finalize the setup, ensuring a streamlined process for managing taxes. The video concludes with a warm farewell, encouraging viewers to apply these steps in their own work.

Takeaways

- 😀 The tutorial starts with a greeting and wishes for health and wellbeing.

- 😀 The goal is to continue the learning from a previous session on creating a new company file and entering account details.

- 😀 The session focuses on how to set up tax codes, specifically for VAT (Pajak Pertambahan Nilai or PPN) in the Mayona application.

- 😀 PPN is explained as a 10% Value Added Tax (VAT), which is the primary tax discussed in the tutorial.

- 😀 The first step is to open the 'Menu' and select the 'Text Code' option.

- 😀 Users can either create a new tax code or modify the existing 'GST' code, which is recommended for simplicity.

- 😀 The code is renamed from 'GST' to 'PPN' (Pajak Pertambahan Nilai), and the description is updated accordingly.

- 😀 The VAT rate for PPN is set to 10%, aligning with the standard VAT rate in Indonesia.

- 😀 Linked accounts for sales transactions (PPN Output) and purchase transactions (PPN Input) are set up to correctly account for tax.

- 😀 The tutorial also demonstrates how to delete unused tax codes, ensuring only necessary ones (PPN and NTT) remain in the system.

- 😀 The session concludes with a friendly goodbye and an invitation for the next lesson.

Q & A

What is the main focus of this video tutorial?

-The main focus of the video is to teach how to create tax codes in the Mayona application, specifically for PPN (Value Added Tax) and NTT (no tax) scenarios.

What are the steps to create a new tax code in Mayona?

-To create a new tax code, go to the 'Menu' and select 'Text Code', then either create a new code or modify an existing one (like 'GST') to 'PPN'. Adjust the description, tax rate, and account links accordingly.

What is the tax rate for PPN mentioned in the tutorial?

-The tax rate for PPN (Value Added Tax) is 10%.

How should you link the tax code to sales and purchase transactions?

-For sales transactions, link the tax code to 'PPN.com' under the appropriate account. For purchase transactions, link it to 'PPN income'.

What does 'NTT' stand for in the context of the tax codes?

-NTT stands for 'No Tax', which is used when no tax is applied to a particular transaction.

How can you delete a tax code that is not in use?

-To delete an unused tax code, click the arrow next to it, select 'Edit', and then choose 'Delete'.

What is the benefit of editing an existing tax code instead of creating a new one?

-Editing an existing tax code, like changing 'GST' to 'PPN', can save time and avoid creating unnecessary duplicate codes.

Why is the tax rate of 10% significant in this tutorial?

-The 10% tax rate is in line with the Value Added Tax (PPN) rate in Indonesia, which is used as an example in the tutorial.

What accounts should be linked to the tax codes in the system?

-For PPN, link the 'PPN.com' account for sales and 'PPN income' for purchases.

What should you do after setting up the PPN and NTT tax codes?

-Once the PPN and NTT codes are set up, you can remove any other unused tax codes to keep the system organized.

Outlines

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنMindmap

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنKeywords

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنHighlights

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنTranscripts

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنتصفح المزيد من مقاطع الفيديو ذات الصلة

Cara Lapor eBupot Unifikasi Full Lengkap

3 Setup Pajak dan Link Account Dengan MYOB

#1 REACT JS INTRO, REACT JS COURSE 2023

GSTR1 NEW UPDATE | GSTR-1 TABLE 12 HSN में हुआ बड़ा बदलाव | B2B AND B2C TABLE MANDATORY

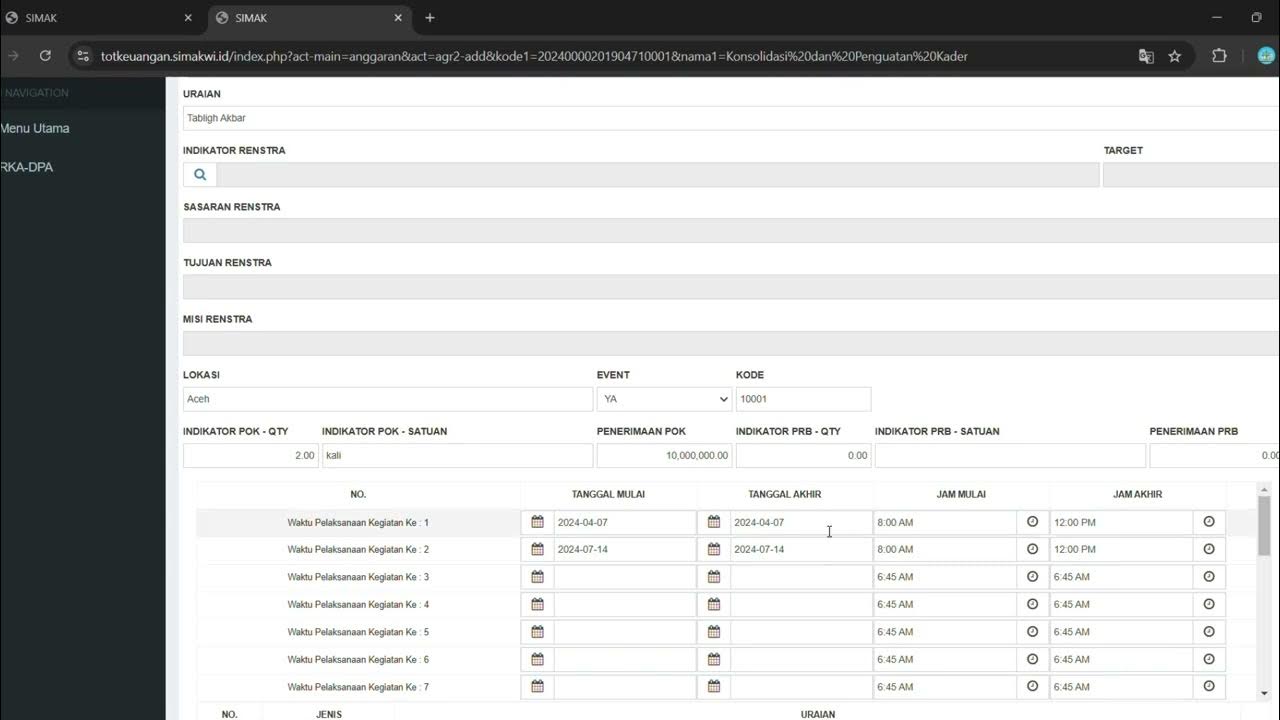

LOGIN SIMAK DAN PENGINPUTAN RKA DAERAH

Cara Lapor Dokumen Tertentu yang Dipersamakan Sebagai Faktur Pajak | Tutorial Lengkap

5.0 / 5 (0 votes)