Inflation and Deflation

Summary

TLDRThis script explores the concept of inflation, illustrating its impact with the example of Jane and Bob's house appreciating in value due to inflation over the years. It defines inflation as a general rise in prices and a decrease in purchasing power, contrasting it with hyperinflation. The script explains the importance of the Consumer Price Index (CPI) in measuring inflation and the three main causes: currency oversupply, increased aggregate demand, and rising production costs. It also touches on the effects of inflation on fixed-income individuals and the negative view of deflation, concluding that some inflation is beneficial for economic growth.

Takeaways

- 💡 Inflation is a general increase in prices and a fall in the purchasing value of money over time.

- 🏠 An example of inflation's impact is seen in the increase in the value of Jane and Bob's house from $15,000 to $150,000 since 1970.

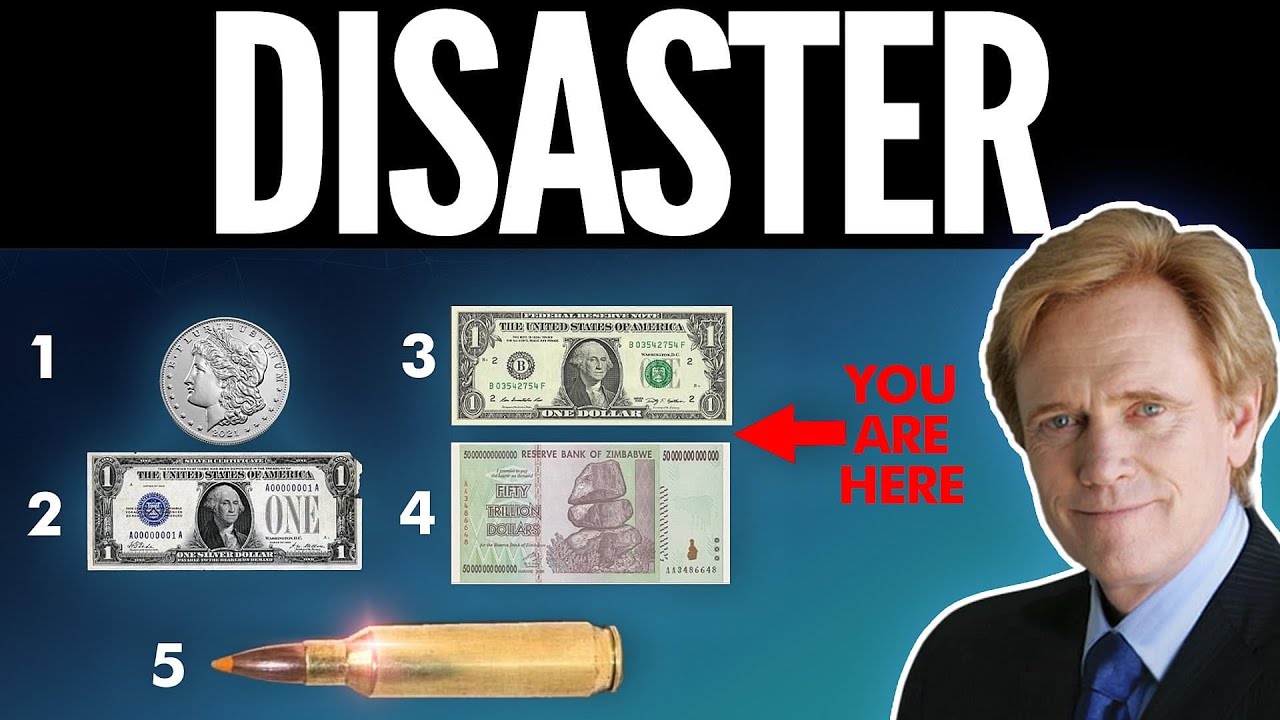

- 🔍 Hyperinflation is an extreme form of inflation that leads to an economic crisis, as seen in countries like Bolivia, Venezuela, and Zimbabwe.

- 💸 Purchasing power is the amount of goods you can buy with a unit of currency, which decreases as prices rise due to inflation.

