The Three Basic Tax Types

Summary

TLDRThis script introduces the three fundamental types of taxes: sales, income, and property. It explains how sales taxes are paid by consumers for goods and services, supporting state and local services; income taxes, deducted from paychecks, fund federal and state governments; and property taxes, levied on assets like homes and vehicles, finance local amenities and services. Understanding these tax categories is crucial for making informed decisions about jobs, living locations, and voting.

Takeaways

- 🏷️ The price tag on an item may not reflect the final price due to taxes.

- 💰 Taxes influence our lives beyond just increasing the cost of purchases.

- 📚 Understanding taxes is crucial for making informed financial decisions.

- 📊 Taxes can be categorized into three main types: consumption, income, and property taxes.

- 🛒 Sales taxes are paid by consumers at the point of purchase for goods and services.

- 🏫 Sales tax revenue is used to fund state and local services such as education, transportation, and health care.

- 💼 Individual income tax is levied on various sources of earned income and is a significant source of revenue for federal and state governments.

- 🏠 Property taxes are levied on assets you own, such as homes, land, or vehicles, and are used to fund local services and amenities.

- 💹 Taxes affect how much of your income you can keep, save, or spend.

- 🔍 Knowing the different types of taxes can help in making decisions about jobs, living locations, and voting choices.

- 📚 For more information on tax types, visit taxfoundation.org's educational resources.

Q & A

What is the initial lesson about money that children often learn?

-The initial lesson about money for children is that the price on the tag may not be the same as the price on the receipt due to the inclusion of taxes.

Why are taxes important beyond the cost of goods?

-Taxes are important because they have a significant impact on our lives, providing revenue for essential services like education, transportation, and healthcare.

How many basic types of taxes are mentioned in the script?

-The script mentions three basic types of taxes: taxes on what you buy, taxes on what you earn, and taxes on what you own.

What is the role of sales taxes?

-Sales taxes are paid by the consumer when buying most goods and services, providing state and local revenue for funding services.

How are individual income taxes collected?

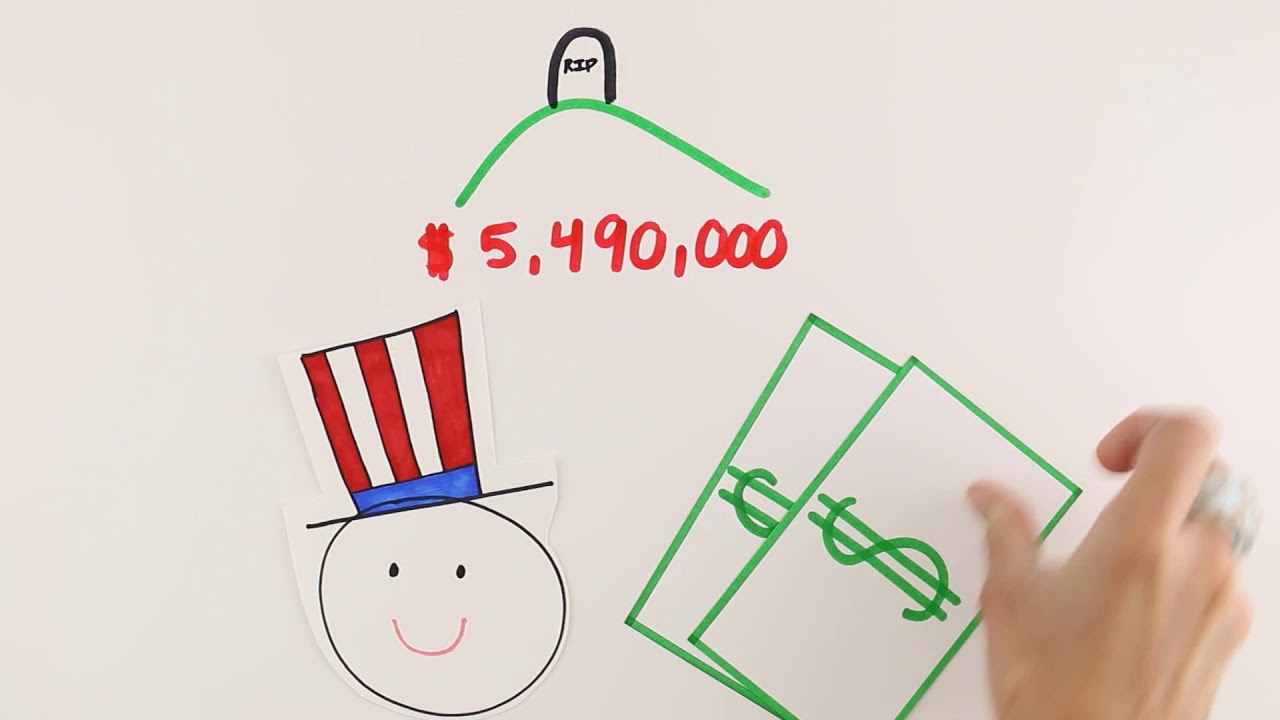

-Individual income taxes are collected on various sources of income and are often taken directly from paychecks, serving as a major source of revenue for federal and state governments.

What are property taxes, and what do they fund?

-Property taxes are levied on what you own, such as homes, land, or vehicles. They generate local revenue and fund services like parks, public safety, and additional school funding.

How do taxes affect an individual's income?

-Taxes affect an individual's income by reducing the amount they get to keep, save, and spend after deductions.

Why is understanding different tax types important for decision-making?

-Understanding different tax types is important for making informed decisions about jobs, living locations, and voting, as they can influence personal finances and public services.

What is the main source of revenue for federal and state governments according to the script?

-The main source of revenue for federal and state governments is the individual income tax.

What can be done to learn more about the three basic tax types?

-To learn more about the three basic tax types, one can visit taxfoundation.org and explore the tax education section.

How do taxes influence the price of goods and services?

-Taxes influence the price of goods and services by adding to the cost, which is then paid by the consumer at the point of purchase.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Perpajakan (Part 3) | Ekonomi Kelas 11 | EDURAYA MENGAJAR

Types of Taxes in the United States

Should we tax the rich more?

RANGKUMAN JENIS-JENIS PAJAK

Thailand's Real Estate Market Softening. Good Time to Buy?

Reforma Tributária. IVA. IVA Dual. O que muda. Principais aspectos. Imposto seletivo. CBS. IBS.

5.0 / 5 (0 votes)