🚀 Bitcoin Rampage Explodes📈

Summary

TLDRIn this energetic update, the speaker reveals a massive surge in Bitcoin interest and investment, marking the return of the 'pump' not seen since April 2021. With unprecedented capital influx into Bitcoin, considered the hardest asset, the scene is set for what's dubbed the most remarkable economic experiment. Highlights include a record flow into a Bitcoin ETF, significant net realized profit, and global regulatory advancements. The discussion also touches on the strategic movements of high-net-worth individuals and institutions towards Bitcoin investments, hinting at a potential price explosion beyond $100K. This flurry of activity is described as the dawn of a new era, with Bitcoin's performance soaring, fueled by an extraordinary accumulation of ETFs and the anticipation of a tighter supply post-halving.

Takeaways

- 🔥 Bitcoin's excitement and investment interest has surged, reaching levels not seen since April 2021.

- 💰 An unprecedented amount of capital is flowing into Bitcoin, described as the hardest asset on the planet, with significant economic implications.

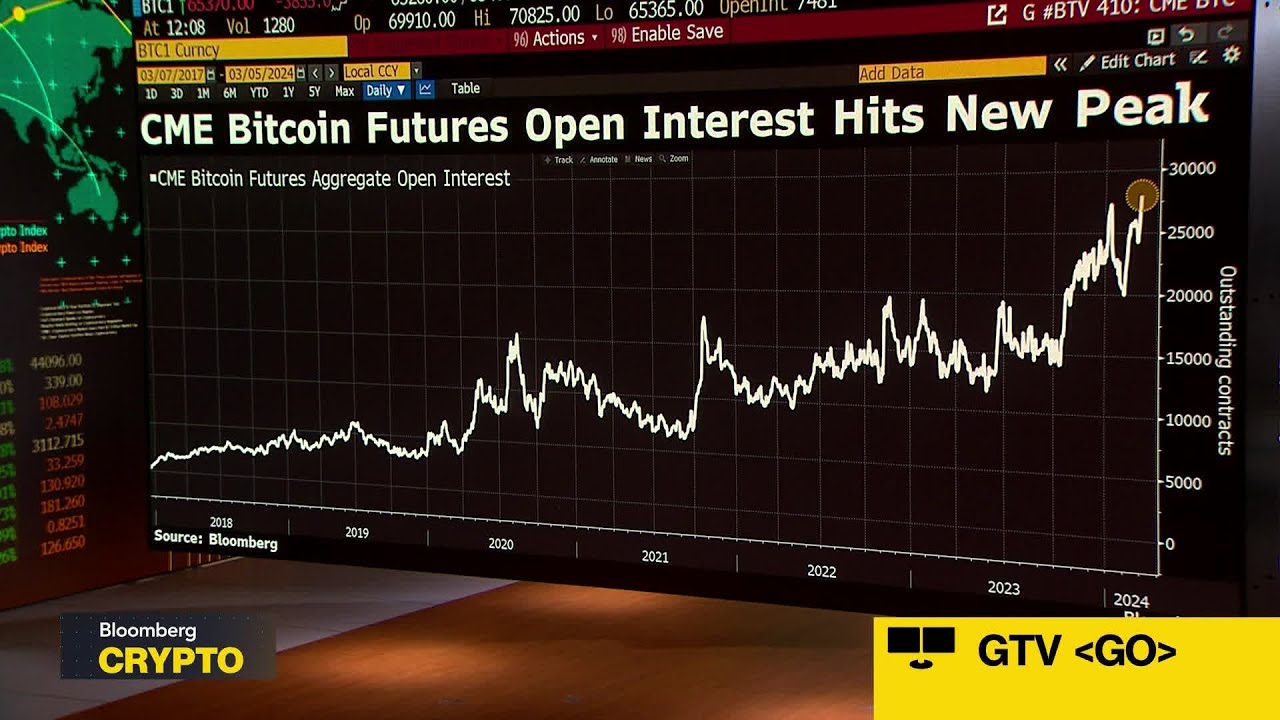

- 🚀 The demand for Bitcoin ETFs is strong and growing, with professional investors showing high interest.

- 📈 Record-breaking inflows into Bitcoin and ETFs highlight a massive surge in investor participation and capital movement.

- 💵 The U.S. Treasury's increased debt issuance is seen as 'stealth liquidity' that could benefit Bitcoin by providing more capital to the market.

- 🖥 South Africa plans to license 60 crypto platforms, indicating a growing acceptance of digital assets globally.

- 📉 Bitcoin's market dynamics are characterized by significant buying pressure and a decrease in selling, driving prices up.

- 🤩 The scale of Bitcoin's adoption and investment is breaking new records, with ETFs absorbing massive amounts of Bitcoin at a rapid pace.

- 💳 Discussions around Bitcoin's legal and economic positioning suggest it's gaining recognition as a legitimate and protected asset in the U.S.

- 💥 Projections suggest Bitcoin could hit unprecedented highs, with potential to reach $228,000 by March 2025 if current trends continue.

Q & A

What has been the significant change in Bitcoin since April 2021 according to the script?

-The significant change mentioned is the return of 'the pump' in Bitcoin's value, which had not been observed since April 2021.

What is the unprecedented event mentioned in the script regarding capital investment?

-The unprecedented event is the immense amount of capital flowing into Bitcoin, described as the hardest asset on the planet.

How does the script describe the current economic situation with Bitcoin?

-The script describes it as the most remarkable economic experiment in the history of the planet due to the unprecedented amount of capital inflow.

What is the predicted impact of the ETFs on Bitcoin according to the script?

-The script predicts that the ETFs will have a significant impact, sucking in large amounts of Bitcoin and potentially leading to a price increase.

What new regulatory change is mentioned in the script regarding South Africa?

-South Africa is planning to deploy 60 cryptocurrency licenses for crypto platforms by the end of the month.

What record does the script highlight regarding Bitcoin ETFs and market activity?

-The script highlights records such as the largest single-day inflow into Bitcoin ETFs and unprecedented net realized profit and loss metrics.

What does the script imply about the future price of Bitcoin?

-The script implies that Bitcoin's price is expected to smash the $100K barrier soon and could potentially reach up to $228K by March 2025.

What are the concerns mentioned regarding the US dollar in comparison to Bitcoin?

-The script mentions concerns about the US dollar's large circulation, unlimited supply, and rapid increase in supply, contrasting it with Bitcoin's capped supply.

What is mentioned about the traditional financial asset, gold, in comparison to Bitcoin?

-The script mentions that Bitcoin ETFs have reached a significant portion of the market value of gold ETFs in a much shorter timeframe, highlighting the shifting investor interest from gold to Bitcoin.

What does the script say about the US government's financial management?

-The script criticizes the US government's financial management, noting that a large portion of its revenue is being used just to pay interest on debt.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade Now5.0 / 5 (0 votes)