Roundtable: Natural Resource Curse

Summary

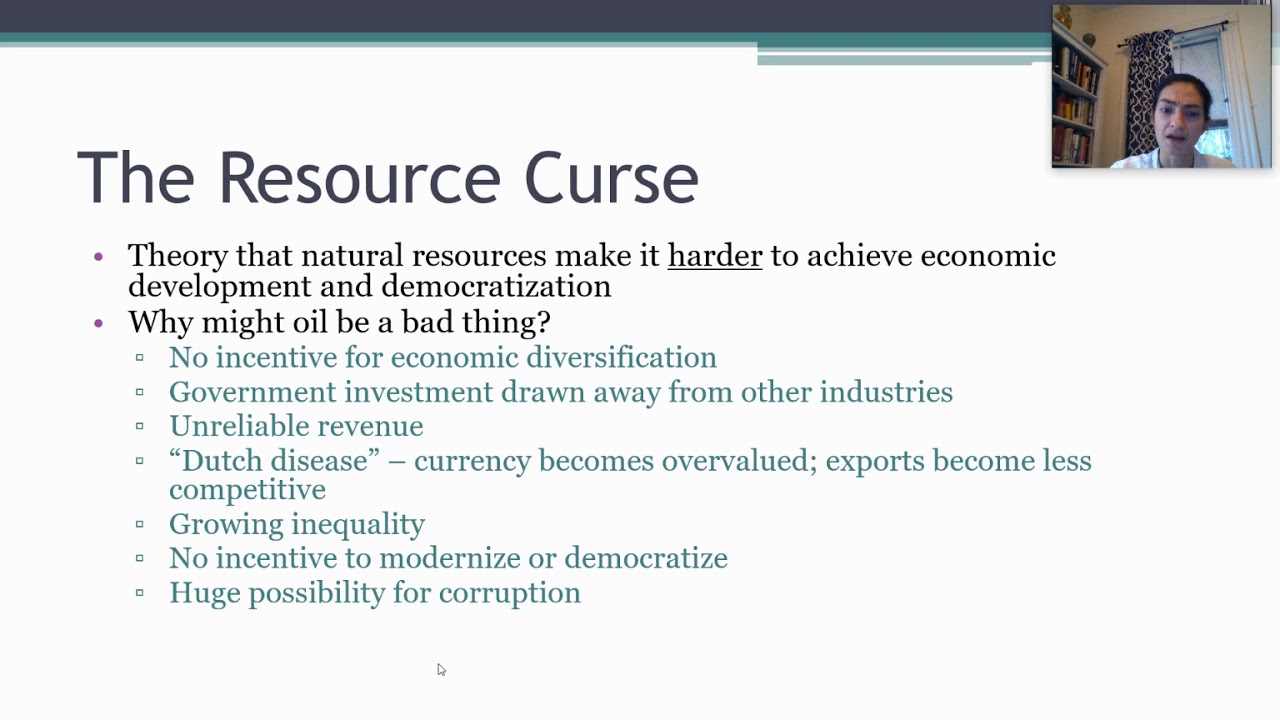

TLDRCountries rich in natural resources are often seen as fortunate, but these resources can become a burden, leading to economic instability, corruption, and authoritarianism. The reliance on a single revenue stream, such as oil, often causes imbalance, making economies vulnerable to price fluctuations. While some countries, like Saudi Arabia, seek to diversify their economies, others, like Norway and Alaska, have used innovative strategies to manage their resource wealth. The key to transforming resources into prosperity lies in good governance and strategic investment.

Takeaways

- 😀 Countries rich in natural resources are often seen as lucky, but the reality can be much more complex.

- 😀 Natural resources can be a burden on economies, linking a country's fate to fluctuating commodity markets.

- 😀 Dependence on natural resources can lead to corruption, exploitation, and poor governance.

- 😀 Some resource-rich countries have experienced slower economic growth, less democracy, and poorer development outcomes.

- 😀 Natural resources can contribute to internal divisions, leading to violence and authoritarianism.

- 😀 An economy too focused on abundant natural resources can become unbalanced, with investment and labor directed away from other industries.

- 😀 Currency appreciation from natural resource exports can make other industries' exports unaffordable, causing economic strain.

- 😀 Countries that rely on a single revenue stream, like oil, face significant challenges in adjusting to market changes.

- 😀 Oil-rich countries like Venezuela struggle with debt due to low oil prices, while others like Saudi Arabia are trying to diversify their economies.

- 😀 Some regions, like Alaska and Norway, have found ways to manage their resource wealth effectively, including sharing revenues with residents or investing in other industries through sovereign wealth funds.

Q & A

What is the 'resource curse' and how does it affect countries rich in natural resources?

-The 'resource curse' refers to the paradox where countries with abundant natural resources, such as oil, often experience poor economic growth, corruption, and instability. Despite their wealth, these resources can lead to dependence on volatile commodity markets, social unrest, and governance issues.

Why can natural resources become a burden rather than a blessing for an economy?

-Natural resources can become a burden when they tie an economy too heavily to fluctuating commodity prices, leading to economic instability. This can crowd out other industries, create unbalanced growth, and foster corruption and exploitation.

How does the dependence on a single revenue stream affect countries with resource wealth?

-Dependence on a single revenue stream, such as oil, can leave countries vulnerable to market changes. When commodity prices drop, economies that rely on these resources struggle, leading to debt issues, reduced development, and economic instability.

What impact does currency appreciation have on resource-rich economies?

-Currency appreciation, often caused by an influx of foreign currency from resource exports, can make other industries' goods and services more expensive. This weakens other sectors, making them less competitive internationally and leaving the economy overdependent on the resource sector.

Can the resource curse be avoided, and if so, how?

-The resource curse can be mitigated through good governance, economic diversification, and strategic investments. Countries like Norway and Alaska have implemented successful models by saving resource revenues in sovereign wealth funds and distributing some revenues to residents.

How is Venezuela an example of the resource curse?

-Venezuela, despite having the world's largest oil reserves, is struggling economically due to its over-reliance on oil revenues. When oil prices drop, the country faces severe debt crises, illustrating the dangers of relying too heavily on a single resource for national income.

What is Saudi Arabia doing to avoid the resource curse?

-Saudi Arabia is actively working to diversify its economy away from oil dependence. This includes initiatives like Vision 2030, which aims to develop other sectors, such as tourism and technology, to ensure long-term economic stability.

What is a sovereign wealth fund, and how does it help countries with abundant resources?

-A sovereign wealth fund is a state-owned investment fund that uses revenue from natural resources to invest in other industries and assets, creating long-term financial security. Norway, for example, uses its sovereign wealth fund to invest in global markets and diversify its economy.

How does Alaska manage its resource wealth differently from other regions?

-Alaska shares a portion of its oil revenues with its residents, providing them with direct financial benefits. This model helps ensure that the state’s wealth is distributed more equally and that its economy is not solely reliant on oil exports.

Can natural resources contribute to both economic prosperity and instability?

-Yes, natural resources can contribute to both prosperity and instability. When well-managed, they can bring financial security and economic growth. However, without good governance and diversification, they can lead to economic volatility, corruption, and social unrest.

Outlines

此内容仅限付费用户访问。 请升级后访问。

立即升级Mindmap

此内容仅限付费用户访问。 请升级后访问。

立即升级Keywords

此内容仅限付费用户访问。 请升级后访问。

立即升级Highlights

此内容仅限付费用户访问。 请升级后访问。

立即升级Transcripts

此内容仅限付费用户访问。 请升级后访问。

立即升级5.0 / 5 (0 votes)