Economic Growth and Stock Returns | The Informed Investor

Summary

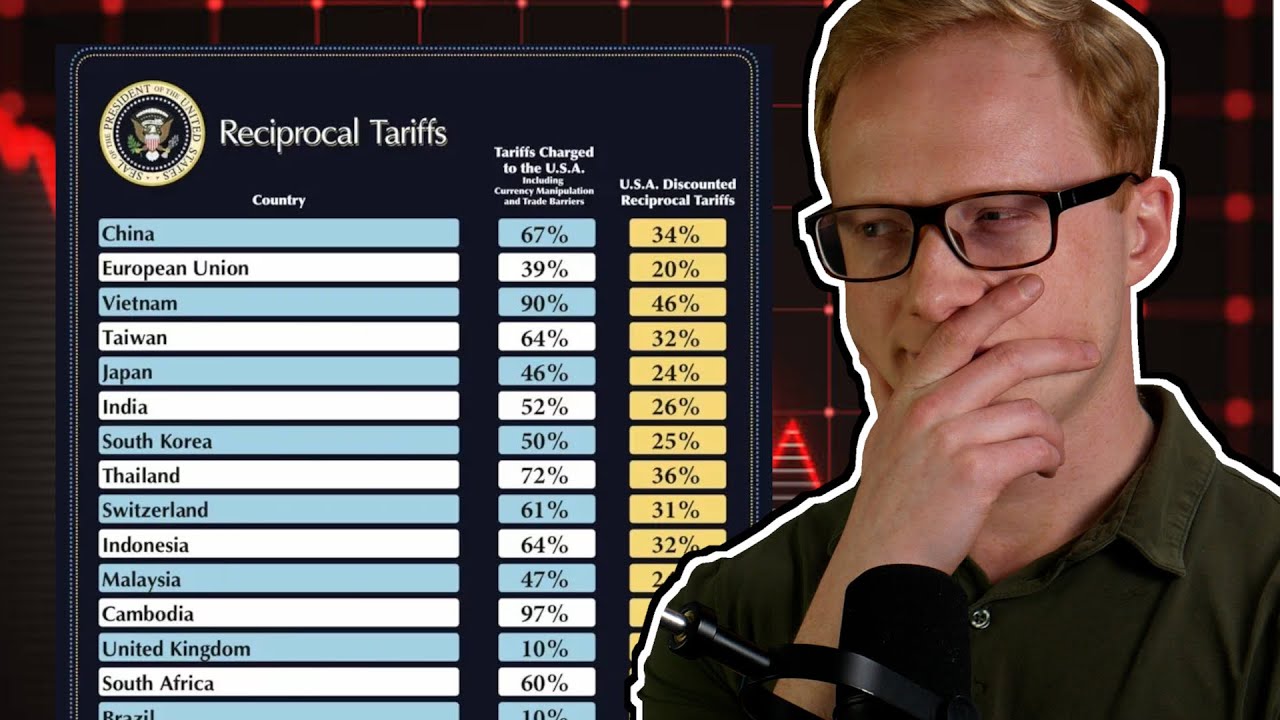

TLDRIn this episode of 'The Informed Investor,' Mark Goer, Wes Krill, and Jake Dinder discuss economic growth and its relationship with GDP, focusing on the impact of tariffs and the volatility they bring to markets. They explore the unpredictable nature of stock market returns, emphasizing that markets react to expectations rather than current economic data. With examples from history, including the 2008 financial crisis and the COVID-19 recession, they highlight how markets often price in information ahead of official announcements. The conversation encourages a disciplined investment approach, emphasizing the forward-looking nature of markets.

Takeaways

- 😀 Economic growth and GDP are influenced by external factors like tariffs, and the market is always forward-looking in reacting to changes in expectations.

- 😀 Stock market returns don't show a strong correlation with GDP growth on a year-to-year basis, but market returns tend to predict future GDP changes.

- 😀 The market's reaction is based on the *expectation* of future growth, rather than current economic circumstances.

- 😀 Past economic downturns, such as the end of World War II, show how multiple factors can drive stock market performance despite economic contractions.

- 😀 The relationship between high GDP growth countries and stock market returns is not as intuitive as many believe, with low GDP growth countries sometimes outperforming high-growth ones.

- 😀 Investors should be cautious of trying to time markets based on economic indicators like GDP growth, as long-term returns across all countries have generally been solid.

- 😀 A key point about investing is understanding that the market prices in expectations, meaning that even during economic struggles, markets may reflect positive future returns.

