What Went Wrong at Peloton - Supply Chain in Focus

Summary

TLDRPeloton, a home fitness company, soared to success during the pandemic with soaring revenues but later faced a dramatic downfall due to supply chain issues and overestimating demand. The company's stock price plummeted, leading to layoffs and a potential sale. The script explores the bullwhip effect in supply chains, the pitfalls of time series forecasting, and the importance of probabilistic forecasts in operations planning for uncertain times, emphasizing the critical role of supply chain management in a company's success or failure.

Takeaways

- 🚀 Peloton's Revenue Growth: Peloton's revenue saw a dramatic increase from $700 million in 2019 to $4 billion in 2021 due to the pandemic-driven demand for home fitness equipment.

- 📉 Stock Price Decline: Despite revenue growth, Peloton's stock price dropped significantly from a high of $162 in December 2020 to less than $30, indicating a market perception problem.

- 💼 Layoffs and Potential Sale: The company faced financial difficulties, leading to the layoff of 2,800 employees and consideration of a sale to major corporations like Nike, Amazon, or Apple.

- 🌐 Supply Chain Challenges: The pandemic-induced demand surge led to supply chain issues, with delivery delays causing customer dissatisfaction and impacting the company's reputation.

- 💸 High Delivery Costs: To address supply chain issues, Peloton invested heavily in air cargo, increasing delivery costs per product by tenfold and burning cash.

- 🏭 Acquisition of Precor: Peloton acquired Precor for $420 million to scale up operations and gain access to 625,000 square feet of U.S. manufacturing space.

- 📉 Impact of Vaccine News: The announcement of a viable COVID-19 vaccine led to a 25% drop in Peloton's stock value as investors anticipated a return to gym attendance.

- 📈 Misestimation of Demand: The company underestimated the impact of reopening on demand, leading to overproduction and excess inventory.

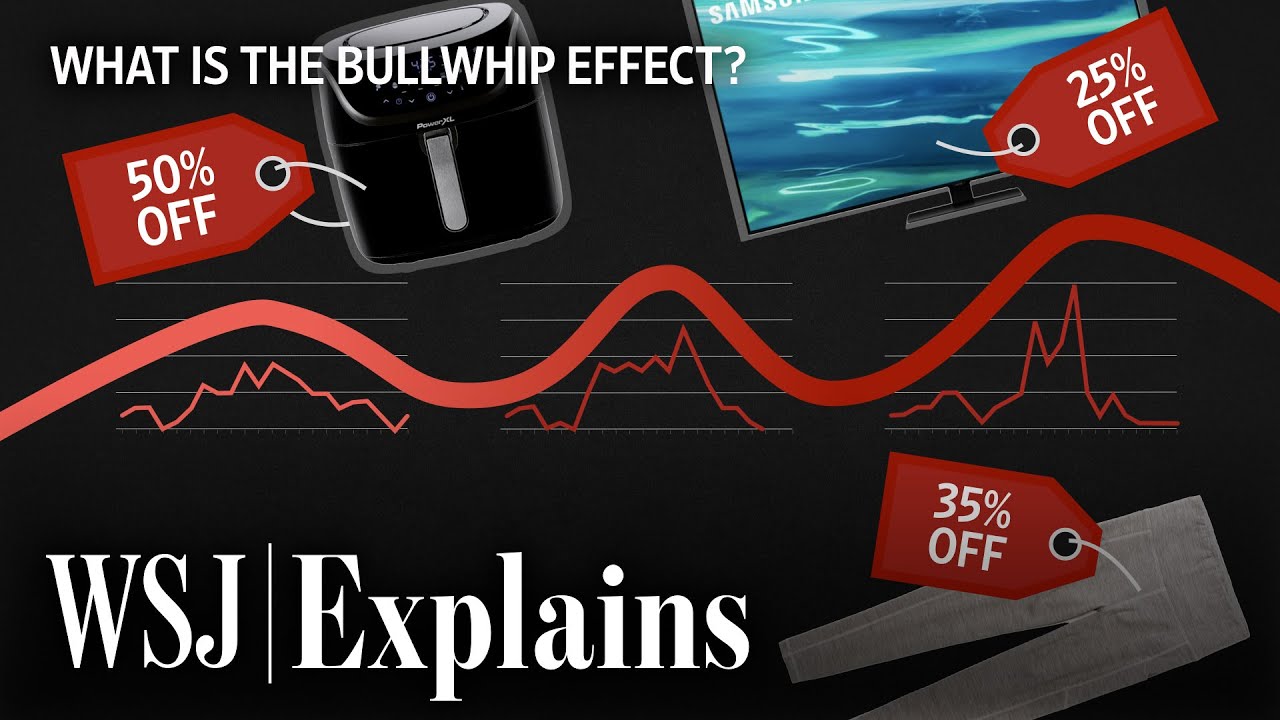

- 🔍 The Bullwhip Effect: The script explains the bullwhip effect in supply chains, which Peloton experienced, causing inefficiencies and high costs due to amplified demand fluctuations.

