Financial Analysis: A Guided Tour through the Income Statement

Summary

TLDRThis video provides an insightful breakdown of a typical income statement, focusing on major components such as net operating revenue, cost of goods sold, and operating income. It explains the structure of an income statement, highlighting the different layers, from revenue to net income, and the economic processes behind them. The video also discusses the relationship between the income statement and the balance sheet, including how profits and losses are managed—whether through dividends, retained earnings, or adjustments to equity. The goal is to provide a clear understanding of financial reporting and its impact on large companies.

Takeaways

- 😀 An income statement summarizes a company's revenues, costs, and profits or losses for a given financial period, such as a year.

- 😀 The income statement is presented in layers, each representing a different stage of financial calculation, from sales to net income.

- 😀 The first layer of the income statement shows net operating revenue (sales), followed by the cost of goods sold (COGS), leading to the gross profit.

- 😀 Gross profit is calculated as Net Operating Revenue minus COGS, giving insight into the basic profitability of the company's core operations.

- 😀 Non-attributable costs, like selling, general, and administrative expenses (SG&A) and R&D, are deducted in the second layer of the income statement.

- 😀 Operating income (EBIT) is the result after deducting non-attributable costs, representing the earnings before interest and taxes from the core business.

- 😀 The financial layer includes interest expenses and income, which relate to the company's financing activities, such as loans or investments.

- 😀 The income before income taxes result is calculated after the financial layer, serving as the taxable income for corporate income tax purposes.

- 😀 The final layer of the income statement accounts for corporate income taxes, leading to the bottom line: net income.

- 😀 Companies can decide what to do with their net income, such as distributing dividends to shareholders or reinvesting it as retained earnings.

- 😀 Losses must be deducted from equity because shareholders are not required to contribute additional funds to cover losses, unlike with profits.

Q & A

What is the purpose of an income statement?

-The income statement summarizes a company's revenues, expenses, and profits over a specific period, typically a financial year. It provides insights into the company's financial performance.

What is the significance of the 'net operating revenue' in an income statement?

-Net operating revenue, or sales, represents the total income generated by a company from its core operations, excluding other sources like investment income. It is a critical measure of a company's ability to generate revenue.

Why is the income statement considered a sub-account of equity in accounting?

-In accounting, the income statement is also known as the Profit and Loss (P&L) account, and it is considered a sub-account of equity because the company's profits or losses impact the equity section of the balance sheet.

What are the three options for handling profit or loss in the income statement?

-The three options are: 1) Distribute the profit as a dividend to shareholders, reducing cash; 2) Retain earnings, transferring the profit to reinvested earnings; 3) Deduct a loss from equity, as no shareholders will cover the loss.

What is the structure of a typical income statement?

-A typical income statement consists of several layers, starting with attributable items like net operating revenue and cost of goods sold. It then includes non-attributable costs, operating income, financial expenses, and income taxes, ending with the net income.

What is the difference between attributable and non-attributable costs?

-Attributable costs are directly linked to a specific product, like the materials or labor used to produce it. Non-attributable costs, such as selling expenses or R&D, cannot be directly linked to individual products and are considered more general expenses.

What does 'gross profit' represent on an income statement?

-Gross profit is the difference between net operating revenue and the cost of goods sold. It represents the basic profitability of a company’s core operations, excluding indirect costs like administrative and marketing expenses.

What is the purpose of the 'financial layer' in an income statement?

-The financial layer shows the company’s financial income and expenses, including interest income, interest expenses, and any equity income from investments. It represents the costs and earnings associated with financing and investment activities.

Why is the operating income (EBIT) important in the context of the income statement?

-Operating income, or EBIT (Earnings Before Interest and Taxes), reflects the profitability of a company’s core operations before any financial or tax impacts. It gives a clear picture of a company's operational efficiency.

How do taxes affect the net income reported in an income statement?

-Income taxes are calculated based on the 'income before taxes' result. After applying the corporate tax rate, the remaining amount is the net income, which is the final profit or loss reported to shareholders.