- 📈 Price indexes, like the Consumer Price Index (CPI), measure the average price changes of a standard group of goods over time.

- 📊 The CPI in the U.S. is updated every 10 years to reflect changes in consumer spending habits and includes eight categories of goods and services.

- 🌟 Moderate inflation (around 2-3%) is considered healthy as it promotes investment and economic growth.

- 💰 Causes of inflation include the quantity theory (too much currency), increased aggregate demand, and higher production costs for producers.

- 📉 Deflation is the opposite of inflation, characterized by a decrease in the overall price level and is generally viewed negatively by economists.

- 👴 Inflation is particularly concerning for those on fixed incomes, such as Social Security recipients, as their income does not increase with rising prices.

- 🚀 Understanding and adapting to inflation is crucial for economic stability and growth in the long run.

Q & A

What is inflation and why does it cause prices to increase over time?

-Inflation is a general increase in prices and a fall in the purchasing value of money over time. It causes prices to increase as more money is available, leading to higher demand for goods and services, which in turn drives up prices.

Can you provide an example from the script that illustrates the impact of inflation on property values?

-Jane and Bob bought their house in 1970 for $15,000, and by the time they wanted to retire, it was worth $150,000. This significant increase in value is attributed to inflation.

What is hyperinflation and how does it differ from regular inflation?

-Hyperinflation is a dramatic and rapid increase in prices that is generally unsustainable and can lead to an economic crisis. It differs from regular inflation in that it is much more extreme and can quickly devalue a currency.

How does inflation affect the purchasing power of money?

-Inflation reduces the purchasing power of money because as prices increase, each unit of currency can buy less. This means that the same amount of money can purchase fewer goods and services over time.

What is the Consumer Price Index (CPI) and why is it important?

-The CPI is a measure that shows how the average price of a standard group of goods and services changes over time. It's important because it helps economists calculate the inflation rate and understand price changes in the economy.

How often are the categories of the CPI updated and why?

-The categories of the CPI are updated every 10 years to adjust for changes in consumer spending habits, ensuring that the index remains representative of the average consumer's purchases.

What is considered a healthy rate of inflation and why?

-A healthy rate of inflation is around 2-3%. This level is considered good because it promotes investment and economic growth, as people are more likely to invest knowing that the value of money may increase over time.

What are the three main causes of inflation as discussed in the script?

-The three main causes of inflation are: 1) The quantity theory of inflation, which suggests that an excess of currency can cause prices to rise. 2) An increase in aggregate demand, which happens when more people can afford to buy goods and services, driving up prices. 3) Higher production costs for producers, which may lead them to raise prices to maintain profits.

Why is inflation particularly concerning for those on a fixed income?

-Inflation is concerning for those on a fixed income because their income does not increase even when prices go up, which reduces their purchasing power and can make it harder to afford necessities.

What is deflation and how does it affect an economy?

-Deflation is a reduction in the overall level of prices in an economy. It is generally viewed negatively because producers may slow down production in response to falling prices, leading to layoffs, salary reductions, and a halt in economic growth.

Why is some level of inflation considered beneficial for an economy?

-Some level of inflation is beneficial because it encourages spending and investment, as people and businesses expect prices to rise and thus are motivated to invest now to avoid higher costs in the future. This can stimulate economic activity and growth.

Outlines

此内容仅限付费用户访问。 请升级后访问。

立即升级Mindmap

此内容仅限付费用户访问。 请升级后访问。

立即升级Keywords

此内容仅限付费用户访问。 请升级后访问。

立即升级Highlights

此内容仅限付费用户访问。 请升级后访问。

立即升级Transcripts

此内容仅限付费用户访问。 请升级后访问。

立即升级浏览更多相关视频

The Truth behind Inflation | Explained by Dhruv Rathee

Silver vs Fiat: The Fall of Minimum Wage in Real Terms | Mike Maloney

Why You NEED to know the Time Value of Money Formula (Excel NPV function)

How to Double Your Money? 💰 | How to be Rich? | Financial Education

20 August 2024

Money: Humanity's Biggest Illusion

5.0 / 5 (0 votes)