Is the S&P 500 Too Concentrated?

Summary

TLDRThe video discusses concerns over the S&P 500 becoming overly concentrated in a handful of large tech stocks, which now make up a significant portion of the index's market capitalization and performance. It analyzes the validity of these concerns, noting both pros and cons - while concentration has increased, it's not unprecedented. Ultimately, the S&P 500 remains representative of the US market, but investors should understand they are making some implicit bets on factors like large caps and US stocks. Alternate index investing options with different exposures are also highlighted for those wanting a more passive strategy.

Takeaways

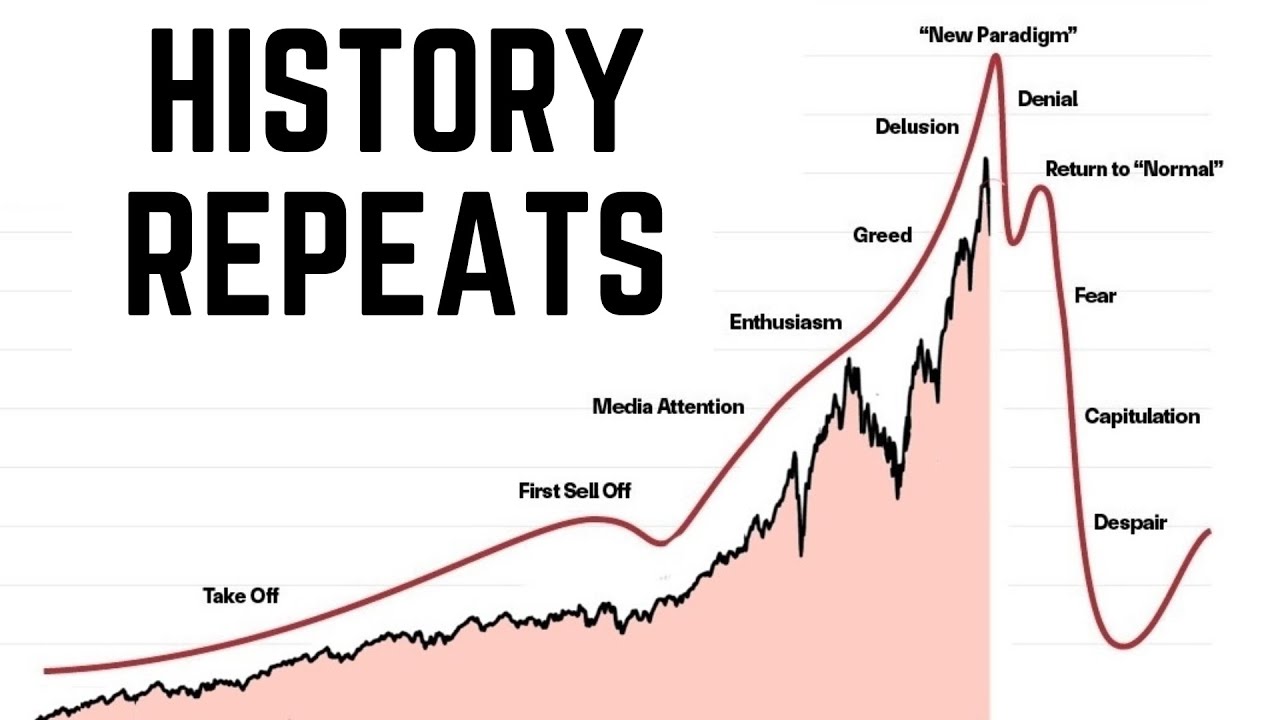

- 😀 The S&P 500 is becoming more concentrated in top large-cap tech stocks, raising concerns about diversification and exposure to overvalued companies

- 😮 The top 10 S&P 500 companies now represent about 1/3 of the index's total market cap, the highest since the 1970s

- 📈 But historically the index has seen similar or even higher levels of concentration in the past

- 😕 The index's increased concentration comes from the mega-cap tech stocks becoming more expensive relative to other companies

- 🤔 Some claim index investing itself is causing inflated valuations, but active trading still outweighs passive investing

- 💡 The S&P 500 aims to represent the US stock market, and still captures 80% of total market cap

- 🤨 Putting money in the S&P 500 involves some active bets - on US large caps over small caps, tech sectors, and US vs international markets

- 📉 The index has exposure beyond just the top 10 names, and overall diversification isn't yet severely hampered

- 🔎 Alternatives like equal-weight and total market indexes can provide broader diversification

- 😊 The S&P 500 has still been a solid investment over long periods, but concentration is a risk to weigh

Q & A

What percentage of the global stock market does the US stock market represent despite only being 25% of the global economy?

-The US stock market represents roughly 60% of the global stock market capitalization despite the country only representing 25% of the global economy measured by GDP.

What is the current average PE multiple for the S&P 500 versus other markets?

-The S&P 500 currently trades at an average PE multiple of 24.2 times versus 16.5 times for the Canadian S&P TSX Composite and cheaper valuations for many other international markets.

What were the two main reasons given for why smaller cap stocks tend to earn higher returns over the long term?

-The two main reasons are that smaller companies tend to have an easier time growing their operations since they are less mature and established, and larger companies tend to already have high valuations baked in relative to their future earnings growth potential.

What percentage of the S&P 500 earnings in 2024 is expected to come from the Magnificent 7 companies?

-The Magnificent 7 companies are only expected to contribute 19.5% of the S&P 500's earnings in 2024 despite representing 28.6% of its market capitalization in the prior year.

How many stocks are technically included in the S&P 500?

-While referred to as the top 500 companies, the S&P 500 technically includes 505 stocks currently due to some companies having multiple share classes included.

What time period saw a peak in concentration level for the S&P 500's top 10 holdings?

-Concentration for the S&P 500's top 10 holdings peaked above 40% back in the 1960s before coming down closer to 30% for much of the 1970s.

What are some other broad market index alternatives mentioned besides the S&P 500?

-Some other broad market index alternatives mentioned include the S&P Total Market Index, Russell 3000 Index, CRSP US Total Market Index, and MSCI World Index.

What two criteria must a company meet to qualify for inclusion in the S&P 500?

-Two of the main criteria for a company to be added to the S&P 500 are having positive as-reported earnings and adequate liquidity.

What is tracking error and why does it matter when selecting an index fund?

-Tracking error refers to how closely an index fund mimics the actual performance of the underlying index. Minimizing tracking error is important to ensure your index fund investment effectively matches the benchmark.

How can investors mitigate the concentration risk of the S&P 500 highlighted in the passage?

-Investors can mitigate the concentration risk by investing in an equal-weighted S&P 500 fund, exploring other broader market indexes, or diversifying internationally into stocks outside the US market.

Outlines

此内容仅限付费用户访问。 请升级后访问。

立即升级Mindmap

此内容仅限付费用户访问。 请升级后访问。

立即升级Keywords

此内容仅限付费用户访问。 请升级后访问。

立即升级Highlights

此内容仅限付费用户访问。 请升级后访问。

立即升级Transcripts

此内容仅限付费用户访问。 请升级后访问。

立即升级5.0 / 5 (0 votes)