Setting Up Data Centers In India: Assessing The Systemic Tailwinds & Possible Beneficiaries

Summary

TLDRIn a discussion on the future of India's data center industry, Sunil Gupta, co-founder and CEO of Yota Infrastructure, and Harid Kapadia, an analyst at Ilara, explore the impact of AI and government initiatives on data center growth. Gupta highlights the current 1200-megawatt capacity, expecting it to double by 2027 and reach 3000 megawatts by 2030, with AI potentially driving even greater expansion. They also delve into operational capacities, market segments, and the technological evolution of data centers, including the shift towards more efficient cooling systems for handling the heat generated by powerful AI chips.

Takeaways

- 📈 The Indian data center industry has seen significant growth, with a current size of about 1200 megawatts and expected to reach 2000-3000 megawatts by 2027 and 2030, respectively.

- 🌐 The rise of hyperscalers in India, along with the growth of e-commerce, mobile penetration, and cloud adoption, has been a major driver of this expansion.

- 🔌 Yota Infrastructure, co-founded by Sunil Gupta, currently has an operational capacity of over 100 megawatts, with a campus approach that allows for scalability up to 700 megawatts in the future.

- 💡 Both colocation and cloud segments are growing in India, with the collocation market seeing significant expansion due to large capacity builds and leasing space to hyperscale cloud operators or large enterprises.

- 💻 The traditional workloads served by CPU-based servers are evolving with the advent of AI and generative AI, which require training machines with vast amounts of data to make decisions and creations.

- 🚀 The potential of AI to drive data center capacity is immense, with some projections suggesting a doubling or tripling of the current capacity worldwide due to AI alone.

- 🛠️ Data centers of the future will likely be very dense, requiring high power per rack and advanced cooling technologies, moving from air-based to water-based or immersion cooling methods.

- 💡 The shift towards AI and GPU-based processing will necessitate a change in data center design, with a focus on handling the increased power and cooling requirements of these advanced chips.

- 💰 The cost to set up a data center is estimated to be around 60 to 70 crores per megawatt, with potential returns of 12-18% and a payback period that can range from 2.5 to 5 years.

- 🛑 The discussion highlights the dynamic changes in the data center industry, with a potential revolution in how data is stored and processed due to technological advancements.

- 🔍 The interview also touches on the opportunity for companies in the capital goods sector, such as those involved in electrical systems, transformers, and substations, to benefit from the data center boom.

Q & A

What is the current size of India's data center industry?

-As of the time of the transcript, the Indian data center industry is approximately 1200 megawatts.

What is the expected growth of data center capacity in India by 2027?

-The data center capacity in India is expected to double, reaching about 2,000 megawatts by 2027.

What is the projected data center capacity in India by 2030?

-By 2030, the data center capacity in India is expected to grow to around 3,000 megawatts.

What is the potential impact of artificial intelligence on India's data center capacity?

-The push from artificial intelligence, particularly generative AI, could lead to a significant increase beyond the 3,000 megawatts projection, possibly even reaching 17,000 megawatts by 2030.

What is Yota Infrastructure's operational capacity in terms of data center size?

-Yota Infrastructure has an operational capacity of more than 100 megawatts spread across campuses in Delhi and Mumbai.

What is the business model of Yota Infrastructure?

-Yota Infrastructure operates on a campus approach, offering wholesale and retail colocation services, as well as building its own sovereign clouds and providing managed services, including GPU as a service.

What is the cost to set up a data center in India?

-The cost to set up a data center in India is estimated to be around 60 to 70 crores per megawatt.

What is the expected payback period for a data center investment?

-The payback period can vary from as early as 2.5 to 3 years if an anchor customer is secured before the data center goes live, to 4 or 5 years for more speculative investments.

What are the potential returns on investment for a data center?

-The returns on investment for a data center are typically around $80 to $100 per kilowatt per month, which can provide a reasonable return of around 12 to 18%.

How will the advent of AI and generative AI affect traditional data center workloads?

-AI and generative AI will lead to a significant increase in data center capacity needs, as these technologies require training with large amounts of data and more powerful processing capabilities.

What changes are expected in data center design to accommodate AI and generative AI technologies?

