Direct Tax Code 2025 replacing Income Tax Act, 1961 | DTC 2025 | CA Raj K Agrawal

Summary

TLDRIn this video, CA Raj K. Agarwal discusses the upcoming replacement of the Income Tax Act, 1961, with the Direct Tax Code (DTC), set to take effect in April 2025. He explains key differences between the two, including simplifications like the removal of complex residential statuses and tax years. While the DTC aims to streamline the tax system, including lowering taxes for salaried employees, it will also introduce new challenges, such as expanded TDS and a focus on tax compliance. Students are reassured that the Income Tax Act will remain relevant for exams until March 2026. The video highlights significant changes for tax professionals and the general public.

Takeaways

- 😀 The Income Tax Act of 1961 will be replaced by the Direct Tax Code (DTC) starting from April 2025, and it will be applicable in exams from April 2026 onwards.

- 😀 The Direct Tax Code aims to simplify and modernize tax laws, making them concise, easy to read, and understand, in contrast to the complex Income Tax Act.

- 😀 One major change under the DTC is the removal of the Previous Year and Assessment Year concepts, with taxes being assessed only for the Financial Year.

- 😀 The DTC will have only two residential statuses: Resident and Non-Resident, as opposed to the three classifications under the Income Tax Act (ROR, RNOR, NR).

- 😀 The DTC will rename two heads of income: 'Income from Salary' will become 'Employment Income', and 'Income from Other Sources' will become 'Income from Residuary Sources'.

- 😀 The government plans to expand the scope of TDS (Tax Deducted at Source), applying it to nearly all types of income.

- 😀 A significant change is the reduction of taxes for salaried employees, who have traditionally paid more taxes compared to businessmen.

- 😀 The DTC will eliminate many exemptions and deductions found in the current tax system, simplifying compliance for taxpayers.

- 😀 The DTC may allow tax audits to be performed not only by Chartered Accountants (CA) but also by Company Secretaries (CS) and Cost Management Accountants (CMA).

- 😀 There will be a uniform corporate tax rate for both domestic and foreign companies under the DTC, eliminating the differences in current tax rates.

Q & A

What is the Direct Tax Code (DTC) and why is it being introduced?

-The Direct Tax Code (DTC) is a new tax law that will replace the Income Tax Act of 1961. It aims to simplify and modernize the tax system, making it more concise, understandable, and less complex by removing redundant provisions and reducing the scope for ambiguity.

When will the Direct Tax Code come into effect?

-The Direct Tax Code is expected to be introduced in the Union Budget 2025 and will come into effect from April 2025, for the financial year 2025-26.

How will the Direct Tax Code affect students preparing for exams?

-Students appearing for exams before March 2026 will still study the Income Tax Act, as the Direct Tax Code will only apply to exams conducted after April 2026.

What are the key differences between the Income Tax Act and the Direct Tax Code?

-Key differences include the introduction of only two residential statuses (Resident and Non-Resident), the removal of Previous Year and Assessment Year concepts (only Financial Year will be considered), changes in the classification of income heads, and the simplification of tax sections, from 298 to 319.

What changes will occur in the residential status under the Direct Tax Code?

-Under the Direct Tax Code, there will only be two residential statuses: Resident and Non-Resident. The categories of Resident but Not Ordinarily Resident (RNOR) and Non-Resident (NR) will no longer be applicable.

How will income classification change under the Direct Tax Code?

-The Direct Tax Code will rename 'Income from Salary' to 'Employment Income' and 'Income from Other Sources' to 'Income from Residuary Sources.' However, the five broad heads of income will remain the same.

What will happen to the tax rates on capital gains under the Direct Tax Code?

-Capital gains are likely to become part of normal income under the Direct Tax Code. This would mean that capital gains could be taxed at higher tax rates compared to the current regime.

What changes are expected for salaried employees under the Direct Tax Code?

-Salaried employees will benefit from lower tax rates under the Direct Tax Code. The government aims to reduce their tax burden compared to business owners, who often use tax planning strategies to minimize their taxes.

Will the Direct Tax Code affect the tax audit process?

-Yes, there is a possibility that Chartered Accountants (CAs) may no longer have exclusive rights to conduct tax audits. Company Secretaries (CS) and Cost Management Accountants (CMA) may also be authorized to perform tax audits under the new code.

