Order Block Trading Strategy | Smart Money Concept | Brain Titans

Summary

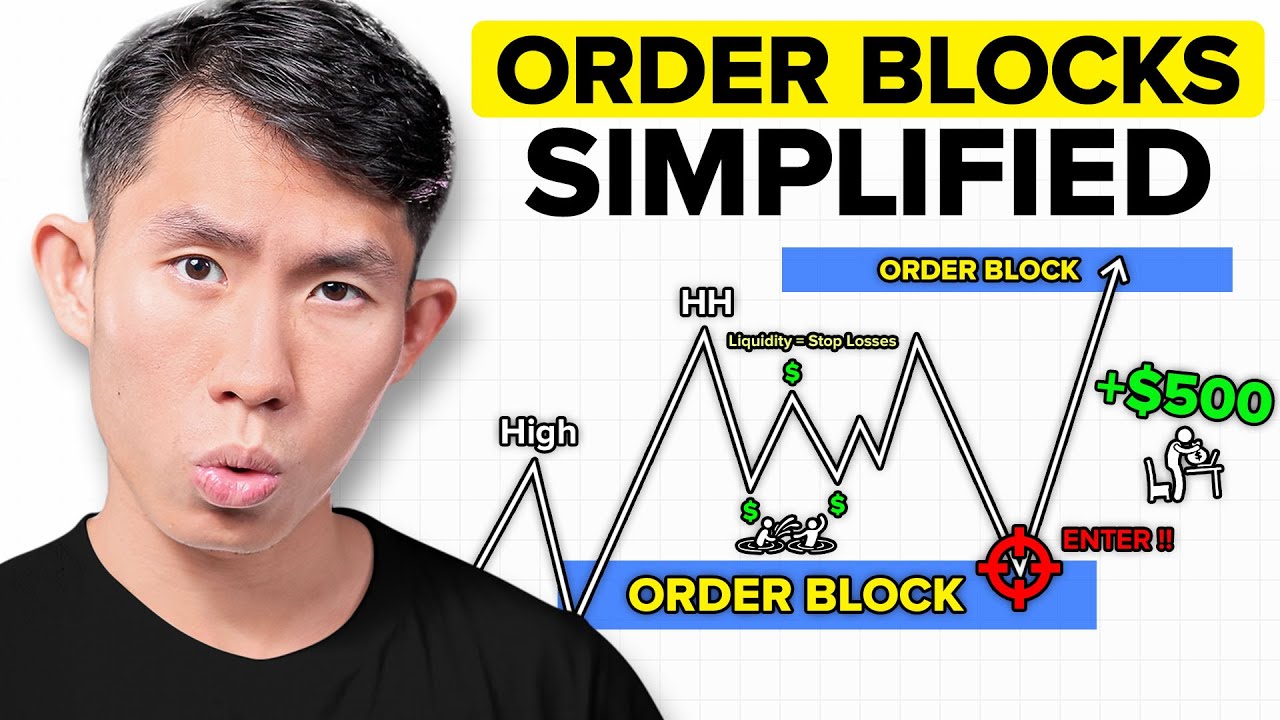

TLDRIn this video on the Smart Money Concept, viewers learn how to identify valid order blocks on a 5-minute Nifty chart. The concept explains the need for institutional buyers to avoid placing large market orders all at once, instead using order blocks to execute their trades in specific zones. The video covers key rules for recognizing valid order blocks, including liquidity sweeps, price imbalances, and structure breaks. It also provides step-by-step instructions for marking these zones and planning trade entries. Additionally, it emphasizes the importance of understanding the broader market context and using stop losses for risk management.

Takeaways

- 😀 Understanding order blocks is crucial for identifying institutional trading zones where large buyers and sellers execute their orders.

- 😀 Order blocks are demand and supply zones formed when large institutional traders place orders in a market, aiming to prevent price disruption.

- 😀 Simply marking the last candle before a strong move is an incorrect way to identify an order block; context and rules must be applied.

- 😀 Liquidity sweep, where a candle breaks the low or high of its previous candle, is the first rule to recognize a valid order block.

