Orderblocks Simplified - ICT Concepts

Summary

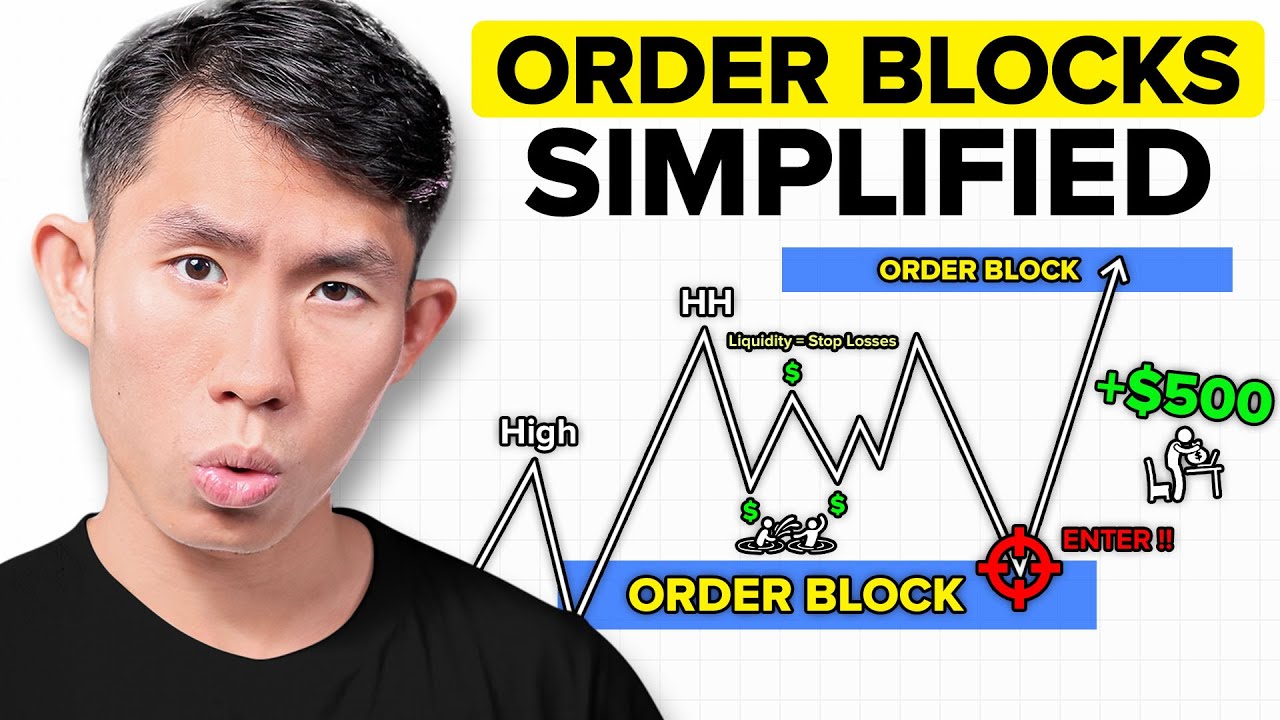

TLDRThis video covers how to identify and use order blocks in trading, explaining the process step-by-step. The presenter outlines key concepts, including recognizing bullish and bearish order blocks, identifying high and low probability order blocks, and understanding their significance. The video also demonstrates practical examples on price charts, such as liquidity sweeps, structural breaks, and how to use the opening price or the wick of candles for entries. Additionally, the concept of mean thresholds is discussed to optimize stop loss placement, helping traders reduce risk while maintaining effective entry points.

Takeaways

- 😀 Identifying a bearish order block starts with a sweep of a high, followed by a break in structure down, and the appearance of a down-close candle.

- 😀 Bullish order blocks are identified after a sweep of sell-side liquidity, followed by a break in structure up, with an up-close candle being a key marker.

- 😀 The most reliable order blocks feature large candle bodies and small wicks, where the opening price is the preferred point of interest.

- 😀 For low-probability order blocks, the wick or the wick-to-open method should be used for entries, especially when in a confirmed trend.