- 😀 The concept of markets pricing in expectations is especially true during periods of volatility like tariff announcements, where market reactions occur ahead of official data.

- 😀 Recessions may already be priced into the market before they are officially declared, highlighting the market's forward-looking nature and the difficulty of predicting exact timing.

- 😀 Despite recessions and economic contractions, markets often recover quickly, with returns in the years following a recession sometimes matching or exceeding long-term averages.

- 😀 Economic indicators like GDP and unemployment are useful for understanding past conditions, but they may not provide accurate predictions for future market movements, emphasizing the importance of a disciplined investment approach.

Q & A

How do stock market returns relate to GDP growth according to the discussion?

-The stock market doesn't show a strong correlation with GDP growth when considering the contemporaneous relationship between the two. However, a strong relationship emerges when comparing lagged market returns with the following year's GDP growth, suggesting that positive market returns often precede economic expansions.

What is the key point Wes Krill emphasizes about how markets react to economic conditions?

-Wes Krill highlights that markets are forward-looking and react to changes in expectations rather than to the current economic conditions. This is demonstrated by how stock prices often reflect the anticipated outcomes of economic indicators before those outcomes occur.

Can the impact of tariffs on economic growth be clearly predicted?

-While tariffs can affect economic growth, it is difficult to predict their exact impact on a day-to-day basis. The Yale Budget Lab helps update expectations based on changing international conditions, but the broader conversation involves understanding how tariffs interact with other economic factors.

What does Wes Krill mean when he says markets react to 'changes in circumstances' rather than to circumstances themselves?

-Wes Krill explains that markets respond to changes in expectations or new information about the economy. It's not the current state of the economy that drives stock market movements, but rather shifts in anticipated economic outcomes, such as changes in tariffs or policy.

Why is the year 1945 considered an interesting example of market behavior?

-The market in 1945 had a strong return despite the economy contracting the following year. This was due to the end of World War II, which brought positive expectations about peace, even though the economy was transitioning from wartime to peacetime production.

What surprising finding did Jake Dinder share about countries with high vs. low GDP growth?

-Jake Dinder shared that, contrary to what might be expected, countries with low GDP growth tend to outperform those with high GDP growth in terms of market returns over time. Both high and low GDP growth countries generate solid returns, so it’s important to diversify rather than focus solely on GDP growth.

How does market behavior differ from the conventional understanding of recessions?

-While recessions are often identified with a backward-looking approach, markets are forward-looking and typically react to anticipated economic slowdowns before they officially occur. For instance, stock markets can bottom out before the official announcement of a recession and often recover before the recession is declared over.

What role does the National Bureau of Economic Research (NBER) play in identifying recessions?

-The NBER uses historical data to identify recessions, but by the time a recession is officially declared, the market has often already adjusted to the anticipated economic changes. This delay in identifying recessions means that market participants usually react before official data is released.

How does the financial crisis of 2008 illustrate the market’s behavior in relation to recessions?

-During the 2008 financial crisis, the recession officially started in December 2007, but the market had already fallen by 40% before it was announced. The market recovered significantly after the official announcement of the recession’s end, showing that the market anticipates and reacts to economic conditions long before they are officially recognized.

What does the example of April 2020 demonstrate about market expectations and economic data?

-In April 2020, despite unemployment reaching 14.8%, one of the highest rates since the Great Depression, the stock market rose almost 13%. This illustrates how markets anticipate future economic conditions and price in expectations, which can often be more optimistic than the reality of the economic data.

Outlines

此内容仅限付费用户访问。 请升级后访问。

立即升级Mindmap

此内容仅限付费用户访问。 请升级后访问。

立即升级Keywords

此内容仅限付费用户访问。 请升级后访问。

立即升级Highlights

此内容仅限付费用户访问。 请升级后访问。

立即升级Transcripts

此内容仅限付费用户访问。 请升级后访问。

立即升级浏览更多相关视频

2025 Outlook: Europe’s economies brace for more political upheaval

The Crazy Tariff Announcement Crashing Markets

Global Outlook October 2024: looking ahead to 2025

Digebuk Tarif 32% Trump! Ekonomi Indonesia Bisa Jeblok? - [Primetime News]

Stock investing strategy for EVERYONE (which I developed)

RBI Governor Sanjay Malhotra Explains EXACT Impact Of Trump's Tariffs On India's Growth | Repo Rate

5.0 / 5 (0 votes)