Payroll taxes: Here's a breakdown of what gets taken out of your pay and what you are taxed on

Summary

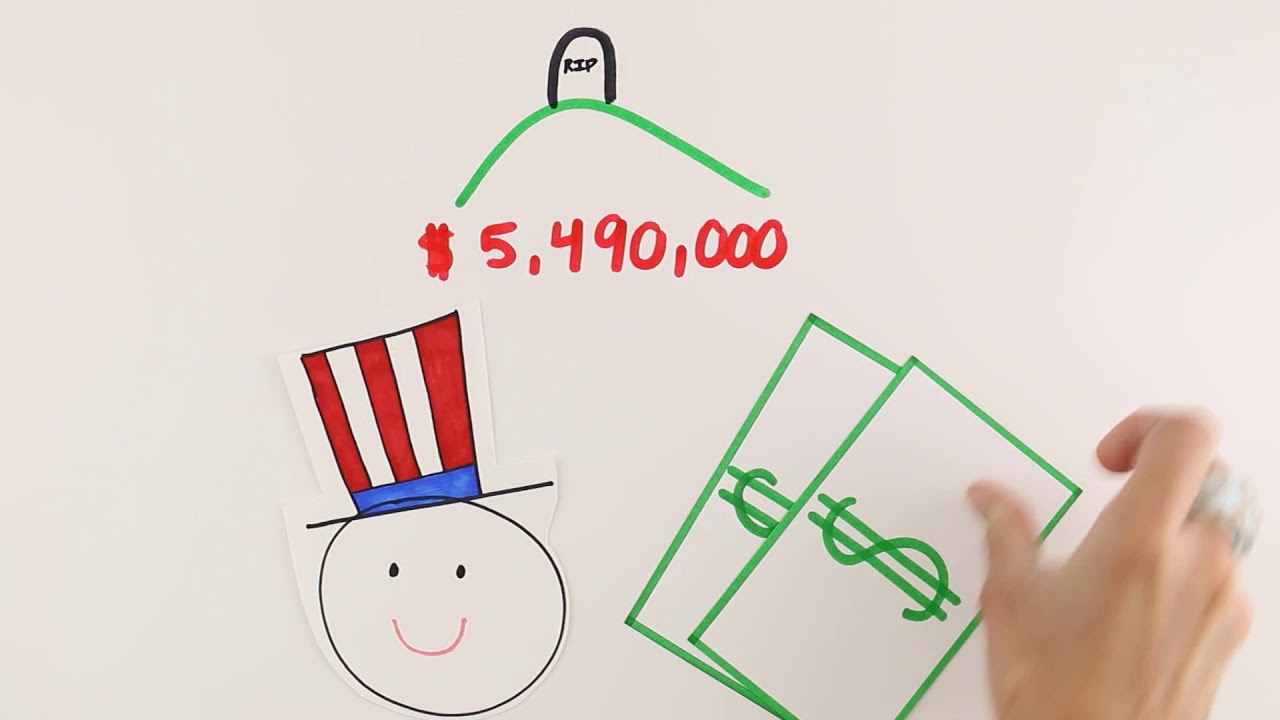

TLDRThis video explains the various payroll taxes that are automatically deducted from your paycheck, including federal, state, and local income taxes, unemployment taxes, and Social Security and Medicare contributions. It details how these taxes fund programs like healthcare, infrastructure, and disaster relief. The video also highlights the tax filing status' impact on federal tax rates and how different states and localities determine tax rates. Additionally, it emphasizes the importance of ensuring proper tax withholding to avoid personal liability for underpayment, including taxes on bonuses and benefits.

Takeaways

- 😀 Payroll taxes include federal, state, and local income taxes, as well as federal and state unemployment taxes, and Medicare and Social Security taxes.

- 😀 Both employers and employees pay payroll taxes, which are automatically deducted from every paycheck at a fixed rate for federal income taxes.

- 😀 Federal income tax rates are based on your tax filing status and the number of withholding allowances you choose.

- 😀 State and local taxes may either be a flat rate or based on income, and they apply to the compensation income earned where you work, not where you live.

- 😀 The most favorable tax filing status is 'married filing jointly' or 'qualifying widow or widower.'

- 😀 Employers use IRS-provided tax tables to determine the federal income tax deductions from an employee's paycheck.

- 😀 If insufficient payroll taxes are withheld from your paycheck, the IRS can hold you personally liable for the shortfall.

- 😀 Bonuses, non-cash gifts, and benefits such as life insurance are also subject to federal income tax.

- 😀 Payroll taxes fund various government programs, including road construction, emergency disaster relief, safety, healthcare, and environmental regulations.

- 😀 You must pay taxes based on the location where you work, not where you live, if your state or locality has an income tax.

Q & A

What are payroll taxes?

-Payroll taxes are taxes automatically deducted from an employee's paycheck to fund various government programs such as Social Security, Medicare, unemployment benefits, and income taxes at federal, state, and local levels.

What types of taxes are included under payroll taxes?

-Payroll taxes include federal, state, and local income taxes, federal and state unemployment taxes, and Medicare and Social Security taxes.

Who is responsible for paying payroll taxes?

-Both employers and employees are responsible for paying payroll taxes, with the taxes being automatically withheld from an employee's paycheck.

How are federal income taxes calculated?

-Federal income taxes are based on a flat rate that depends on your tax filing status and the number of withholding allowances you designate when filling out the federal tax withholding form.

What is the most favorable tax filing status for payroll taxes?

-The most favorable tax filing status is 'married filing jointly' or 'qualifying widow or widower' as these statuses typically provide the lowest tax rates.

How do states and local governments determine income taxes?

-States that levy an income tax may set a flat rate or establish rates based on the income earned. Local governments that levy income taxes generally tax compensation income based on where you work, not where you live.

What happens if an employer fails to withhold enough payroll taxes from an employee’s paycheck?

-If an employer fails to withhold sufficient payroll taxes, the IRS can hold the employee personally liable for the shortfall, meaning the employee would have to pay the missing amount.

Are bonuses subject to payroll taxes?

-Yes, bonuses, along with non-cash gifts and benefits such as life insurance, are subject to federal income tax and must be included in the payroll tax calculations.

What types of government programs are funded by payroll taxes?

-Payroll taxes help fund a wide range of government programs, including road construction, emergency disaster relief, safety programs, healthcare, and environmental regulations.

How are state and local income taxes different from federal taxes?

-State and local income taxes are determined by the state or locality where you work, and can vary by region, while federal taxes are set by the IRS and apply nationwide based on your income and filing status.

Outlines

此内容仅限付费用户访问。 请升级后访问。

立即升级Mindmap

此内容仅限付费用户访问。 请升级后访问。

立即升级Keywords

此内容仅限付费用户访问。 请升级后访问。

立即升级Highlights

此内容仅限付费用户访问。 请升级后访问。

立即升级Transcripts

此内容仅限付费用户访问。 请升级后访问。

立即升级5.0 / 5 (0 votes)