- 😀 A valid bearish order block requires the price to have broken structure down, with the order block being the last up-close candle before the move down.

- 😀 For a bullish order block, it’s important to check the liquidity sweep and break structure before identifying a down-close candle as the order block.

- 😀 In trending markets, down-close candles can signal potential order blocks, where price is expected to be supported before continuing in the trend.

- 😀 The 'mean threshold' of an order block is defined as the 8.5 Fibonacci retracement from the body high to the body low, offering a smaller stop size and better risk management.

- 😀 The opening price of an order block is preferred for entries in higher-probability scenarios, while the wick-to-open method works better in lower-probability conditions.

- 😀 Testing different methods like using the open, wick, or mean threshold can help traders find their ideal entry strategy for different order blocks.

Q & A

What is the primary focus of this video?

-The video primarily focuses on explaining how to identify and use order blocks in trading, providing insights on both bullish and bearish order blocks, their structures, and how to enter trades using them.

What is an order block, and how is it identified?

-An order block is a price zone where significant buying or selling occurred, leading to a strong market move. It is identified by a sweep of liquidity (either high or low), followed by a breaker structure. For bearish order blocks, the identification begins with a sweep of a high, followed by a downward structure break, while for bullish order blocks, it involves a sweep of a low and then a break upwards.

What is a 'liquidity sweep,' and why is it important?

-A liquidity sweep refers to the market moving to collect stop-loss orders, often by breaking recent highs or lows. It's important because it signals a potential reversal or continuation in price action, which is crucial for identifying valid order blocks.

What does 'breaking structure' mean in this context?

-Breaking structure refers to the market moving past a significant level or point, indicating a shift in the prevailing trend. For a bullish order block, it means breaking a previous high, and for a bearish order block, it means breaking a previous low.

How do you determine the entry point when using order blocks?

-The entry point is typically the open price of the identified order block candle or series of candles. Alternatively, traders can use the wick or mean threshold (Fibonacci level) of the order block to enter, depending on the specific characteristics of the order block.

What are 'high probability' and 'low probability' order blocks?

-High probability order blocks are characterized by large candle bodies and small wicks, indicating a strong and decisive price move. Low probability order blocks are often marked by small candles or isolated single candles in the middle of a trend, which are less reliable for trade entries.

When should you use high probability order blocks versus low probability ones?

-High probability order blocks should be used when there is a clear and strong market move with large candles, while low probability order blocks are useful in trending markets or when there are few options, often acting as a last-resort entry point.

How does timeframe affect the selection of order blocks?

-Timeframes play a role in determining the significance of an order block. A series of small candles on a lower timeframe may become a larger, more significant candle on a higher timeframe, and traders often adjust their order block analysis based on the timeframe they are trading.

What is the mean threshold of an order block, and why is it beneficial?

-The mean threshold of an order block is the area between the body high and body low of the order block candle, calculated at the 8.5% Fibonacci level. It is beneficial because it reduces the stop-loss size compared to using the open of the order block, offering a better risk-to-reward ratio.

How can you use multiple order blocks in a trending market?

-In a trending market, multiple order blocks can be used by identifying each support or resistance level where price retraces to before continuing in the direction of the trend. Traders often look for consecutive order blocks as price moves toward a higher or lower timeframe objective.

Outlines

此内容仅限付费用户访问。 请升级后访问。

立即升级Mindmap

此内容仅限付费用户访问。 请升级后访问。

立即升级Keywords

此内容仅限付费用户访问。 请升级后访问。

立即升级Highlights

此内容仅限付费用户访问。 请升级后访问。

立即升级Transcripts

此内容仅限付费用户访问。 请升级后访问。

立即升级浏览更多相关视频

Master Order Blocks to Trade like Banks (no bs guide)

How to Identify and Trade Order Blocks

The Ultimate Order Block Trading Strategy (FULL Masterclass) | SMC

Perfecting LTF Orderblock Entries With CRT - Candle Range Theory - ICT Concepts

Market Maker Models Explained | Step By Step Approach | ICT Concepts

This Order Block Strategy Changed My Trading (Full Guide)

5.0 / 5 (0 votes)