The "Order Block" Theory

Summary

TLDRThis video script offers a comprehensive guide to understanding order blocks in trading, a strategy to outperform the competition. It covers four key steps: identifying market bias, recognizing order blocks, applying relativity theory across time frames, and analyzing retracements. The script emphasizes the importance of context, the rules for identifying high-probability order blocks, and the significance of fair value gaps in determining market direction, ultimately aiming to enhance viewers' trading strategies.

Takeaways

- 😀 Bias is the direction of the market, also known as overall drawn liquidity, and is crucial for understanding where the market is likely to move next.

- 🔍 Order blocks are not just any up or down candles; they must come off previous support or resistance levels, often forming off of fair value gaps or previous order blocks.

- 📊 To mark an order block correctly, one must consider the relationship between the fair value gap and the candle's wick or body, as this affects the block's sensitivity and potential to hold.

- 📚 Relativity theory in trading emphasizes the importance of context across different time frames, with higher time frames being the most influential.

- 🔄 Retracement is a key concept for confirming an order block's validity, with fair value gaps and expansion phase candles providing signals about the market's intention to continue in a certain direction.

- 📉 Bearish fair value gaps indicate a strong downward push in the market, suggesting that price is likely to continue lower, especially if they are respected during retracements.

- 📈 Bullish order blocks may not hold if there is significant bearish momentum, as seen through expansion phase candles and potential fair value gaps going against the intended direction.

- 🛑 Disrespecting a fair value gap by trading back into the first candle's low can negate the bearish signal and confirm a higher probability of the price continuing in the bullish direction.

- ⏳ Traders should avoid focusing on lower time frame order blocks without context from higher time frames, as these can be misleading and of lower probability.

- 🔑 Understanding the basics of price action, such as fair value gaps and expansion phase candles, is fundamental to recognizing market manipulation and potential trading opportunities.

- 📝 The script suggests a step-by-step approach to analyzing order blocks, starting with identifying bias, understanding order block formation, applying relativity theory, and finally analyzing retracement patterns.

Q & A

What are the four steps mentioned in the video script to understand order blocks?

-The four steps are: 1) Understanding bias, which is the direction of the market. 2) Identifying what an order block is and its significance. 3) Applying the relativity theory, which involves understanding the context of different time frames. 4) Analyzing retracement, which is the process of the price moving back towards an order block.

What is meant by 'bias' in the context of the video script?

-Bias refers to the overall direction of the market, also known as the direction of liquidity flow. It helps in determining the most probable direction in which the market is aiming.

