Trading Transformation Day 17: Fair Value Gaps + Imbalances pt.1

Summary

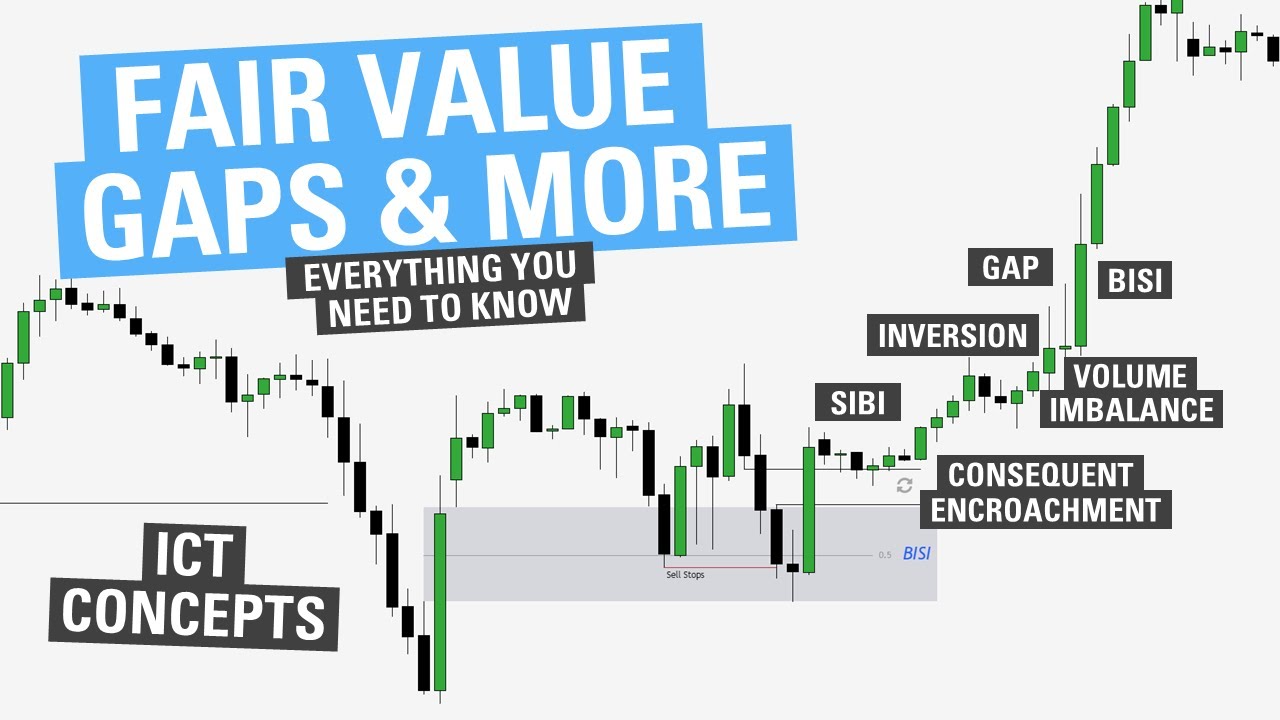

TLDRIn this video, the concept of fair value gaps (or imbalances) in trading is explored. These gaps represent a price range where there is an imbalance of market orders, either a surplus of buy orders or sell orders. The video explains how these imbalances form and why they are important: they serve as potential continuation signals, helping traders predict market direction when price revisits these gaps. The video distinguishes between fair value gaps and liquidity, emphasizing that gaps are not mandatory to fill but provide useful confluence for trading decisions.

Takeaways

- 😀 Fair Value Gaps and Imbalances refer to price ranges in the market that lack orders in the opposite direction of the prevailing market sentiment.

- 😀 These gaps occur when there is an imbalance between buy and sell orders, resulting in a price gap on the chart.

- 😀 Fair Value Gaps and Imbalances are used interchangeably, as they both describe the same market phenomenon.

- 😀 A price gap with a lack of sell orders typically forms when there is an influx of buy orders, and vice versa for sell orders.

