Better English Conversations: Increase Your Economic Vocabulary

Summary

TLDRThis video lesson aims to simplify complex economic terms and make them accessible for everyday conversations. From understanding GDP, inflation, and unemployment rates to exploring economic measures like supply and demand, the video breaks down key concepts to help viewers confidently discuss economic topics. It also covers job-related terms such as wage growth and cost of living, and explains government policies like tariffs and national debt. With practical examples and clear explanations, the video empowers viewers to engage in discussions about the economy in both personal and professional settings.

Takeaways

- 😀 Understanding economic terms like GDP, inflation, and tariffs helps you better navigate daily decisions and professional conversations.

- 😀 GDP (Gross Domestic Product) is a key measure of economic activity, reflecting the total value of goods and services produced by a country in a year.

- 😀 Inflation refers to the rising cost of goods and services over time, which affects everything from groceries to gas prices.

- 😀 The unemployment rate is a vital indicator of economic health, showing the percentage of people who want to work but can't find jobs.

- 😀 Supply and demand explain price changes: high demand and low supply lead to price hikes, while low demand and high supply result in price drops.

- 😀 Economic changes are often described using terms like 'spike' (a sudden rise in prices) and 'dip' (a sudden fall in prices).

- 😀 Recessions are periods when the economy shrinks, leading to reduced spending, job losses, and lower business activity.

- 😀 The boom and bust cycle represents natural economic fluctuations, where growth (boom) is followed by a slowdown (bust).

- 😀 The gig economy refers to a flexible work structure where individuals take on short-term projects for various clients, rather than full-time employment.

- 😀 The central bank manages a country's money system by controlling interest rates, which affect borrowing, saving, and overall economic activity.

- 😀 Tariffs are taxes on imported goods, which can increase the cost for consumers and influence the availability of foreign products in the market.

Q & A

What is GDP, and why is it important in understanding a country's economy?

-GDP, or Gross Domestic Product, is the total value of everything a country produces and sells in one year, including goods and services. It's important because it shows the overall economic activity and growth in a country. A growing GDP indicates a thriving economy, while a shrinking GDP can signal economic problems.

How does inflation affect the prices of goods and services?

-Inflation causes the prices of goods and services to rise over time. This means that the same amount of money will buy fewer items in the future. Inflation impacts daily life by making things like groceries and gas more expensive, and it can also affect savings, as their value diminishes.

What is the unemployment rate, and why is it a key economic indicator?

-The unemployment rate is the percentage of people who want to work but can't find jobs. It's an important indicator because it shows how well the economy is performing in terms of providing job opportunities. A high unemployment rate signals economic struggles, while a low rate indicates a healthy job market.

What does the term 'supply and demand' mean, and how does it influence prices?

-Supply and demand refer to the relationship between how much of a product is available (supply) and how much people want it (demand). When demand is high and supply is low, prices tend to rise. Conversely, when supply is high and demand is low, prices tend to fall. This concept explains why prices fluctuate for items like umbrellas, concert tickets, or houses.

What is a recession, and what are its effects on the economy?

-A recession is a period when the economy contracts, typically marked by decreased consumer spending, lower business activity, and rising unemployment. During a recession, businesses may close or reduce operations, and job opportunities become scarce. People generally spend less, and housing prices may drop.

What does it mean when the economy goes through a boom and bust cycle?

-The boom and bust cycle describes the natural fluctuations in the economy. A 'boom' is a period of growth, where businesses thrive, and spending is high, similar to spring. A 'bust' is a slowdown, where economic activity declines, businesses struggle, and unemployment rises, akin to winter. These cycles are normal and expected in economic life.

What is wage growth, and how does it relate to inflation?

-Wage growth refers to the increase in pay over time. For example, if someone's monthly salary increases from $2,000 to $2,100, that's a 5% wage growth. Wage growth is closely tied to inflation because it measures whether workers' salaries are keeping pace with rising prices. If wages don't increase at the same rate as inflation, people's purchasing power decreases.

What is the gig economy, and how does it differ from traditional employment?

-The gig economy refers to a labor market where people work for various clients on short-term, flexible projects, rather than holding full-time, permanent jobs. Examples include freelance work, ride-share driving, and project consulting. The gig economy offers flexibility but often lacks the benefits and stability of traditional employment.

How do tariffs affect the price of imported goods?