- 🛠 Supply Chain Solutions: The transcript suggests that better tools and practices, such as enhanced visibility, collaboration, and reduced lead times, could help mitigate the bullwhip effect.

- 📊 Probabilistic Forecasting: The script advocates for probabilistic forecasts over traditional time series forecasts to better account for uncertainty and a range of potential outcomes.

- ⏱️ Timing of Internalization: The company's decision to internalize operations may have been premature, and it should have considered the high uncertainty and the need for flexible, reversible strategies.

Q & A

What was the financial situation of Peloton in 2019 and how did it change in the following years?

-In 2019, Peloton's revenue was nearly 700 million dollars. It doubled in 2020 to reach 1.82 billion, and then doubled again in 2021 to reach 4 billion dollars.

How did the COVID-19 pandemic impact Peloton's business?

-The COVID-19 pandemic led to people being stranded at home and gyms closing, which increased the demand for home exercise equipment. Peloton, focusing on motivating people to do sports at home through their classes, seemed destined for meteoric success during this period.

Why did Peloton's stock price decline despite increasing revenues?

-Although revenues were growing, Peloton's stock price reached a high of 162 dollars in December 2020 but has since been declining and now sits at less than 30 dollars, a drop of 80 percent, possibly due to supply chain issues and market concerns about the company's long-term viability.

What supply chain challenges did Peloton face during the pandemic?

-Peloton faced challenges with demand outstripping supply, leading to delivery delays and customer dissatisfaction. The company was also affected by the shipping crisis, which impacted companies importing goods manufactured in Asia.

How did Peloton attempt to address the supply chain issues?

-Peloton invested a hundred million dollars to speed up delivery, including the use of air cargo instead of ocean freight to move products from its Asian manufacturer to the US, which increased the cost of delivery for each product by 10 times.

What was the impact of the vaccine news on Peloton's stock value?

-When the first news of a viable COVID-19 vaccine came out, Peloton's stock value fell by 25 percent as investors feared that gyms would reopen and the demand for digital fitness would decrease.

What is the 'bullwhip effect' mentioned in the script?

-The bullwhip effect is a phenomenon where the fluctuations of the system exceed the magnitude of the fluctuations that are fed into the system, often causing inefficiencies and costs through poor customer satisfaction, loss of revenues, and excess inventory.

How did Peloton's management underestimate the reopening impact on their business?

-Peloton's management planned operations against a version of the future they believed would come to pass, possibly ignoring adverse alternatives that seemed less likely to happen, leading to overestimation of demand and the bullwhip effect.

What steps can be taken to mitigate the bullwhip effect in supply chains?

-Mitigating the bullwhip effect can involve enhancing visibility and collaboration across stakeholders in the supply chain, reducing lead time delays and order sizes, and adopting a more stable form of pricing.

Why did Peloton decide to cancel the construction of their first factory?

-Peloton decided to cancel the construction of their first factory due to a tremendous backlog of inventory and the need to reduce reconstructing capital expenditures, which amounted to 60 million dollars.

What changes did Peloton make to their operations planning in response to the challenges they faced?

-Peloton shifted towards third-party fulfillment vendors for warehousing and delivery operations, and re-evaluated their long-term decisions, possibly considering probabilistic forecasts and a focus on the company's survival rather than maximizing sales and margins.

Outlines

此内容仅限付费用户访问。 请升级后访问。

立即升级Mindmap

此内容仅限付费用户访问。 请升级后访问。

立即升级Keywords

此内容仅限付费用户访问。 请升级后访问。

立即升级Highlights

此内容仅限付费用户访问。 请升级后访问。

立即升级Transcripts

此内容仅限付费用户访问。 请升级后访问。

立即升级浏览更多相关视频

Why Everything Is On Sale: The Bullwhip Effect | WSJ

How 3 Million Grocery Items Are Delivered To Homes Every Week | Big Business

LOG'S - NOTRE HISTOIRE

Why are supply chain problems causing issues on shop shelves? - BBC News

Why Global Supply Chains May Never Be the Same | WSJ Documentary

Supply Chain as a Growth Strategy

5.0 / 5 (0 votes)