- 😀 The main benefit of identifying Fair Value Gaps is that they provide insights into potential market continuation when the price revisits the gap area.

- 😀 If the price revisits an imbalance and buying or selling power emerges in the same direction, it indicates that more orders were filled, and the market is likely to continue in that direction.

- 😀 Fair Value Gaps serve as a continuation confluence, helping traders predict whether the market will sustain its direction.

- 😀 Fair Value Gaps differ from liquidity and order blocks; liquidity is about seeking to fill orders, while order blocks are price areas where market orders are concentrated but don’t always need to be revisited.

- 😀 Fair Value Gaps help predict market trends, but their effectiveness relies on price revisiting the gap and exhibiting buying or selling power.

- 😀 An imbalance is considered a price range that lacks sufficient orders in the opposite direction, which becomes crucial when price action revisits these levels.

- 😀 Traders can use Fair Value Gaps to gauge market direction, especially in cases where price revisits the gap and reinforces the trend with new buying or selling orders.

Q & A

What is the concept of a Fair Value Gap or Imbalance?

-A Fair Value Gap (FVG) or Imbalance refers to a price range in the market that lacks orders in the opposite direction of the current market sentiment. Essentially, it's an area where buy or sell orders are lacking after a large price movement, creating a gap in the order flow.

Why are Fair Value Gaps beneficial to traders?

-Fair Value Gaps are beneficial because they help traders predict future price movements. If price revisits an area with an imbalance, and buying or selling power is observed in the same direction as the market sentiment, it suggests that more orders were filled and price is likely to continue in the original direction.

What does it mean when a price range lacks sell orders after a large price movement?

-It means that after a large upward price movement, the price range is imbalanced, lacking sell orders. If the price revisits this range and buying power is observed, it suggests the market will continue higher since more buy orders were filled in that area.

How can you use Fair Value Gaps to predict market direction?

-By identifying areas where there is an imbalance of market orders (such as a gap with a lack of sell or buy orders), traders can anticipate that when price revisits these areas, the imbalance will cause the price to continue moving in the same direction if more orders are filled at that level.

What is the difference between Fair Value Gaps and liquidity?

-Fair Value Gaps are considered continuation confluences that help predict price direction based on an imbalance of market orders. Liquidity, on the other hand, acts as a magnet for price to reach certain areas where there is a large concentration of orders (such as highs and lows), with the purpose of filling these orders and moving the market.

What role do Order Blocks play in relation to Fair Value Gaps?

-Order Blocks, like Fair Value Gaps, are also continuation confluences. They represent areas where large orders were previously filled. While liquidity can draw price towards these levels to fill orders, an Order Block is not necessarily revisited, but if it is, it can indicate that the market will continue in the same direction if buying or selling power is observed.

Can the price always revisit a Fair Value Gap?

-No, the price does not always revisit a Fair Value Gap. However, when it does, and buying or selling power is seen in the same direction as the initial market sentiment, it can confirm that more orders were filled and the price is likely to continue in that direction.

How does identifying a Fair Value Gap relate to the market sentiment?

-Identifying a Fair Value Gap helps confirm the market sentiment. If there is an imbalance in the market where there are more buy orders than sell orders, it suggests a bullish sentiment. If price revisits this gap and buying power is observed, it indicates that the market will likely continue its bullish direction.

What happens when price revisits a Fair Value Gap and shows opposite market behavior?

-If price revisits a Fair Value Gap and shows behavior opposite to the initial market sentiment (such as selling power in a previously bullish gap), this can indicate a reversal or change in market direction. The lack of orders in the opposite direction can result in price movement contrary to the original sentiment.

What is a continuation confluence in trading?

-A continuation confluence refers to an event or condition that suggests the market will continue in the same direction as it was previously moving. Fair Value Gaps and Order Blocks are examples of continuation confluences because they indicate that price is likely to continue moving in the direction established by a previous price movement, given that more orders have been filled.

Outlines

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنMindmap

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنKeywords

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنHighlights

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنTranscripts

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنتصفح المزيد من مقاطع الفيديو ذات الصلة

5.0 / 5 (0 votes)