-Tariffs are taxes imposed on imported goods, increasing their cost when sold in the domestic market. For example, if a $300 phone is imported with a 10% tariff, the price increases by $30, making the phone cost $330. While tariffs are paid by businesses, the cost is usually passed on to consumers, raising prices on imported products.

What is the role of a central bank in an economy?

-The central bank manages a country's money supply and sets key interest rates to control economic stability. By adjusting interest rates, the central bank influences borrowing and savings. For example, raising interest rates makes borrowing more expensive, while lowering them encourages borrowing and spending. The central bank plays a crucial role in regulating inflation and ensuring economic stability.

Outlines

此内容仅限付费用户访问。 请升级后访问。

立即升级Mindmap

此内容仅限付费用户访问。 请升级后访问。

立即升级Keywords

此内容仅限付费用户访问。 请升级后访问。

立即升级Highlights

此内容仅限付费用户访问。 请升级后访问。

立即升级Transcripts

此内容仅限付费用户访问。 请升级后访问。

立即升级浏览更多相关视频

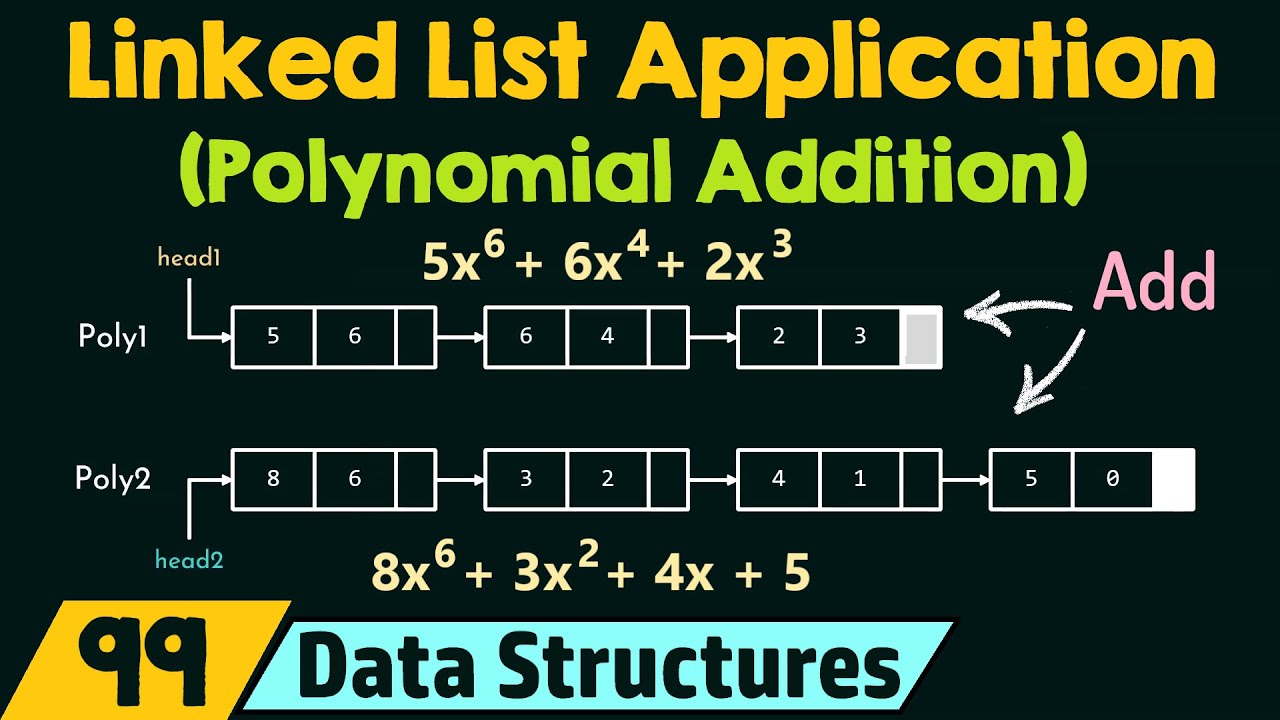

Application of Linked List (Addition of Two Polynomials)

Medical Terminology - The Basics - Lesson 1

Kegiatan-Kegiatan Ekonomi Part 1 (Produksi) || Ekonomi Kelas X

Apa bedanya kata Isyriin عشرين dan Isyruun عشرون dalam Bahasa Arab?

Learn English | Expressions to use at the bank

Video Sumber Belajar Bahasa Arab Materi Profesi (Al-Mihnah) Kelas 4 MI | Nafisatul Aliya

5.0 / 5 (0 votes)