Bitcoin Hits Record High Above $69,000

Summary

TLDRThe discussion revolves around the surge of Bitcoin to record highs since November 2021, highlighting the stark contrast in the market environment with significantly higher interest rates. The speaker attributes this surge to increased demand driven by the launch of Bitcoin spot ETFs and the upcoming 'halving' event in April. The discussion then shifts to evaluating different Bitcoin ETF issuers, emphasizing the importance of due diligence by considering factors like the issuer's experience, dedication to the crypto space, and educational resources. The speaker expresses a preference for BitWise's ETF due to the firm's longstanding focus on the crypto market.

Takeaways

- 😀 Bitcoin reached a new record high price since November 2021, despite the Federal Reserve's interest rate hikes.

- 🤑 Bitcoin is considered the ultimate risk asset, and people are increasingly willing to invest in risky assets.

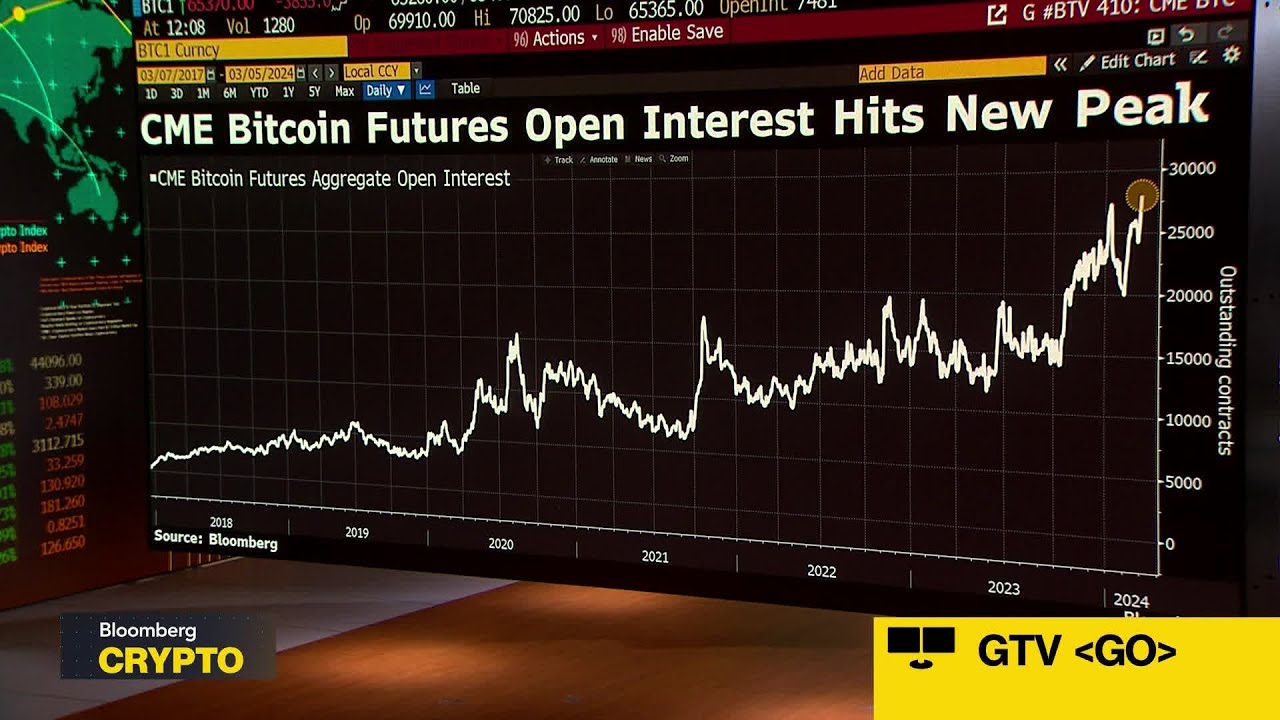

- 📈 The launch of several Bitcoin spot ETFs has driven market demand and contributed to Bitcoin's price surge.

