COMPLETE Order Blocks Course (so you can trade like banks)

Summary

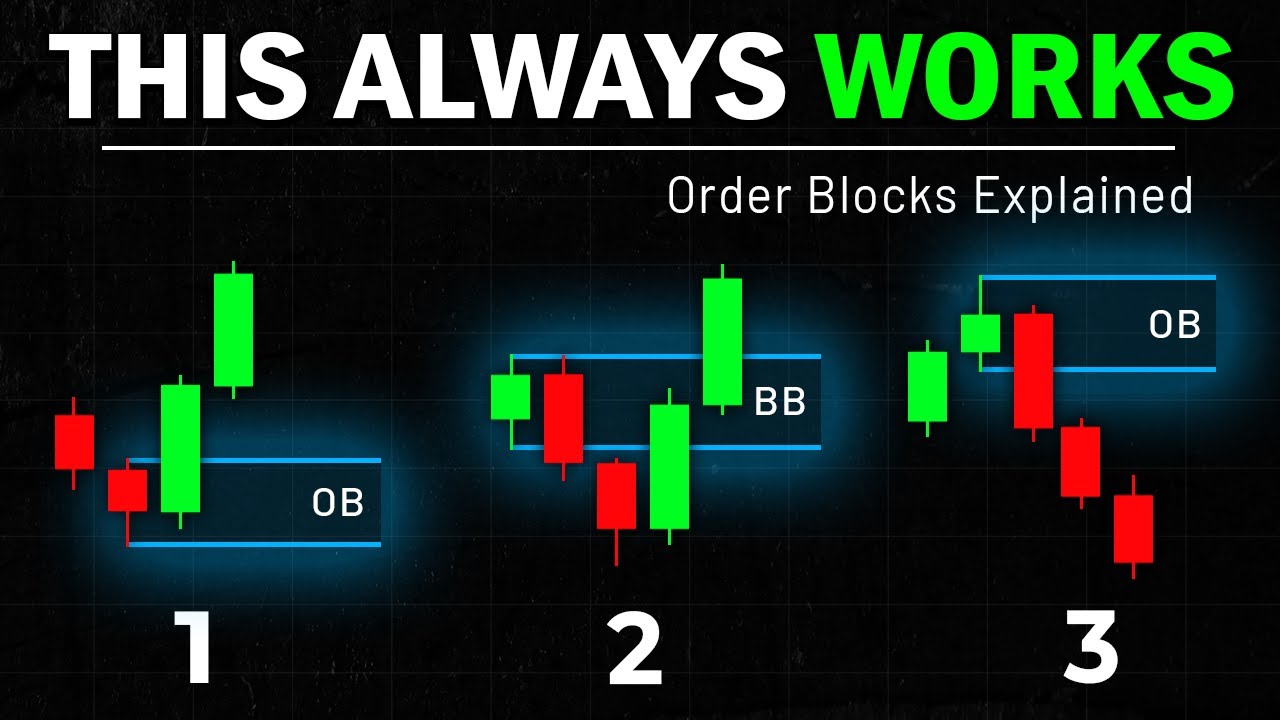

TLDRIn this video, the speaker breaks down advanced trading strategies using order blocks and confirmation entries. They explain how traders can identify key price zones where significant movements might occur, emphasizing the importance of waiting for confirmation before entering trades. The video contrasts 'risk entries' with 'confirmation entries,' with a focus on the latter for more reliable outcomes. The speaker also introduces the concept of combining liquidity concepts with order blocks to predict smart money movements. The advice is geared towards beginners to gradually master risk entries, then confirmation entries for better trading results.

Takeaways

- 😀 Confirmation entries reduce the risk of losing trades by waiting for extra confirmation signals before entering a position.

- 😀 Risk entries, while quicker, can be riskier as they involve entering without waiting for confirmation, which can result in the price blowing past the order block.

- 😀 Advanced traders can use lower timeframes (like the 5-minute chart) to refine their entry points and confirm market shifts.

- 😀 The market shift to a downside is a key confirmation signal for entering a sell position after price has tapped an order block.

- 😀 It's important to wait for a pullback and confirm the market's direction before entering a trade for better risk management.

- 😀 Confirmation entry provides a higher level of precision, potentially leading to more successful trades compared to risk entries.

- 😀 Combining order blocks with liquidity concepts can help traders understand smart money movements and predict where the market might go next.