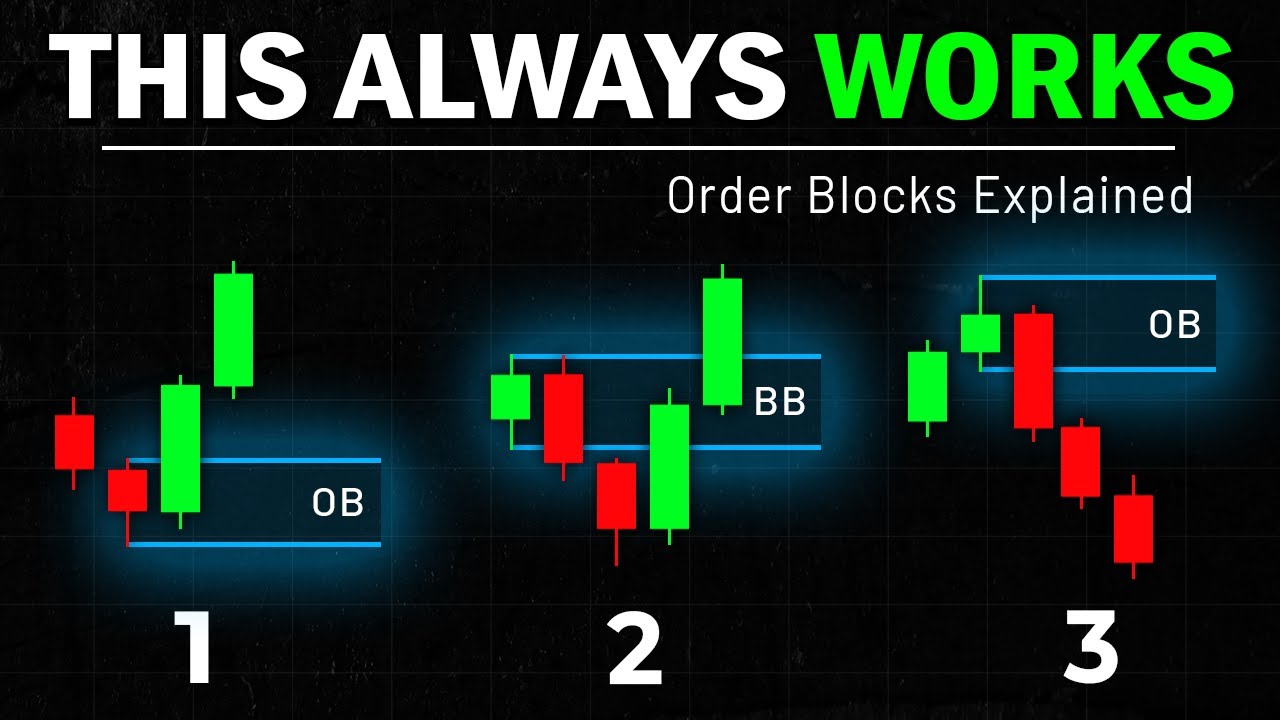

How does the script define an 'order block'?

-An order block is not just any up or down candle on a chart. It is a high-probability area that comes off a previous support or resistance level, often formed off of previous fair value gaps or off of previous order blocks.

What is the importance of 'fair value gaps' in the context of order blocks?

-Fair value gaps are important because they indicate the intention of price action. They can signal potential areas of support or resistance and are used to confirm the strength of an order block.

Can you explain the concept of 'expansion phase candle' mentioned in the script?

-An expansion phase candle is part of a three-candle pattern where the second candle closes below the first candle's low in a bearish scenario, indicating a potential fair value gap and a strong momentum against the current price direction.

What is the significance of 'retracement' in the context of trading and order blocks?

-Retracement refers to the price moving back towards an order block after it has been traded. It helps in confirming whether an order block will hold or not by observing the price action and the creation or disrespect of fair value gaps.

Why is it a mistake to look at order blocks on lower time frames without context?

-Looking at order blocks on lower time frames without context can lead to incorrect assumptions about their strength and reliability. Higher time frames provide the overall direction and context, which are crucial for order blocks to hold.

How does the script suggest marking an order block for trading purposes?

-The script suggests marking an order block based on the fair value gaps. If a fair value gap overlaps with the low (wick) of the order block, mark the wick. If not, mark the body of the order block.

What is the 'context area' mentioned in the script and why is it important?

-A context area is an overall area where there is the highest probability of time frames below the daily for order blocks to hold. It is important because it provides a reliable area for trading decisions based on the strength of order blocks.

How does the script describe the process of confirming an order block?

-The script describes the process of confirming an order block by observing the retracement and the potential or actual creation of fair value gaps. If the retracement does not create a fair value gap or disrespects an existing one, it confirms the strength of the order block.

What role do 'swing highs' and 'swing lows' play in identifying order blocks and bias?

-Swing highs and swing lows are significant price points that indicate potential support or resistance levels. They help in identifying the direction of the market (bias) and in forming order blocks, especially in the context of bearish or bullish lacks.

Outlines

此内容仅限付费用户访问。 请升级后访问。

立即升级Mindmap

此内容仅限付费用户访问。 请升级后访问。

立即升级Keywords

此内容仅限付费用户访问。 请升级后访问。

立即升级Highlights

此内容仅限付费用户访问。 请升级后访问。

立即升级Transcripts

此内容仅限付费用户访问。 请升级后访问。

立即升级浏览更多相关视频

Master Order Blocks to Trade like Banks (no bs guide)

🔴 1-2-3 ORDER BLOCKS Trading Strategy Banks Don’t Want You To Know About

Order Blocks Explained: 3 Best Strategies Revealed

The Ultimate Order Block Trading Strategy (FULL Masterclass) | SMC

Why Valid Order Blocks Fail in Forex Trading, Exploring the Order Flow Trading Strategy

Trading Order Blocks Simplified

5.0 / 5 (0 votes)