Outlines

此内容仅限付费用户访问。 请升级后访问。

立即升级Mindmap

此内容仅限付费用户访问。 请升级后访问。

立即升级Keywords

此内容仅限付费用户访问。 请升级后访问。

立即升级Highlights

此内容仅限付费用户访问。 请升级后访问。

立即升级Transcripts

此内容仅限付费用户访问。 请升级后访问。

立即升级浏览更多相关视频

Cara Baca Laporan Laba Rugi Emiten | feat. Brenda Andrina

Gross and operating profit | Stocks and bonds | Finance & Capital Markets | Khan Academy

Cara HITUNG LABA BERSIH (Profit Bisnis) untuk Usaha Kecil

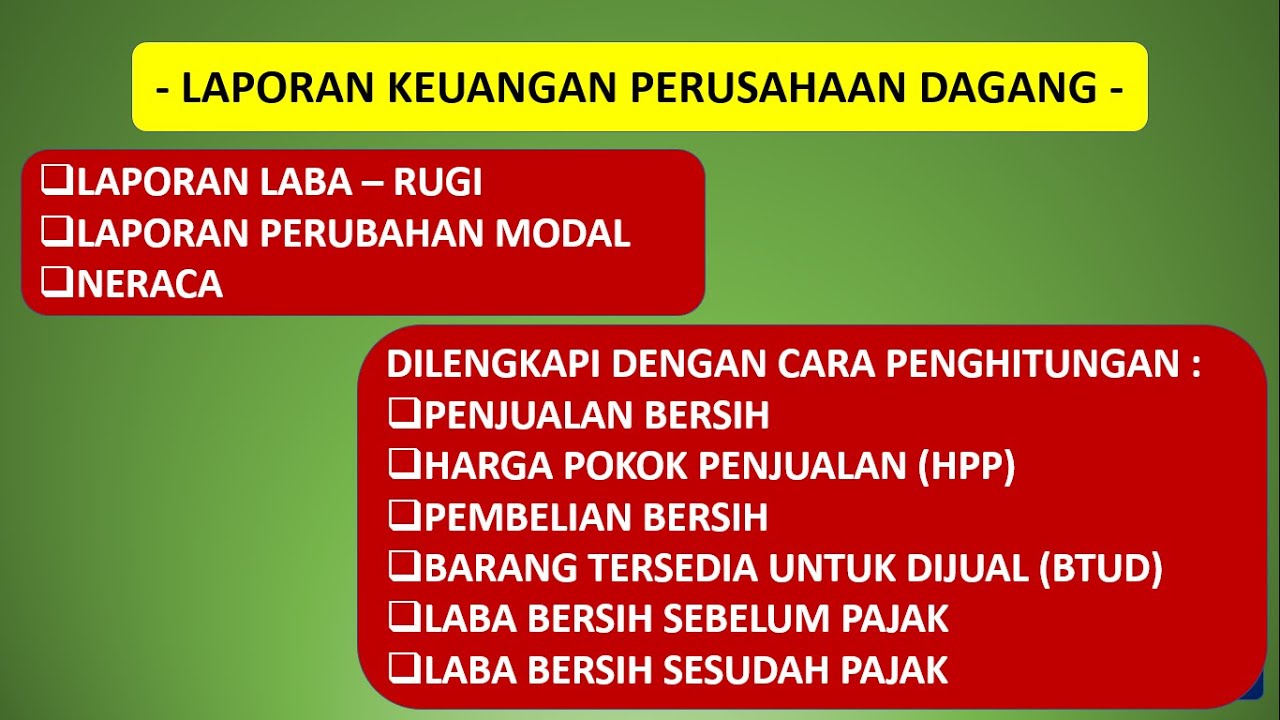

LAPORAN LABA RUGI PADA PERUSAHAAN DAGANG

LAPORAN KEUANGAN PERUSAHAAN DAGANG

FA 50 - Horizontal Analysis

5.0 / 5 (0 votes)