- 💧 Bitcoin has limited liquidity, with only 10-15% of the total Bitcoin supply being actively traded.

- 🌊 Inflows into the newly launched Bitcoin ETFs, some with over $1 billion in assets, have been significant drivers of price.

- 📆 The upcoming Bitcoin halving event in April 2024 is expected to further push up the price.

- 🔍 When evaluating Bitcoin ETFs, investors should consider the issuer's reputation, experience in the crypto space, and dedication to education.

- 🏆 Established firms like Fidelity and BlackRock have seen success with their Bitcoin ETFs due to their scale and brand recognition.

- 💎 Smaller issuers like Bitwise, with a strong focus on the crypto space, are preferred by some investors for their expertise.

- 🧠 Due diligence for Bitcoin ETFs should focus on the issuer's credibility and understanding of the crypto market, rather than just the underlying asset.

Q & A

Why is Bitcoin considered the ultimate risk asset?

-Bitcoin is considered the ultimate risk asset because it is a highly volatile and speculative cryptocurrency. Its price tends to fluctuate significantly based on market sentiment and demand, making it a risky investment.

What factors have contributed to Bitcoin's recent surge to a record high in March 2024?

-The launch of 11 Bitcoin spot ETFs (exchange-traded funds) in mid-January 2024, which increased market demand and liquidity, the upcoming Bitcoin halving event in April 2024, and the overall risk-on sentiment among investors are cited as tailwinds that have driven Bitcoin's price to new record highs.

How does the launch of Bitcoin spot ETFs impact the market?

-The launch of Bitcoin spot ETFs has increased market demand and liquidity for Bitcoin. It is estimated that these ETFs are trading with only about 10-15% of the available Bitcoin liquidity, leading to significant inflows and price appreciation.

What is the significance of the Bitcoin halving event in April 2024?

-The Bitcoin halving event, which occurs roughly every four years, is a mechanism that halves the reward for mining new Bitcoin blocks. This is expected to reduce the supply of new Bitcoin entering the market, potentially driving up the price due to increased scarcity.

How do investors evaluate and choose among the various Bitcoin spot ETFs?

-According to the script, investors tend to look at the issuer's reputation, experience in the crypto space, and dedication to the industry. Well-established issuers like Fidelity and BlackRock have seen the highest inflows due to their overall trust and brand recognition, while crypto-native issuers like Bitwise are preferred by some investors for their specialized knowledge and focus on the crypto market.

What is the importance of liquidity in the Bitcoin market?

