Use Moving Averages Like A Pro ( 7 HACKS )

Summary

TLDRIn this video, viewers learn how to use the moving average indicator to make more informed trade decisions. The moving average helps identify market trends, reversals, and areas of support and resistance. Key techniques include comparing price movement to moving averages, using dual moving averages for trend analysis, and recognizing crossovers for reversal signals. The video also emphasizes the role of moving averages in identifying dynamic support and resistance levels, offering valuable insights for traders looking to enhance their strategies and avoid bad trades.

Takeaways

- 😀 A moving average (MA) is a technical indicator that calculates the average closing price over a specified period to help identify trends.

- 😀 MAs help smooth out market noise and reveal the underlying price trend, making them a useful tool for technical analysis.

- 😀 Short-term MAs (e.g., 20-period) are used to identify short-term trends, while long-term MAs (e.g., 200-period) are used to identify long-term trends.

- 😀 When the price is above the moving average, it indicates an uptrend, suggesting buy opportunities. When it's below, it signals a downtrend, suggesting sell opportunities.

- 😀 In sideways or range-bound markets, the price fluctuates above and below the MA, which suggests caution and a wait-and-see approach for clear trend development.

- 😀 Using two moving averages (e.g., 20-period and 200-period) helps traders capture both short-term and long-term trend dynamics.

- 😀 The slope of a moving average provides insight into the strength of the trend. A steeper slope indicates a strong trend, while a gentler slope signals a weaker trend.

- 😀 The crossover of two MAs (e.g., 50-period and 200-period) is used to identify potential trend reversals. A short-term MA crossing above the long-term MA indicates a bullish reversal, while crossing below signals a bearish reversal.

- 😀 Moving averages can act as dynamic levels of support and resistance. In an uptrend, the MA can act as support, while in a downtrend, it can act as resistance.

- 😀 Using moving averages in conjunction with other indicators and analysis helps reduce the risk of false signals and enhances trading accuracy.

- 😀 Avoid entering trades during fake crossovers or when the price is moving sideways. Confirmation with other factors is crucial for successful trading.

Q & A

What is a moving average and how is it calculated?

-A moving average is a technical indicator that calculates the average closing price of an asset over a specific period. For example, a 10-period moving average calculates the average of the last 10 closing prices. This helps to smooth out price fluctuations and identify trends.

What are the most commonly used moving average periods?

-The most commonly used moving averages are 20, 50, 100, and 200 periods. These can help identify short-term and long-term trends, with the 200-period moving average typically used for long-term trends, and the 20-period moving average used for short-term trends.

How can the location of the price relative to the moving average help identify trends?

-If the price is above the moving average and has consistently stayed above it, the market is in an uptrend. If the price is below the moving average, the market is in a downtrend. In range-bound markets, the price fluctuates above and below the moving average.

What is the advantage of using two moving averages with different period settings?

-Using two moving averages with different periods—such as a short-term 20-period MA and a long-term 200-period MA—helps traders confirm trends. The short-term moving average indicates immediate market direction, while the long-term moving average confirms the overall trend, helping traders avoid going against the broader market direction.

How does the slope of a moving average indicate trend strength?

-The slope of the moving average shows the strength of a trend. In a strong uptrend, the moving average has a steep upward slope, while in a weak uptrend, the slope is gentler. Similarly, in a strong downtrend, the slope is steep and downward, and in a weak downtrend, it’s more gradual.

How can traders identify reversals using moving averages?

-Traders can identify reversals by observing price crossovers or moving average crossovers. A price crossover from above to below the moving average signals a bearish reversal, while crossing from below to above indicates a bullish reversal. Moving average crossovers occur when a shorter-period MA crosses a longer-period MA, signaling trend shifts.

What is the difference between price crossovers and moving average crossovers?

-A price crossover occurs when the price itself crosses the moving average line, indicating potential trend changes. A moving average crossover occurs when one moving average crosses another, typically a shorter-period MA crossing a longer-period MA. The latter is generally considered a more reliable signal of a trend reversal.

What role does a moving average play as a dynamic support or resistance level?

-In an uptrend, the moving average acts as a dynamic support level where price often bounces back, providing potential buying opportunities. In a downtrend, the moving average acts as a resistance level, where price tends to reverse downward, signaling potential selling opportunities.

When should a trader avoid trading using moving averages?

-A trader should avoid trading when the market is range-bound, with price fluctuating around the moving average without establishing a clear trend. In such situations, the market lacks direction, making it difficult to make reliable trading decisions.

What can a trader infer if the short-term moving average is above the long-term moving average?

-If the short-term moving average (e.g., 50-period) is above the long-term moving average (e.g., 200-period), it indicates that the market is in an uptrend, and traders should focus on buying opportunities.

Outlines

此内容仅限付费用户访问。 请升级后访问。

立即升级Mindmap

此内容仅限付费用户访问。 请升级后访问。

立即升级Keywords

此内容仅限付费用户访问。 请升级后访问。

立即升级Highlights

此内容仅限付费用户访问。 请升级后访问。

立即升级Transcripts

此内容仅限付费用户访问。 请升级后访问。

立即升级浏览更多相关视频

No Loss Ichimoku Cloud Trading Strategy for Nifty & Banknifty | Dhan

100% Never Lose | Best Binary Options Trading Strategy

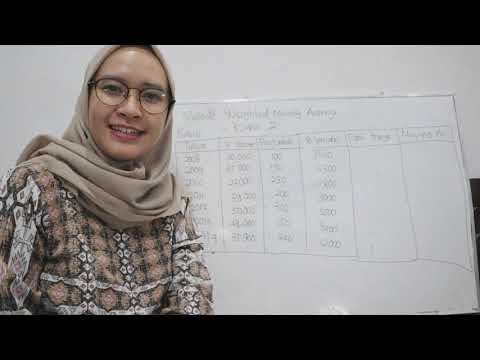

Peramalan Permintaan Part 1 (Moving Average and Weighted Moving Average)

MACD Revealed: The TRUTH About This Misunderstood Indicator

NEVER Miss a TREND! MACD Indicator Trading Strategy | MACD Divergence

Supertrend Indicator Strategy with VWAP Crossover | Chartink Screener for Intraday Trading #intraday

5.0 / 5 (0 votes)