Why LOOKING POOR Is Important

Summary

TLDRThis video shares a personal story of a friend's financial downfall, highlighting the impact of overspending on wants versus needs. The narrator emphasizes the importance of prioritizing practical purchases, such as a reliable scooter or laptop, and maintaining financial discipline. Key advice includes saving before spending, investing in insurance, and having a long-term vision for financial freedom. The video stresses the value of making small trade-offs now to achieve future goals like work-life balance and a less stressful corporate career.

Takeaways

- 😀 The desire to show off material possessions can lead to unnecessary financial strain.

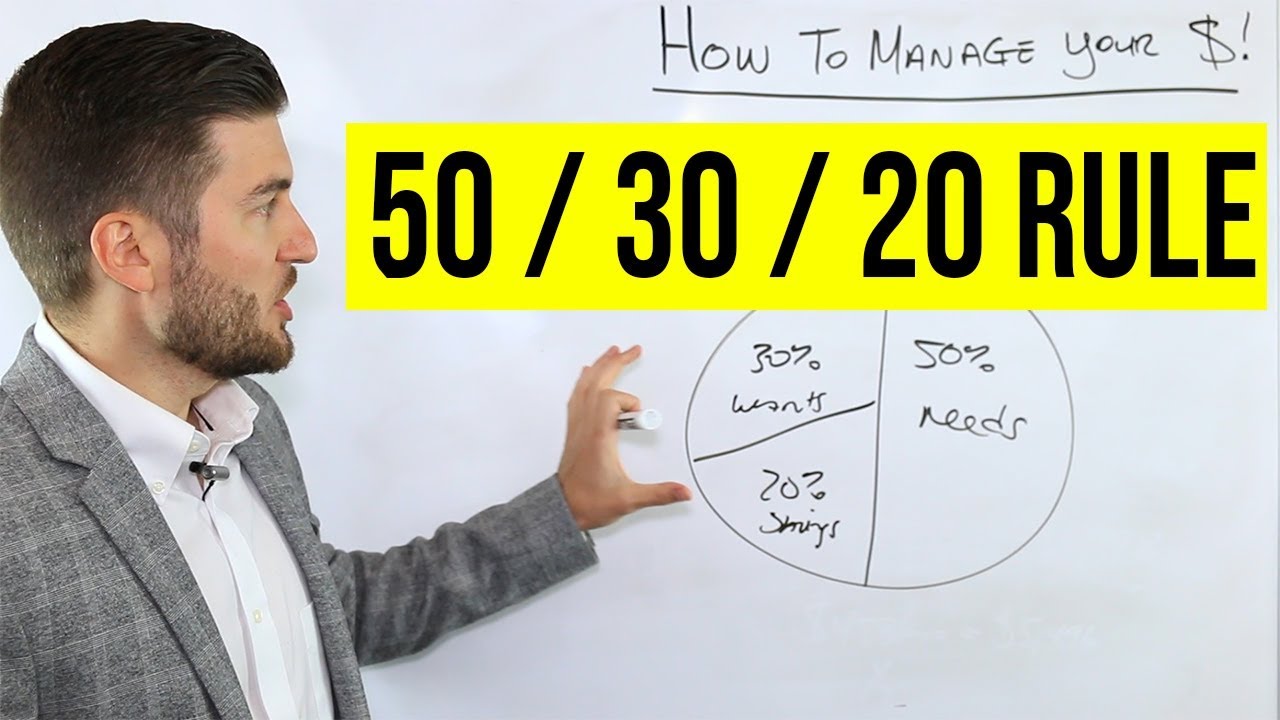

- 😀 Prioritizing needs over wants is crucial for maintaining long-term financial stability.

- 😀 Practical choices, like using a scooter instead of a car, can save money while fulfilling necessary needs.

- 😀 Focus on spending money on things that truly add value to your life (e.g., convenience, reliability, and time-saving tools).

- 😀 Expensive purchases, like high-end mobile phones, should be avoided unless they are truly necessary.