How will TDS (Tax Deducted at Source) be affected by the Direct Tax Code?

-The scope of TDS will be expanded to include almost every type of income. However, the TDS rate is expected to be slightly reduced to make it more efficient and less burdensome for taxpayers.

Outlines

此内容仅限付费用户访问。 请升级后访问。

立即升级Mindmap

此内容仅限付费用户访问。 请升级后访问。

立即升级Keywords

此内容仅限付费用户访问。 请升级后访问。

立即升级Highlights

此内容仅限付费用户访问。 请升级后访问。

立即升级Transcripts

此内容仅限付费用户访问。 请升级后访问。

立即升级浏览更多相关视频

1. Concept of Indirect Taxes - Introduction | GST Lecture 1 | CA Raj K Agrawal

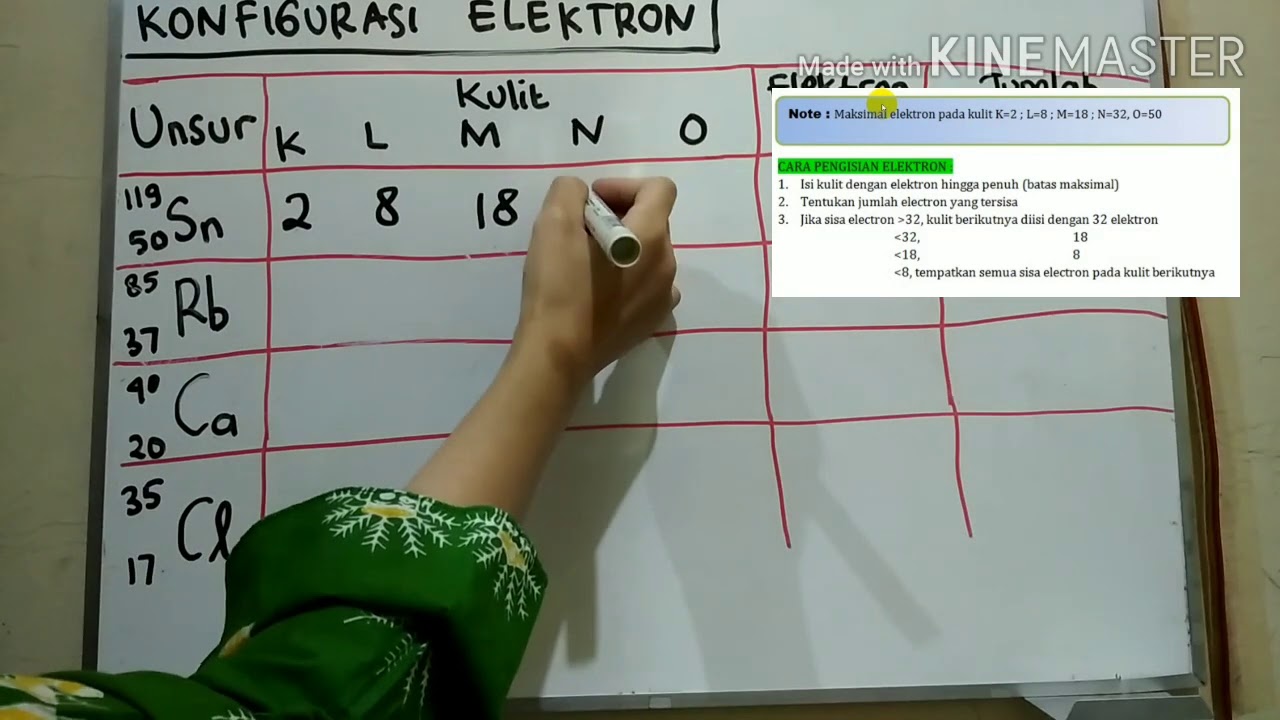

Struktur Atom : Konfigurasi Elektron 2 8 dst

Cara Menggunakan Perangkat Uji Tanah Kering

BEST *FREE* YOUTUBE CHANNELS FOR CA INTERMEDIATE MAY 2025 / SEPT 2025 | AS PER ICAI NEW SYLLABUS

UNSUR HARA MAKRO DAN MIKRO LENGKAP : NITROGEN, FOSFAT, KALIUM, BORON, KALSIUM, SULFUR, ZINK, SILIKA

How to Write a Career Change CV (*With Examples*)

5.0 / 5 (0 votes)