2022 ICT Mentorship Episode 32

Summary

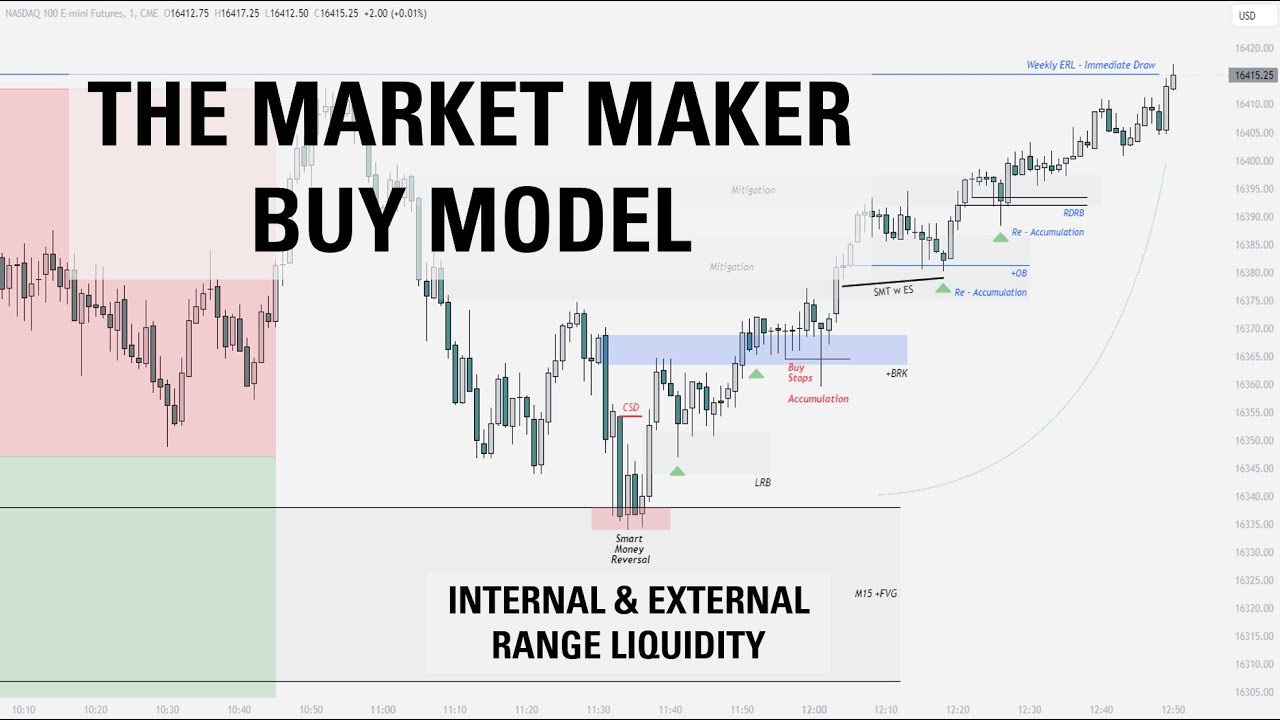

TLDRIn this detailed commentary, the speaker walks viewers through a day of market analysis, using Twitter to guide followers step-by-step through various trades. They explain the significance of specific price levels, market behavior, and trading strategies, particularly in a choppy, consolidation day. Highlighting the use of buy-side liquidity, smart money, and market psychology, the speaker shares real-time decision-making with their followers, showcasing a live trading experience, and offering insights into their methodology. The speaker also emphasizes the importance of critical thinking over relying solely on technical indicators.

Takeaways

- 😀 The speaker uses Twitter to walk followers through real-time market analysis, with timestamped tweets ensuring clarity and transparency.

- 😀 The focus is on teaching price action analysis, showing how market movements and setups can be predicted before they happen.

- 😀 The concept of an 'outside day' is explained, where the current day’s range is outside the previous day's range, often indicating a potential reversal or setup for further movement.

- 😀 The speaker emphasizes understanding the market’s algorithm, which often moves back and forth within a certain range until a specific time window (e.g., 3:00-4:00 PM).

- 😀 A key strategy discussed is the use of buy-side liquidity to trigger stops and create false breakouts, ultimately leading to a move back to the middle of the range.

- 😀 The importance of patience in identifying clean trade setups during choppy, range-bound market conditions is emphasized.

