W co inwestować w 2025 roku — moja strategia

Summary

TLDRIn 2024, the speaker saw strong investment returns, including a 27% rise in stocks, 133% in Bitcoin, and gains from government bonds and gold. They emphasize a long-term investment strategy focused on staying in the market, avoiding market timing, and diversifying across different asset types, including stocks, bonds, and cryptocurrencies. For 2025, the speaker plans to continue investing through ETFs, focusing on global and developed market funds, while using tax-advantage accounts in Poland. They stress the importance of managing risk based on investment horizons and maintaining calm during market downturns.

Takeaways

- 😀 2024 was a strong year for investments, with a 27% increase in stocks, 133% growth in Bitcoin, and profits from gold and government bonds.

- 😀 The speaker emphasizes a long-term investment strategy rather than trying to time the market, which is often ineffective.

- 😀 The average investor typically underperforms the market, achieving only a 2.9% annual return over 20 years, compared to 7.5% for the S&P 500.

- 😀 Trying to predict market movements (timing the market) rarely works and can lead to negative consequences, even if successful once.

- 😀 A key investment philosophy is: ‘Don’t try to beat the market, just stay in it,’ focusing on steady, long-term growth.

- 😀 The importance of not panicking during market crises is highlighted—market downturns are temporary and often followed by significant recoveries.

- 😀 Despite experiencing a 46% loss during the dot-com bubble and a 52% loss during the 2008 financial crisis, long-term investors saw substantial gains.

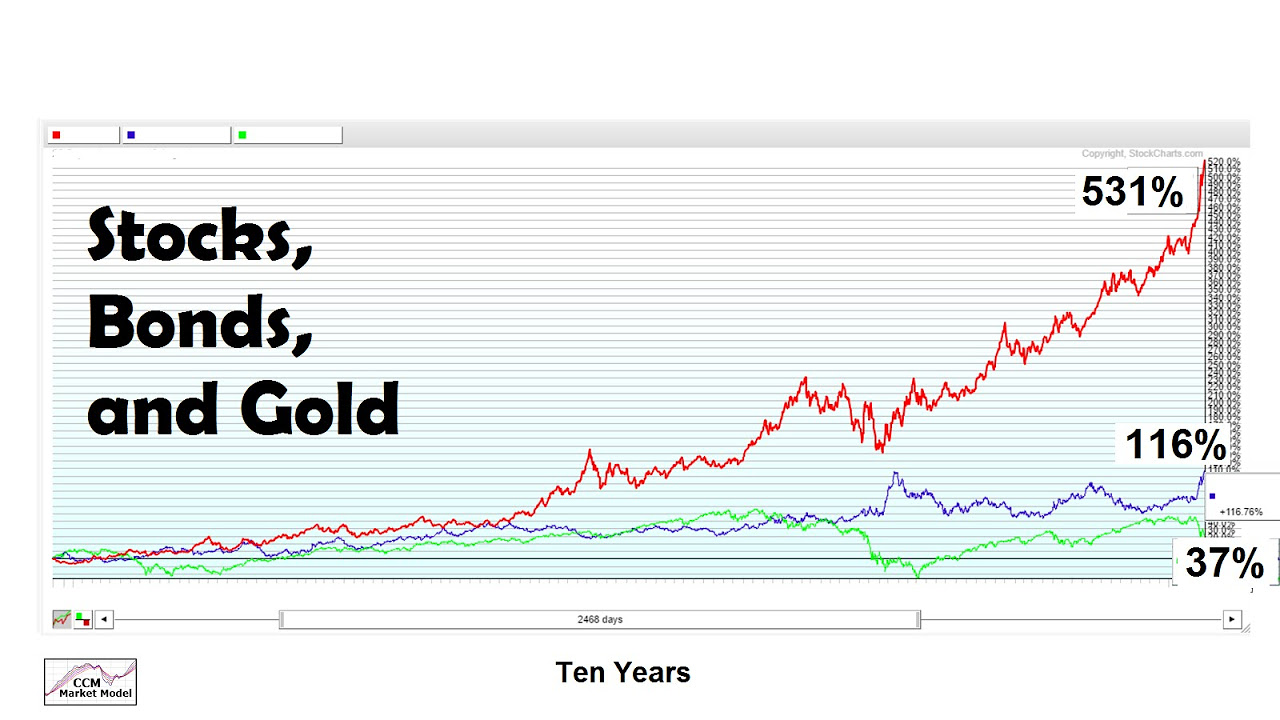

- 😀 Diversification is essential, with the speaker investing in a mix of stocks, government bonds, Bitcoin, and precious metals like gold and silver.

