FA27 - Inventory Discounts (2/10, Net 30) EXPLAINED

Summary

TLDRThis video walks through a series of accounting transactions for Romney Inc., focusing on journal entries for inventory purchases, returns, discounts, and sales. The instructor highlights key concepts like treating freight costs as part of inventory value, applying discounts, and handling returns. The video also covers how to record these transactions in a systematic way, making it a useful resource for anyone learning accounting basics. The instructor emphasizes that while the problem may seem complex due to the number of transactions, it's manageable when broken down step-by-step.

Takeaways

- 📘 The video provides instructions on how to download a counting workbook from a website and access both public and members-only videos on YouTube.

- 🔍 The script covers a detailed walkthrough of accounting transactions for Romney Inc., including purchases, sales, returns, and discounts.

- 🛒 On February 1st, inventory was purchased on account for $3,400, with a 2% discount available if paid within ten days.

- 🚚 February 2nd involved paying $200 for freight, which is considered part of the inventory cost rather than an expense.

- 🔄 A return of $400 worth of inventory occurred on February 5th, adjusting the accounts payable and inventory values.

- 💳 On February 9th, the inventory was paid for in full, with a 2% discount applied, resulting in a payment of $2,940.

- 📈 Sales on February 11th included selling inventory on account for $3,500, with terms of 2/10 net 30, indicating a possible discount for early payment.

- 📦 Additional inventory was purchased on February 14th for $2,500, with a 1% discount for payment within the net 30 terms.

- 🛍 Another sale was made on February 19th, this time for $1,500 on account, with a cost of goods sold (COGS) of $600 and terms of 2/10 net 30.

- 💸 Payment for the February 14th inventory purchase was made on February 21st, taking the 1% discount, resulting in a payment of $2,475.

- 🔄 A customer from the February 11th transaction paid the full amount owed on February 24th, without taking the discount.

- 🛒 A customer from the February 19th transaction returned $100 worth of inventory on February 25th, which was credited back to their account and restocked.

- 💳 The final transaction on February 28th involved a customer from the February 19th sale paying the amount owing, less a 2% discount for early payment, totaling $1,372.

Q & A

Where can the problem discussed in the video be downloaded?

-The problem can be downloaded at CountingWorkbook.com by clicking on the PDF link.

What additional content is available on the website besides the public YouTube videos?

-The website offers more videos than those listed publicly on YouTube, including members-only videos covering every problem in the workbook.

What is the first transaction discussed in the problem, and how is it recorded?

-The first transaction is a purchase of inventory on account for $3,400. It is recorded by debiting Inventory for $3,400 and crediting Accounts Payable for $3,400.

How should the cost of freight for inventory be recorded?

-The cost of freight, which is $200 in this case, should be debited to Inventory rather than an expense account, as it is part of the cost of acquiring the asset.

What is the journal entry for returning $400 of inventory?

-The journal entry for returning $400 of inventory involves crediting Inventory for $400 and debiting Accounts Payable for $400.

How is the discount on inventory payment calculated and recorded?

-The discount is 2% of the remaining $3,000 owed after a return, which equals $60. The payment is recorded by crediting Cash for $2,940, debiting Accounts Payable for $3,000, and reducing Inventory by $60.

What entries are made when inventory is sold on account?

-When inventory is sold on account for $3,500, the entries are: Debit Accounts Receivable $3,500, Credit Sales Revenue $3,500, Debit Cost of Goods Sold $1,600, and Credit Inventory $1,600.

How is the inventory purchase on February 14th recorded, considering the discount terms?

-The purchase of $2,500 is recorded by debiting Inventory and crediting Accounts Payable for $2,500. Upon payment with a 1% discount, Cash is credited for $2,475, Accounts Payable is debited for $2,500, and Inventory is reduced by $25.

What happens when a customer returns inventory?

-When a customer returns $100 worth of inventory, Accounts Receivable is credited, Sales Returns is debited for $100, Cost of Goods Sold is credited for $40, and Inventory is debited for $40.

How is the final payment from the customer on February 28th recorded, including the discount?

