RBI Governor Sanjay Malhotra Explains EXACT Impact Of Trump's Tariffs On India's Growth | Repo Rate

Summary

TLDRThe transcript outlines economic challenges and growth projections, focusing on uncertainty's impact on both growth and inflation. It highlights how trade frictions, tariffs, and global volatility may dampen investment and consumer spending, while positive aspects such as a strong agriculture sector, resilient services, and improving investment activity offer potential for growth. The real GDP growth for the year is projected at 6.5%, slightly revised down due to global uncertainties. Despite the risks, including external trade disruptions, the economy shows positive momentum in key sectors, with expectations for stable growth and manageable inflation.

Takeaways

- 😀 Uncertainty negatively impacts growth by affecting investment and spending decisions of both businesses and households.

- 😀 Global growth is being hampered by trade frictions, which will also affect domestic growth.

- 😀 Higher tariffs are expected to reduce net exports, affecting economic performance.

- 😀 The impact of relative tariffs is complex, as tariffs with some countries remain quite low, adding to the uncertainty.

- 😀 The effect of tariffs is influenced by factors like the elasticity of export and import demand and the policies adopted by India.

- 😀 India is actively engaging with the US administration on foreign trade agreements, which could affect growth.

- 😀 The impact of global uncertainties on growth is difficult to quantify due to various unknown factors.

- 😀 Inflation risks are two-sided: uncertainties may cause currency pressures leading to imported inflation, but a slowdown in global growth could soften commodity and crude oil prices.

- 😀 Despite the global trade and policy uncertainties, the risk of inflation is not expected to be a major concern in India.

- 😀 India's real GDP growth is projected to be 6.5% for this fiscal year, with slight fluctuations across quarters (Q1: 6.5%, Q2: 6.7%, Q3: 6.6%, Q4: 6.3%).

- 😀 The growth projection has been revised down by 20 basis points due to global trade disruptions and policy uncertainties, from an earlier forecast of 6.7%.

Q & A

What are the key factors impacting growth as mentioned in the transcript?

-The key factors impacting growth include uncertainty, which dampens investment and spending decisions, global trade frictions, higher tariffs impacting net exports, and the unknown impact of relative tariffs and the elasticities of export and import demand.

How do trade frictions affect domestic growth?

-Trade frictions reduce global growth, which in turn affects domestic growth by hindering trade opportunities and market stability.

What is the significance of tariffs in the context of the script?

-Higher tariffs are expected to negatively impact net exports. However, the impact of relative tariffs is uncertain as some countries' tariffs are relatively low.

What role does uncertainty play in inflation risks?

-Uncertainty can lead to upward pressure on inflation due to potential currency pressures, which may increase imported inflation. However, a slowdown in global growth could put downward pressure on inflation by reducing commodity and crude oil prices.

What is the expected GDP growth for the current fiscal year?

-The real GDP is projected to grow at 6.5% for the fiscal year 2025-2026, which follows a growth rate of 9.2% in the previous year.

What are the prospects for different sectors like agriculture, manufacturing, and services?

-The agriculture sector has bright prospects due to healthy reservoir levels and robust crop production. Manufacturing is showing signs of revival, and the services sector remains resilient with steady demand.

How is domestic consumption expected to perform?

-Rural demand remains healthy due to positive prospects in agriculture, while urban consumption is gradually picking up with an increase in discretionary spending.

What factors are contributing to the positive outlook for investment activity?

-Investment activity is gaining traction due to higher capacity utilization, continued government focus on infrastructure spending, healthy bank and corporate balance sheets, and easing financial conditions.

What impact are global trade uncertainties expected to have on exports?

-Global trade uncertainties are expected to weigh down merchandise exports, although services exports are projected to remain resilient despite these challenges.

What are the updated growth projections for the fiscal year 2025-2026?

-The GDP growth projection for fiscal 2025-2026 has been revised to 6.5%, with quarterly projections of 6.5% for Q1, 6.7% for Q2, 6.6% for Q3, and 6.3% for Q4.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

US Tariffs Destroy India's iPhone Industry? | Modi Trapped! IMF talks with Pakistan | Good News Came

[Kaleidoskop] - Kilas Balik APBN 2024

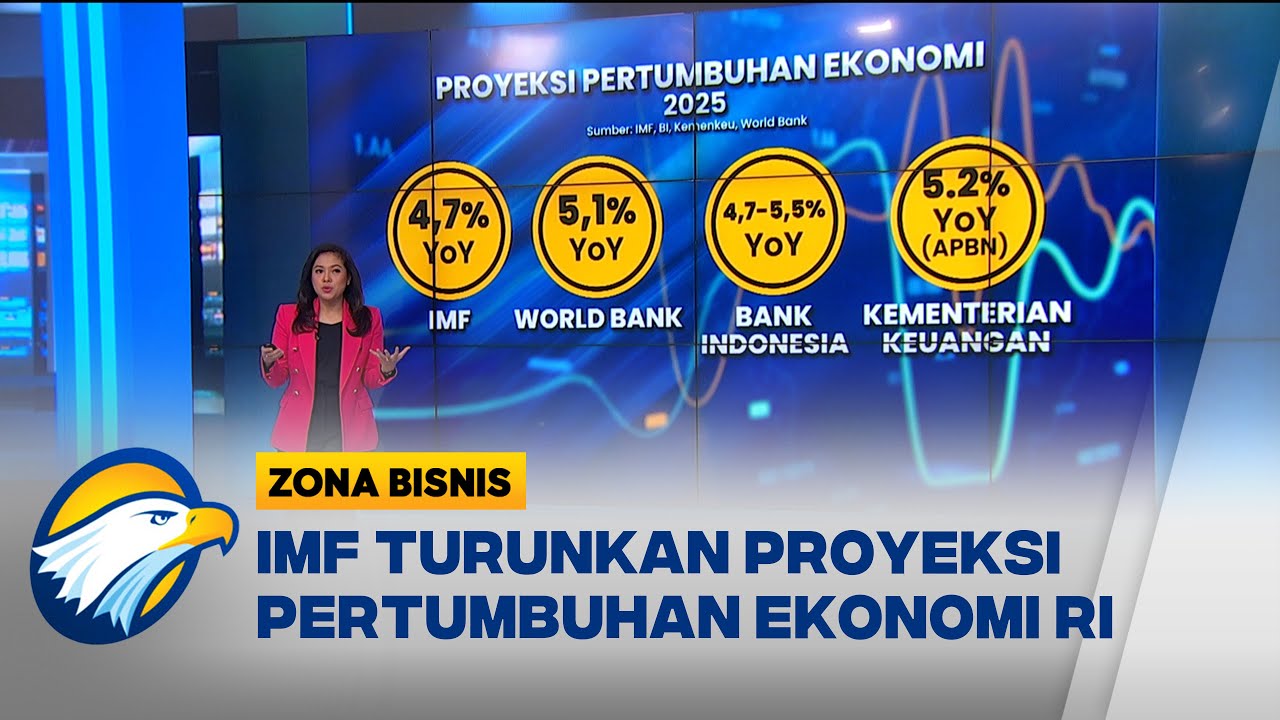

IMF Ramal Ekonomi Indonesia 2025-2026 Bakal Anjlok! [Zona Bisnis]

Belajar Baca Research Report-2 (Analisa Fundamental Saham)

Good News | After Budget Cars, Dollar Price Decrease? | Hafeez Pasha Break Big News | GNN

Mercado eleva estimativa para PIB e inflação em 2024; Alan Ghani, Amanda Klein e Beraldo analisam

5.0 / 5 (0 votes)