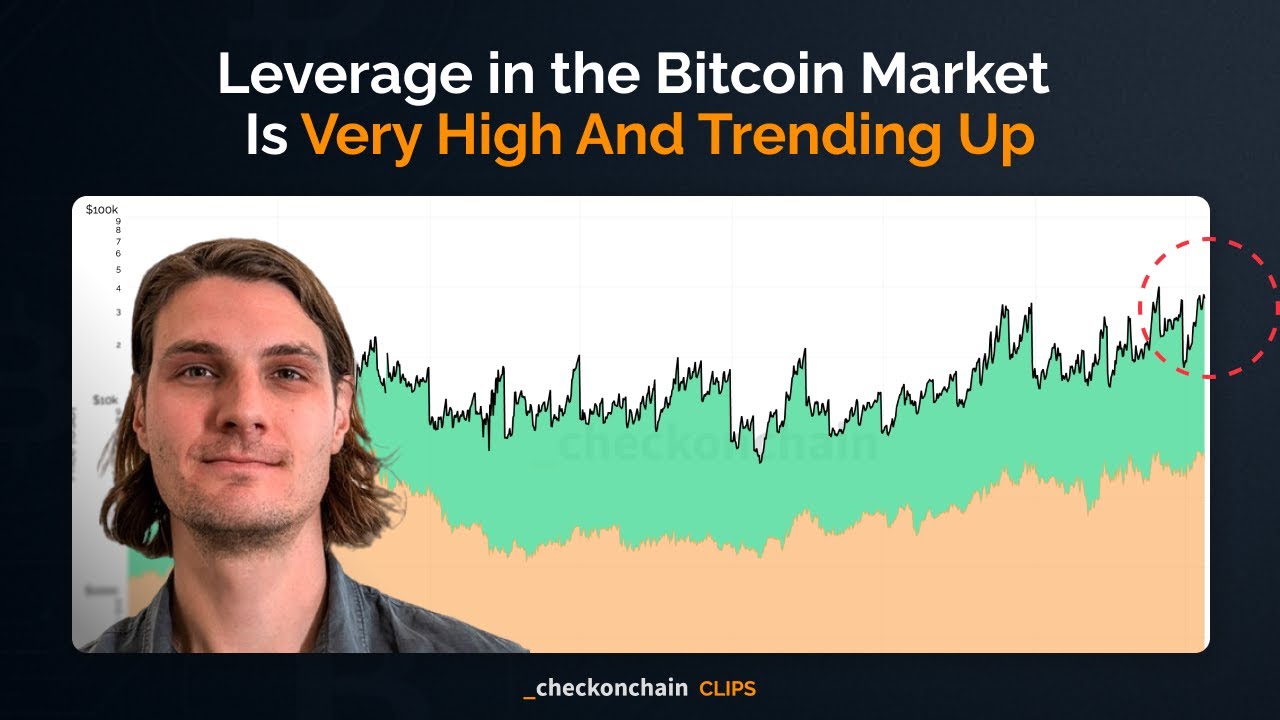

-Liquidity is crucial in the Bitcoin market, as it is estimated that only 10-15% of the total Bitcoin supply is actively traded or considered liquid. This limited liquidity can lead to significant price volatility and impact the market's ability to absorb large inflows or outflows of capital.

How does the current interest rate environment impact the demand for risk assets like Bitcoin?

-The script mentions that, with the Federal Reserve's interest rates now well above 5% in March 2024 (compared to near-zero levels in November 2021), investors are more inclined to take on risk and invest in risk assets like Bitcoin, as they seek higher potential returns in a higher interest rate environment.

What is the significance of the Bitcoin ETFs having over $1 billion in assets under management?

-The fact that some of the Bitcoin ETFs have over $1 billion in assets under management highlights the significant inflows and demand for these products. It also underscores the growing institutional interest and acceptance of Bitcoin as an investable asset class.

How does the limited liquidity in the Bitcoin market impact the influence of the Bitcoin spot ETFs?

-With only about 10-15% of the total Bitcoin supply considered liquid, the inflows into the Bitcoin spot ETFs can have a disproportionate impact on the market, as they are essentially trading with a limited portion of the available liquidity. This can amplify the price movements and volatility in the Bitcoin market.

What factors should investors consider when conducting due diligence on Bitcoin spot ETFs?

-According to the script, investors should primarily consider the issuer's reputation, experience in the crypto space, and dedication to the industry. Other factors like the fund's expenses, trading volume, and liquidity may also be relevant when evaluating and selecting among the various Bitcoin spot ETF offerings.

Outlines

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنMindmap

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنKeywords

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنHighlights

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنTranscripts

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنتصفح المزيد من مقاطع الفيديو ذات الصلة

Bitcoin Might See 'Flash Crash,' Says Glen Goodman

Signs of a bubble emerging in ASX | The Business | ABC NEWS

🚀 Bitcoin Rampage Explodes📈

Toughest time ever to buy a home in Canada? | About That

Leverage in the Bitcoin Market Is Very High And Trending Up (Premium Market Update Clip)

Bitcoin Elliott Wave Update – A Major Decision Point Ahead for BTC

5.0 / 5 (0 votes)