3 Setup Pajak dan Link Account Dengan MYOB

Summary

TLDRThis video tutorial guides users through setting up an accounting computer application. It covers key tasks such as managing tax codes, adjusting account links for tax handling, and configuring sales and purchase processes. The tutorial walks through the deletion of unnecessary tax codes, linking accounts for various transactions like VAT and sales receipts, and organizing customer and supplier lists. The user learns how to customize their application to meet local needs, including setting up electronic payment systems, tracking freight charges, and managing employee expenses. By the end, users will be equipped to operate the system effectively for accounting tasks.

Takeaways

- 😀 The video tutorial covers the steps of setting up and managing tax settings in an accounting computer application.

- 😀 The first task is to create a list of tax codes and remove unnecessary ones, keeping only the essential tax codes (NPWP and kyb-astra).

- 😀 The tax codes such as 'GST' and 'ente' are not to be deleted during the setup process.

- 😀 In the next step, the user edits tax-related account settings by updating the tax codes and descriptions.

- 😀 The value-added tax (VAT) rate in Indonesia is 10%, and the setup includes making necessary adjustments for collective tax accounts.

- 😀 The tutorial explains linking accounts for tax payments (both income and VAT) and configuring them for future transactions.

- 😀 Several bank account links are created, including for electronic payments, deposits, and various sales or purchase transactions.

- 😀 The process includes configuring sales terms, including the ability to modify discounts, late charges, and freight charges during transactions.

- 😀 For supplier payments, the tutorial highlights the configuration of purchase freight charges and supplier deposits.

- 😀 The video emphasizes maintaining clean account lists by deleting unused or irrelevant accounts, making sure all entries are standardized and necessary.

- 😀 The video concludes by reviewing the entire setup process and the importance of keeping the accounting system organized for further use.

Q & A

What is the main topic of the video tutorial?

-The video tutorial focuses on operating an accounting computer application, specifically how to set up tax codes and account links within the software.

What is the first step discussed in the video for configuring the application?

-The first step discussed is creating a database and a fruit list, which helps in setting up a list of CEOs and other necessary elements.

What tax codes are kept in the application, and which ones are deleted?

-The tax codes NPWP and KYB-Astra are kept, while other codes, such as GST and 'ente', are deleted.

Why are the GST and 'ente' tax codes not deleted?

-The GST (Good and Services Tax) and 'ente' tax codes are not deleted because they are necessary for the tax processing system, specifically for goods and services in Indonesia.

How do you modify tax code descriptions in the system?

-You can edit the tax code descriptions by double-clicking and modifying the details in the system, specifically updating terms such as 'BAB' and 'PDA' for foreign and Indonesian tax terms.

What is the VAT rate in Indonesia, as mentioned in the video?

-The VAT rate in Indonesia is 10%, which is the standard rate for goods and services.

What should be done when linking accounts for tax purposes?

-When linking accounts for taxes, you must ensure the correct association of accounts like VAT income and collective tax accounts, ensuring the appropriate tax rates and descriptions are applied.

What are the different account link categories explained in the tutorial?

-The tutorial explains several account link categories, including banking accounts, sales accounts, customer receivables, and deposit funds, ensuring each is properly connected to the system for accurate financial tracking.

What specific changes are made to the banking account setup?

-In the banking account setup, a new banking account is selected, and the bank's historical balances are connected. Additionally, the payment system is adjusted to include options for cash, banks, and electronic transfers.

How are customer and supplier lists managed in the application?

-Customer and supplier lists are managed by reviewing and deleting unnecessary or unused accounts. This helps in maintaining an efficient and relevant list of contacts for financial operations.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

PERKENALAN APLIKASI MYOB ACCOUNTING (TEORI)

PART 7 PEMBUATAN APLIKASI EXCEL AKUNTANSI 2023 | LABA RUGI

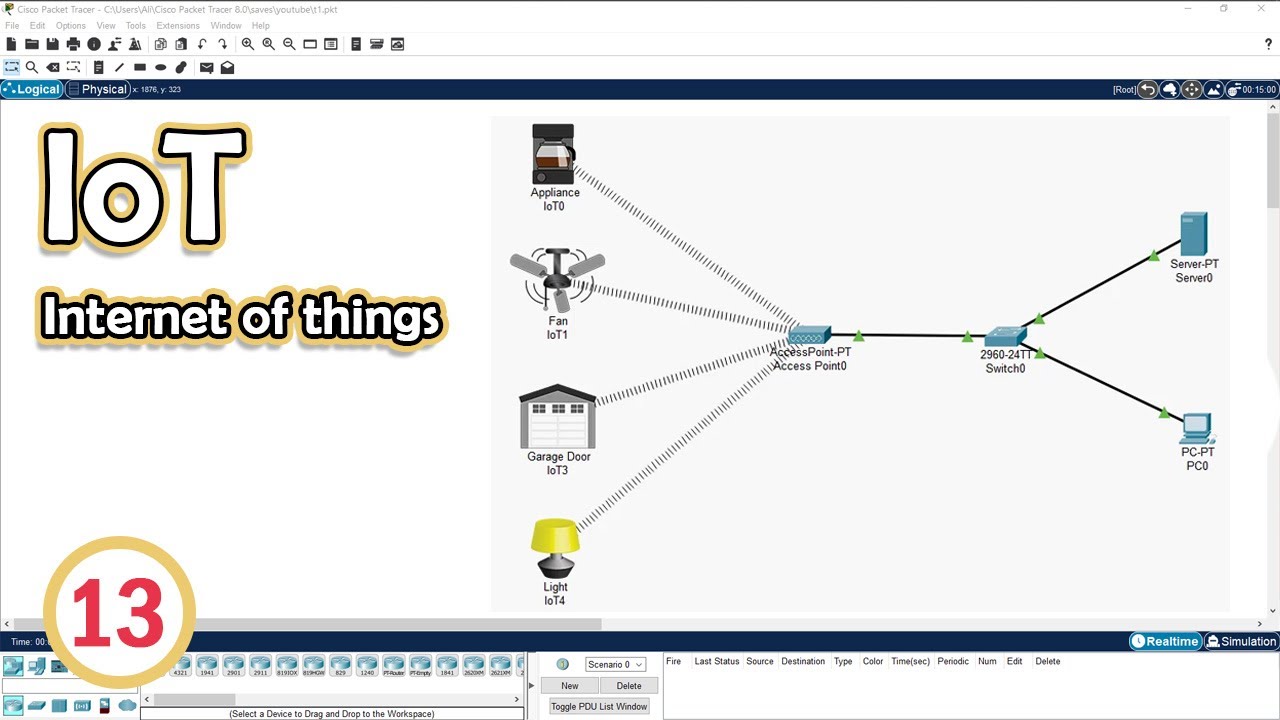

Simulate IoT #13 || cisco packet tracer

Cara Membuat Perpustakaan Digital Gratis dengan SLIMS

CARA SINGKAT MEMAHAMI MODUL CARD FILE PART1

Cara Install n8n di Komputer Lokal Cuman Pakai Docker Dekstop (100% GRATIS + Gampang)

5.0 / 5 (0 votes)