- 😀 Price imbalance or inefficiency between consecutive candles creates a fair value gap (AVG), which is essential for marking a valid order block.

- 😀 An order block remains valid only if it has not been tapped by the market, meaning it must remain unmissed to be effective in future price movements.

- 😀 A valid break of structure (BOS) in price—where a higher high or lower low is formed—helps confirm the validity of an order block.

- 😀 Trade entries in order blocks can be made at three levels: top, midpoint, or bottom, each offering different risk and reward setups.

- 😀 Stop losses are essential in every trade to protect capital, as even valid order blocks may fail if the market moves against the position.

- 😀 The Smart Money Concept suggests that understanding inducements (fake breakouts) is key for anticipating market reversals after large movements.

- 😀 The larger the time frame in which order blocks are identified, the higher the probability of successful trades, but even smaller time frames can work when used correctly.

Q & A

What is the Smart Money Concept, and how is it related to order blocks?

-The Smart Money Concept refers to the actions and strategies employed by large institutional traders or investors in the market. It focuses on understanding where these institutions are entering and exiting trades, typically through the identification of order blocks, which are areas where significant buying or selling actions take place.

How does a big institutional buyer place their orders in the market?

-A large institutional buyer cannot place all their orders at once due to the sheer quantity of their orders. Instead, they place their orders in a specific zone or block. This allows them to execute orders gradually without causing sudden price movements that could increase the cost of their trades.

What is an order block in the Smart Money Concept?

-An order block is a demand or supply zone where large institutions execute their buy or sell orders. These zones are marked by strong price moves that show a reversal after big buying or selling activities. They represent areas where price may return to for unfilled orders to be completed.

What are the common mistakes retail traders make when identifying order blocks?

-Retail traders often identify order blocks incorrectly by marking them based on the first bullish or bearish candle without understanding the rules and conditions for a valid order block. This can lead to false signals and trading losses.

What is Rule 1 for identifying a valid order block?

-Rule 1 involves the concept of a 'last candle liquidity sweep.' For a valid order block, the last bearish candle must break the low of its previous candle, sweeping liquidity below it. In a bullish market structure, the last bullish candle must break the high of the previous bearish candle.

What is meant by 'inefficiency' or 'imbalance' in the context of order blocks?

-Inefficiency or imbalance refers to a price gap between two consecutive candles that indicates an area where price has moved too quickly and left orders unfilled. This gap can be seen as a fair value gap (AVG) and is a sign that the market may return to this area to fill those orders.

What is the significance of 'unmissed' order blocks?

-An 'unmissed' order block remains valid as long as it is not touched or 'mitigated' by the market. If the price taps into the order block zone and completes all pending orders, the block becomes invalid and cannot be used again for future trades.

What is the role of 'inducement' in identifying valid order blocks?

-Inducement refers to a fake breakout or a price move that traps retail traders into entering trades in the wrong direction. This often occurs near significant support or resistance levels. For an order block to be valid, it should be accompanied by inducement, which ensures that the market is trapping traders before moving in the intended direction.

What are the different types of trade entries at an order block?

-There are three main types of trade entries at an order block: 1) Entry at the top area, where a limit buy order is placed at the start of the order block, 2) Entry at the 50% area, where orders are placed around the midpoint of the block, and 3) Entry at the bottom area, where orders are placed near the lower end of the order block, often with a wider stop loss.

How does the time frame impact the accuracy of order block trading?

-The accuracy of order blocks increases with the time frame. Larger time frames tend to have more reliable order blocks as they represent longer periods of market behavior, whereas smaller time frames may result in more false signals or noise in the market.

Outlines

此内容仅限付费用户访问。 请升级后访问。

立即升级Mindmap

此内容仅限付费用户访问。 请升级后访问。

立即升级Keywords

此内容仅限付费用户访问。 请升级后访问。

立即升级Highlights

此内容仅限付费用户访问。 请升级后访问。

立即升级Transcripts

此内容仅限付费用户访问。 请升级后访问。

立即升级5.0 / 5 (0 votes)