-The payment is recorded by debiting Cash for $1,372, crediting Accounts Receivable for $1,400, and recording the $28 discount as a Sales Discount, which reduces Sales Revenue.

Outlines

此内容仅限付费用户访问。 请升级后访问。

立即升级Mindmap

此内容仅限付费用户访问。 请升级后访问。

立即升级Keywords

此内容仅限付费用户访问。 请升级后访问。

立即升级Highlights

此内容仅限付费用户访问。 请升级后访问。

立即升级Transcripts

此内容仅限付费用户访问。 请升级后访问。

立即升级浏览更多相关视频

Lecture 04: Share Capital. [Corporation Accounting]

(9-QT) MENGENTRI BUKTI TRANSAKSI 1-5 | MYOB Accounting Plus V18 ED (Queen Toys)

Accounting for non-accountants (Video 1 in the series) - Intro & Background

MGT101_Topic015

GENERAL LEDGER: Visual Guide to Posting Journals

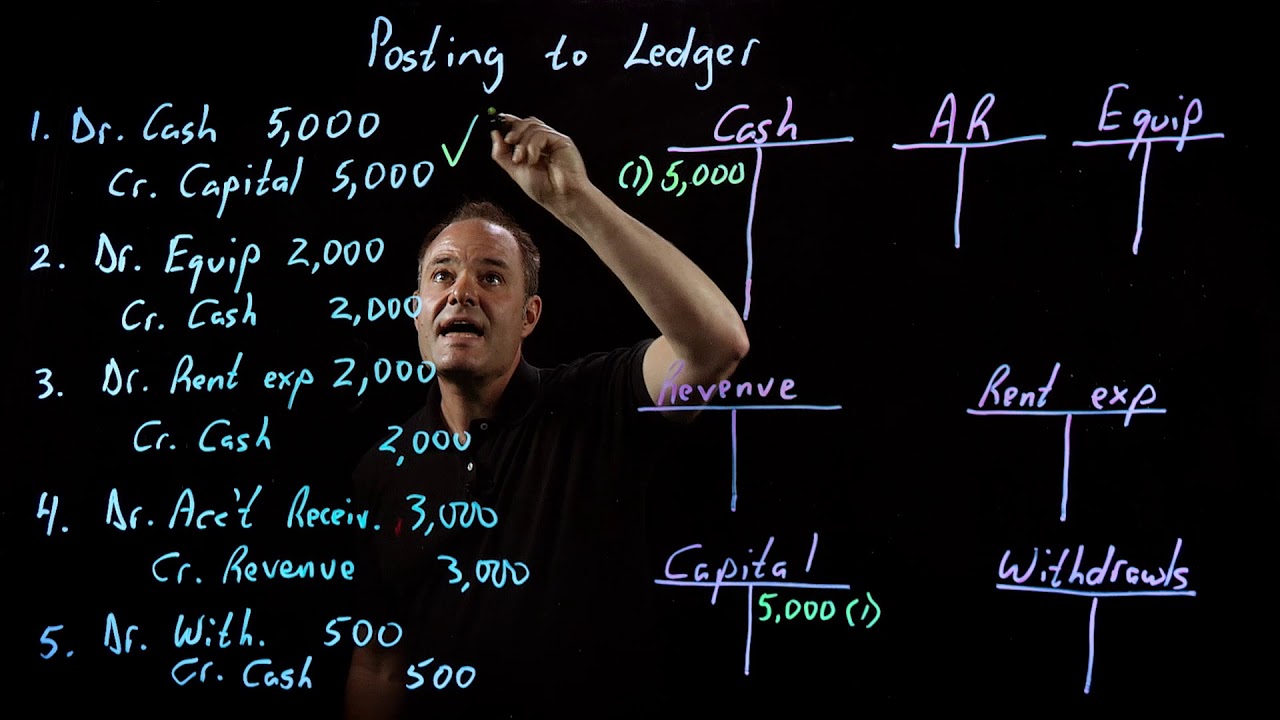

Accounting Fundamentals | Posting to the Ledger

5.0 / 5 (0 votes)