- 😀 The speaker outlines a specific trade setup (short position at 39.40) and discusses the importance of time-based windows for anticipating trade formations.

- 😀 The algorithm is used to generate liquidity for both smart money and retail traders, running stops and generating moves within the market's established range.

- 😀 The speaker shares a personal experience, highlighting the importance of educating others—specifically their son—on trading strategies and seeing him successfully apply the knowledge.

- 😀 The commentary also reflects a deeper critique of trading systems that rely on indicators like MACD or moving averages without considering market logic and the narrative behind price action.

Q & A

What does the speaker mean by an 'outside day' in the market?

-An 'outside day' refers to a trading day where the market's high is higher than the previous day's high, and the market's low is lower than the previous day's low. This indicates a day with a wider range of price action compared to the previous day, often seen as a sign of increased volatility.

What is the significance of the 39.33 and 38.55 price levels mentioned in the script?

-The 39.33 level was a key price point where the speaker anticipated the market would trade up to. The 38.55 level, on the other hand, represented an old low that had not been traded through, and the speaker believed it would eventually be revisited. These levels were part of a broader market strategy for predicting price movements.

What does the speaker mean by '50/50 probability' in relation to market movements?

-The '50/50 probability' refers to a situation where the market could just as easily move higher as it could move lower. This typically happens when the market is in a choppy or indecisive phase, where neither buyers nor sellers have clear control.

How does the speaker define a 'dealing range' in market analysis?

-A 'dealing range' refers to the range between a market's high and low during a specific time period. It helps traders understand the area where significant price action is occurring, and the speaker uses it to assess potential price movements and trade setups.

What role does the concept of 'liquidity' play in the speaker's trading strategy?

-Liquidity plays a critical role in the speaker's strategy. The idea is that market moves can be triggered by liquidity events, such as the running of buy or sell stops. The speaker looks for these liquidity squeezes, where the market runs in a direction to trigger stops, causing rapid price movements.

What is meant by 'smart money' in the context of the speaker's analysis?

-'Smart money' refers to experienced or institutional traders who have a deep understanding of the market and can influence its direction. In the speaker's analysis, smart money uses key levels of liquidity to trigger price moves, often taking advantage of less informed traders.

How does the speaker use specific time windows, such as between 3:00 and 4:00 PM, in his trading strategy?

-The speaker emphasizes the importance of timing, particularly between 3:00 and 4:00 PM, when market participants are more likely to place closing orders. This window can lead to significant price movements, as traders react to market conditions and liquidity levels. The speaker uses this time frame to anticipate and plan trades.

What is the significance of the 'middle of the range' in the speaker's trading methodology?

-The 'middle of the range' is a central price level within the day's trading range that the market often gravitates toward. The speaker uses this concept to predict where the market is likely to move, especially after periods of price action that appear to be 'grinding' or uncertain.

What does the speaker mean by 'choppy' market conditions, and how does he handle them?

-A 'choppy' market refers to a condition where price movements are erratic and lack a clear trend. These conditions are difficult to trade because the market fluctuates up and down without clear direction. The speaker advises waiting for specific setups or signals, like a run on liquidity or a key time window, to identify profitable trade opportunities.

How does the speaker use Twitter in his trading process?

-The speaker uses Twitter to communicate his trade ideas and analysis in real-time, offering followers insights into market conditions and potential setups. He also interacts with his followers, sharing live updates and detailed explanations of the trades he anticipates, including the reasoning behind his strategies.

Outlines

此内容仅限付费用户访问。 请升级后访问。

立即升级Mindmap

此内容仅限付费用户访问。 请升级后访问。

立即升级Keywords

此内容仅限付费用户访问。 请升级后访问。

立即升级Highlights

此内容仅限付费用户访问。 请升级后访问。

立即升级Transcripts

此内容仅限付费用户访问。 请升级后访问。

立即升级浏览更多相关视频

The Market Maker Buy Model | Full Trade Breakdown $NQ

CONQUER Rhetorical Analysis Commentary with THIS!

Cara Mengukur Throughput, Packet Loss, Delay dan Jitter (Parameter QoS) Menggunakan Wireshark

UT BOOTCAMP EP 14 : STRATEGI ENTRY DI M1, MODAL 300K KE 5-6 JUTA HANYA 2 MINGGU AJA!!

How to Earn $175/Hour with Grok For FREE (Make Money Online 2025)

How To Create A WINNING Pre Market Day Trading Plan

5.0 / 5 (0 votes)