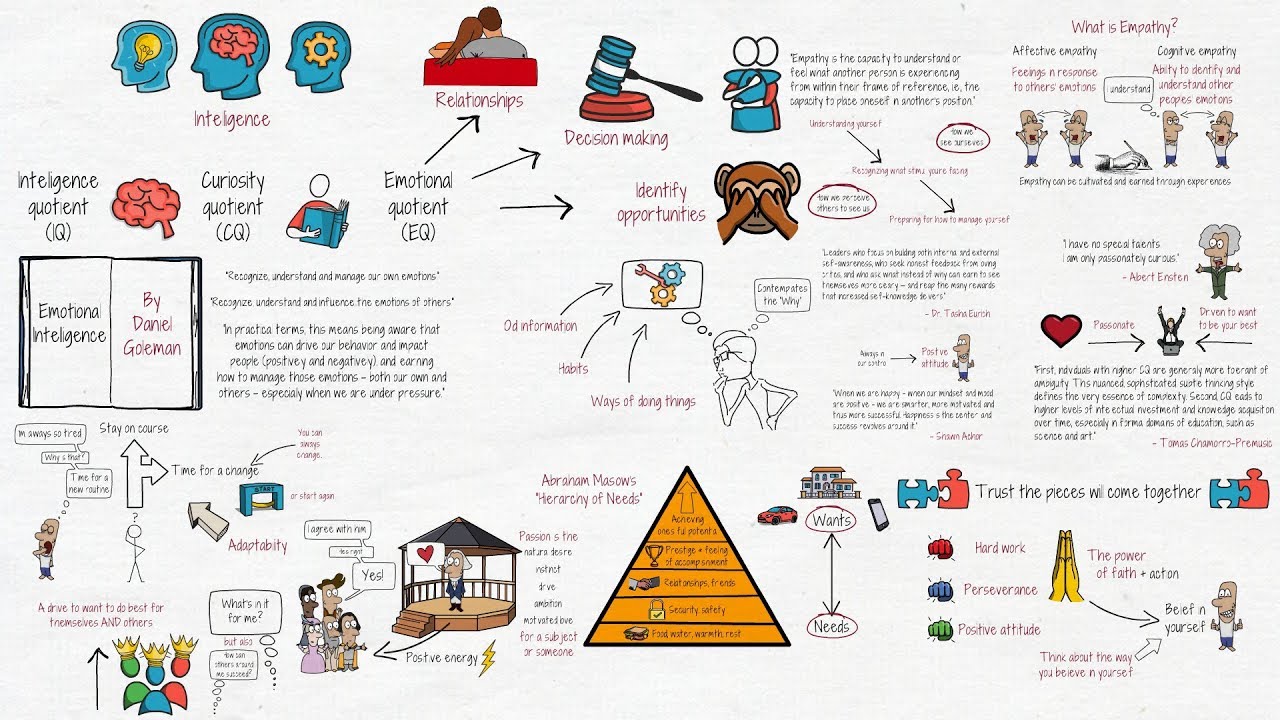

- 😀 Skills and self-development should take priority over material purchases, as they contribute more to long-term success.

- 😀 Saving money before spending it is a habit that can lead to financial security. Automate savings through systems like recurring deposits.

- 😀 Health and life insurance are crucial for protecting wealth and family. They can save you in case of emergencies.

- 😀 Having a long-term vision for financial freedom can help you make smarter short-term financial decisions.

- 😀 Small trade-offs today, such as not overspending, contribute to achieving larger goals like working fewer hours and spending more time with family in the future.

- 😀 The importance of budgeting and living within your means cannot be overstated if you want to build wealth.

Q & A

Why did the speaker's friend face financial difficulties despite his luxurious lifestyle?

-The speaker's friend faced financial difficulties because he overspent on wants rather than needs, including a high-end car, expensive weddings, foreign trips, and other luxury items. This led to a depletion of his savings, and when he lost his job, he had to sell his assets to pay off debts.

What is the primary message the speaker wants to convey about financial priorities?

-The primary message is that setting the right financial priorities is essential. One should focus on needs over wants and avoid overspending on luxuries, as it can lead to financial instability in the long run.

How does the speaker view the necessity of owning a car?

-The speaker acknowledges that owning a car can become a necessity at a certain stage of life but emphasizes that it should be a practical purchase rather than an impulsive decision driven by societal pressures or the desire to show off.

What is the speaker's perspective on purchasing expensive gadgets like smartphones?

-The speaker suggests that buying high-end smartphones is not practical unless absolutely necessary. Instead, one should opt for a functional, cost-effective phone and save money for more important needs like online courses or health-related expenses.

What is the importance of savings according to the speaker?

-The speaker emphasizes that saving a portion of income before spending is a key habit for financial stability. Setting up automatic savings plans like recurring deposits can help build wealth without much effort or awareness.

How does the speaker recommend approaching insurance?

-The speaker highlights the importance of having both health and life insurance. Insurance helps protect wealth and ensures the safety of the family in case of unexpected events like hospitalization or death.

What long-term financial goal does the speaker have?

-The speaker's long-term goal is financial freedom, which includes being able to work less while enjoying more personal time, especially with family. He envisions a work-life balance, potentially working fewer days in the future, as society moves toward more flexible work arrangements.

Why does the speaker prioritize practicality over luxury in daily life?

-The speaker values convenience and reliability, choosing practical options like a lightweight, efficient laptop or a scooter instead of luxury items. This approach aligns with his goal of focusing on long-term savings and investments, rather than short-term pleasures.

What advice does the speaker give regarding the concept of 'wants' versus 'needs'?

-The speaker advises to carefully differentiate between wants and needs. While it's easy to get caught up in social media-driven desires, one should focus on fulfilling real needs and avoid unnecessary luxuries that might lead to financial strain.

What does the speaker mean by the quote, 'If you buy things you do not need, pretty soon you will have to sell things you need'?

-The quote reflects the consequences of overspending on unnecessary items. The speaker warns that indulging in luxuries without regard to financial limits can lead to a situation where essential assets must be sold to cover debts or maintain an unsustainable lifestyle.

Outlines

此内容仅限付费用户访问。 请升级后访问。

立即升级Mindmap

此内容仅限付费用户访问。 请升级后访问。

立即升级Keywords

此内容仅限付费用户访问。 请升级后访问。

立即升级Highlights

此内容仅限付费用户访问。 请升级后访问。

立即升级Transcripts

此内容仅限付费用户访问。 请升级后访问。

立即升级5.0 / 5 (0 votes)