- 😀 Liquidity concepts allow traders to see where large players (smart money) are entering or exiting, which can provide an edge in making informed decisions.

- 😀 A 1:6 risk-to-reward ratio trade, like the one described using a demand zone, is an example of a more refined, advanced entry strategy.

- 😀 Beginners should focus on mastering risk entries first, then gradually progress to confirmation entries and advanced strategies like liquidity concepts.

- 😀 The speaker's personal experience suggests that confirmation entries are more reliable for long-term success than risk entries, which sometimes result in unnecessary losses.

Q & A

What is the difference between risk entry and confirmation entry in trading?

-Risk entry is when a trader enters a trade based on an order block without waiting for additional confirmation, making it a quicker but riskier approach. Confirmation entry, on the other hand, involves waiting for extra confirmation, such as a pullback or market shift, before entering, which tends to be more reliable and better suited for experienced traders.

How does the speaker suggest managing trades using order blocks?

-The speaker suggests waiting for price to approach an order block, then observing whether it respects the zone. For a more reliable trade, it's important to wait for confirmation on a lower time frame (like the 5-minute chart), which shows a market shift before entering the trade.

What is meant by a 'market shift' and why is it important?

-A market shift refers to a change in the market structure where the price moves decisively in one direction, indicating a potential trend. It's important because it signals that the market has moved from a bullish to a bearish phase, or vice versa, allowing traders to enter trades with more confidence.

How does the speaker feel about using risk entries based on personal experience?

-The speaker mentions that, from personal experience, risk entries can sometimes lead to losses, as the price might bypass the order block entirely. They have found that confirmation entries generally work better because they involve waiting for more reliable signals before entering a trade.

What is the role of liquidity concepts in trading?

-Liquidity concepts help traders understand where smart money is entering the market. By combining liquidity analysis with order blocks, traders can gain deeper insights into market movements, predict price action more accurately, and potentially improve the reliability of their trades.

Why does the speaker suggest waiting for extra confirmation before entering a trade?

-Waiting for extra confirmation helps reduce the risk of entering trades prematurely. This confirmation can take the form of a pullback or market shift, ensuring that the trader enters the market when the conditions are more favorable and the trend is clearer.

What is the risk-reward ratio in the advanced confirmation entry example, and why is it important?

-In the advanced confirmation entry example, the risk-reward ratio is 1:6. This means that for every unit of risk, the potential reward is six times greater. A higher risk-reward ratio is important because it increases the chances of a profitable trade, even if some trades result in losses.

What is the significance of the 'demand zone' in the speaker's strategy?

-The demand zone is a price area where buying pressure is expected to be strong, leading to a potential reversal. In the speaker's advanced strategy, they suggest waiting for price to pull back to the demand zone before entering a trade, which provides a more refined and favorable entry point.

How should beginners approach learning the trading methods discussed in the video?

-Beginners should start with risk entries to get comfortable with entering trades. Once they gain experience, they can begin to focus on confirmation entries, which offer more reliable trade setups. As they progress, they can explore more advanced concepts like liquidity analysis and refine their trading approach.

What does the speaker mean by 'x-ray vision' in the context of combining order blocks and liquidity concepts?

-By combining order blocks with liquidity concepts, traders can gain deeper insights into where smart money is entering and where it is likely to enter in the future. This combination gives traders an edge, allowing them to anticipate market movements with more precision, almost like having 'x-ray vision' into the market.

Outlines

此内容仅限付费用户访问。 请升级后访问。

立即升级Mindmap

此内容仅限付费用户访问。 请升级后访问。

立即升级Keywords

此内容仅限付费用户访问。 请升级后访问。

立即升级Highlights

此内容仅限付费用户访问。 请升级后访问。

立即升级Transcripts

此内容仅限付费用户访问。 请升级后访问。

立即升级浏览更多相关视频

The Ultimate Orderblock Strategy for 2025 (Full Guide)

Order Blocks Explained: 3 Best Strategies Revealed

🔴 1-2-3 ORDER BLOCKS Trading Strategy Banks Don’t Want You To Know About

The ONLY Entry Strategy You Will Ever Need

High Probability Order Blocks Secrets | ICT/SMC Concepts [Full In-Depth Guide]

Stop Guessing ENTERIES – Order Blocks vs FVG Simplified for 2025 | PRICE ACTION

5.0 / 5 (0 votes)