- 😀 In 2025, the speaker plans to continue investing in global equity markets through ETFs like the IShares MSCI World UCITS ETF, focusing on developed markets.

- 😀 The speaker plans to maximize contributions to tax-advantaged accounts (IKE and XKE) at the beginning of the year for long-term growth.

- 😀 While stocks remain the primary focus, the speaker is also open to buying more Bitcoin and gold if market conditions change in 2025, to maintain a balanced, diversified portfolio.

Q & A

What was the overall financial performance of the individual's investments in 2024?

-In 2024, the individual saw a 27% increase in stock value, leading to a gain of around 50,000 PLN. Additionally, Bitcoin appreciated by 133%, adding another 30,000 PLN. They also gained from government bonds and a gold coin investment, ultimately becoming nearly 100,000 PLN wealthier.

What is the key to the individual’s investment strategy for 2025?

-The individual plans to continue their long-term investing strategy by sticking to broad-market ETFs, avoiding attempts to time the market, and diversifying across different asset classes such as stocks, cryptocurrencies, government bonds, and precious metals.

Why does the individual avoid timing the market?

-The individual believes that trying to predict market movements, or 'timing the market', usually doesn't work well in the long run. Even if someone gets it right once, it's rare they can repeat the success. Instead, they focus on consistent, long-term investment.

What are the specific ETFs the individual plans to invest in for 2025?

-The individual intends to invest in broad-market ETFs like MSCI World UCITS or Vanguard FTSE All-World UCITS, both of which offer global exposure, including developed markets (like the US, Japan, UK) and emerging markets (such as China and India).

How does the individual plan to utilize tax-advantaged accounts in 2025?

-The individual will maximize contributions to tax-efficient accounts like IKE and XSE, which allow them to invest in a way that minimizes tax impact and helps their investments grow more effectively throughout the year.

What approach does the individual take toward market crises?

-The individual emphasizes that during a market crisis, the best response is not to panic. Instead, they recommend sticking to the strategy of buying and holding assets, knowing that market downturns are often followed by recoveries over the long term.

Why does the individual believe in diversification across different asset types?

-The individual believes diversification helps reduce risk by balancing more volatile assets (like stocks and cryptocurrencies) with safer ones (such as government bonds and precious metals). This approach allows them to weather market fluctuations more effectively.

What role do government bonds play in the individual's portfolio?

-Government bonds serve as a safer, more stable investment compared to stocks and cryptocurrencies. They are used to balance the riskier assets in the individual’s portfolio and provide a safeguard during times of market uncertainty.

How does the individual view the importance of long-term investment?

-The individual believes that the key to successful investing is to remain in the market for the long haul, allowing investments to grow over time. They suggest that even if there are temporary losses or market downturns, the long-term upward trend in markets will typically recover those losses.

What specific plans does the individual have regarding Bitcoin and gold in 2025?

-The individual plans to continue investing in Bitcoin, especially during price drops, and may buy more gold coins as gifts or investment opportunities. Gold is seen as a hedge against market volatility, while Bitcoin provides exposure to a high-risk, high-reward asset class.

Outlines

此内容仅限付费用户访问。 请升级后访问。

立即升级Mindmap

此内容仅限付费用户访问。 请升级后访问。

立即升级Keywords

此内容仅限付费用户访问。 请升级后访问。

立即升级Highlights

此内容仅限付费用户访问。 请升级后访问。

立即升级Transcripts

此内容仅限付费用户访问。 请升级后访问。

立即升级浏览更多相关视频

Investasi Saham vs Obligasi | Mana yang lebih menguntungkan?

Gold Can Add Value To A Stock/Bond Portfolio

Investasi Saham VS Emas | Mana Yang Lebih Menguntungkan?

Will This Bitcoin Bull Market Surprise to the Upside? with Lyn Alden

10 Asset Classes For 2025

DİNLEMEZSEN ELİNDEKİNİ ALIRLAR! / BUNLAR YÜKSELECEK!

5.0 / 5 (0 votes)