-Data centers will need to become denser, with higher power per rack and different cooling technologies, possibly including water-based cooling or immersion cooling for chips, to handle the increased heat generated by AI and generative AI workloads.

Outlines

此内容仅限付费用户访问。 请升级后访问。

立即升级Mindmap

此内容仅限付费用户访问。 请升级后访问。

立即升级Keywords

此内容仅限付费用户访问。 请升级后访问。

立即升级Highlights

此内容仅限付费用户访问。 请升级后访问。

立即升级Transcripts

此内容仅限付费用户访问。 请升级后访问。

立即升级浏览更多相关视频

The inner workings of Asia's largest data centre, in Navi Mumbai

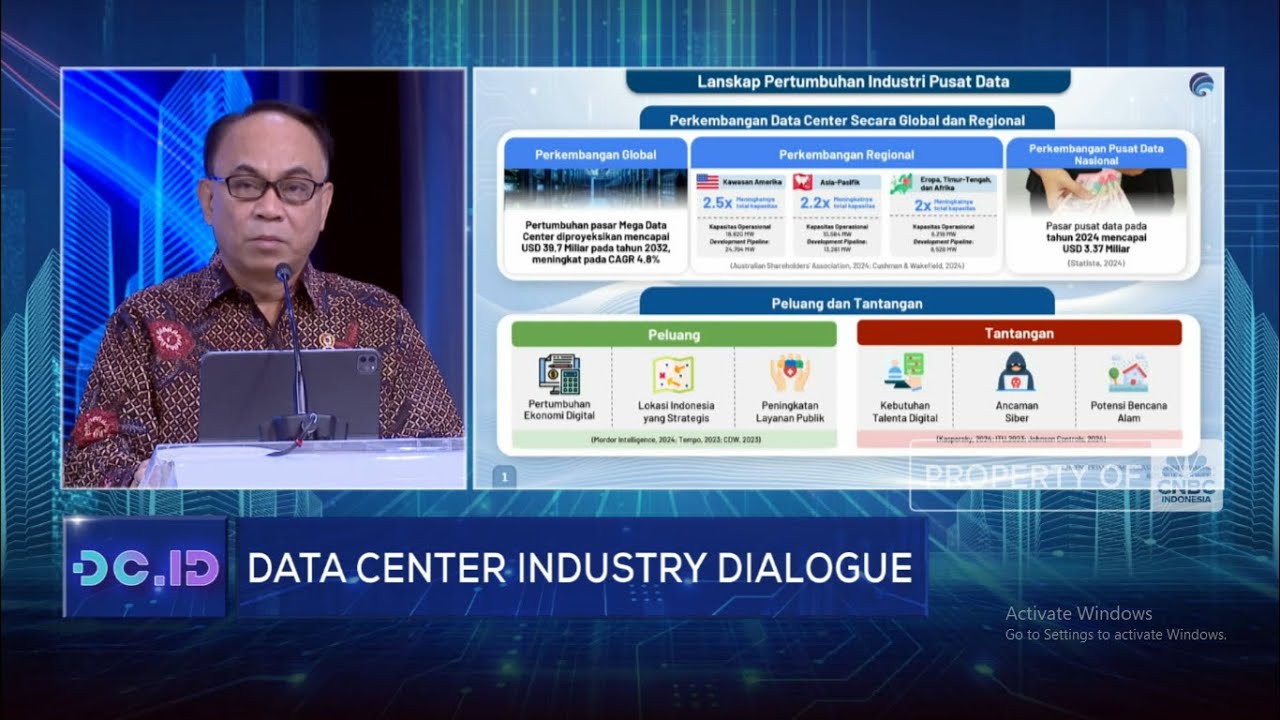

Menkominfo: Bisnis Data Center Beri RI Peluang Cuan USD 3,37 Miliar

Bisnis Kos-kosan Di Era Digital. THE INSIDER with Anggit, CEO & Co-founder Mamikos.

$2.5M Pre-seed Round to Make Weather Forecasts More Accurate #SaaS

Beyond Nvidia: What Wall Street’s missing in the AI boom

Data Center Leaders on Building AI’s Infrastructure

5.0 / 5 (0 votes)