How to Double Your Money? 💰 | How to be Rich? | Financial Education

Summary

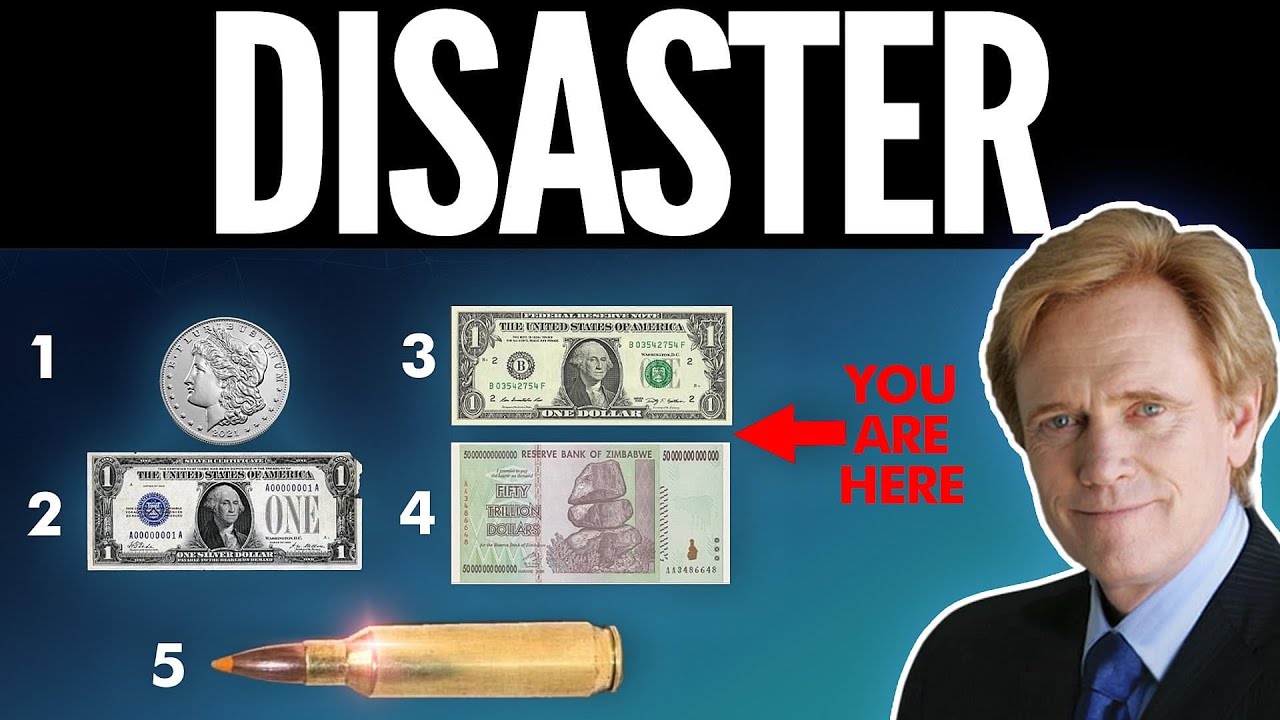

TLDRThis video script discusses the impact of inflation in India over the past 60 years, illustrating its steady rise from 1.78% in 1960 to 7.66% in 2019. It emphasizes the financial strategies of the wealthy to combat inflation, such as investing in businesses and mutual funds for compound growth rather than relying on low-interest bank savings. The script introduces the Rule of 72 to calculate the doubling time of investments and uses the example of Apple's stock growth to highlight the power of investing versus spending. It concludes by encouraging viewers to seek financial education and strategic investment planning to secure their future wealth.

Takeaways

- 📈 Inflation in India has been on an overall upward trend over the past 60 years, starting from 1.78% in 1960 to 7.66% in 2019.

- 💡 The impact of inflation is significant on individuals, especially those who are aware of it and take steps to protect their wealth from its eroding effects.

- 🏦 Banks and governments are perceived as entities that can devalue one's savings through inflation and low-interest rates.

- 🛍️ The example of mango prices increasing from 100 rupees per kg to 108 rupees with an 8% inflation rate illustrates the direct impact on consumers.

- 🔢 The concept of compounding is introduced, explaining how both wealth and inflation can grow exponentially over time.

- 🤔 The script challenges viewers to consider whether their income or profits are keeping pace with inflation and what steps they should take if not.

- 💰 The script emphasizes the importance of not just saving money but investing it wisely to grow wealth and combat inflation.

- 📊 The difference between linear growth (fixed returns) and compound growth (variable, potentially exponential returns) is highlighted.

- 🎯 The 'Rule of 72' is introduced as a simple tool to estimate the time it takes for an investment to double at a given interest rate.

- 🚀 The potential for wealth multiplication through consistent reinvestment and compounding is demonstrated with a hypothetical example of a businessman starting with 2 crores.

- 📚 The script concludes by encouraging viewers to seek further financial education and to engage with the provided financial experts for personalized investment advice.

Q & A

How has inflation in India changed over the last 60 years according to the script?

-The script indicates that inflation in India started at 1.78% in 1960 and has seen various fluctuations, including reaching as high as 28% in some years. By 2019, the inflation rate had increased to 7.66%.

What is the impact of inflation on the cost of purchasing a mango as mentioned in the script?

-The script uses the example of a mango to illustrate the impact of inflation. If inflation increases by 8%, the cost of a mango that was previously 100 rupees per kg would increase to 108 rupees per kg the following year.

What does the script suggest about the role of banks in relation to inflation?

-The script suggests that banks may not be the best place to store money during inflation, as the interest rates offered by banks (typically 3-7%) are often lower than the rate of inflation, leading to a loss in purchasing power.

What is the 'Rule of 72' mentioned in the script, and how is it used?

-The 'Rule of 72' is a simple formula used to estimate the number of years required to double the invested money at a given annual rate of return. It is calculated by dividing 72 by the percentage rate of interest.

How does the script differentiate between linear growth and compound growth?

-Linear growth is described as receiving a fixed return on investment, such as government bonds or certain insurance policies. Compound growth, on the other hand, refers to investments like the stock market or mutual funds, where the returns are reinvested and can potentially lead to exponential growth over time.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

5.0 / 5 (0 votes)